For businesses and professionals in the Philippines navigating their tax responsibilities, maintaining accurate and compliant books of accounts is non-negotiable. Opting for Loose-Leaf Books of Accounts offers flexibility and ease, especially for those who may not prefer the traditional written and bound booklets. The BIR’s Online Registration and Update System (ORUS) streamlines the application and submission process for these documents.

Here’s how to get started:

Step 1: Understanding Loose-Leaf Books of Accounts

Before diving into the application process, it’s essential to comprehend what Loose-Leaf Books of Accounts entail. These are ledger sheets or accounting entries printed and bound in a flexible format, as opposed to pre-printed journals and ledgers. Businesses that opt for this method must seek approval from the BIR to ensure compliance with accounting standards and tax regulations.

At the end of the registration process, you’ll still have to purchase columnar ledgers first for stamping by the BIR. Let’s proceed to the next step for the application for Loose-Leaf Books of Accounts.

Step 2: Preparing the Required Documents for your Application

To apply for the use of Loose-Leaf Books of Accounts, you’ll need to prepare the following documents:

- A Letter of Intent: Address this to the Revenue District Office (RDO) where your business is registered. Clearly state your request to use Loose-Leaf Books of Accounts.

- Duly Accomplished BIR Form 1900: This form is for Application for Authority to Use Computerized Accounting System or Loose-Leaf Books of Accounts.

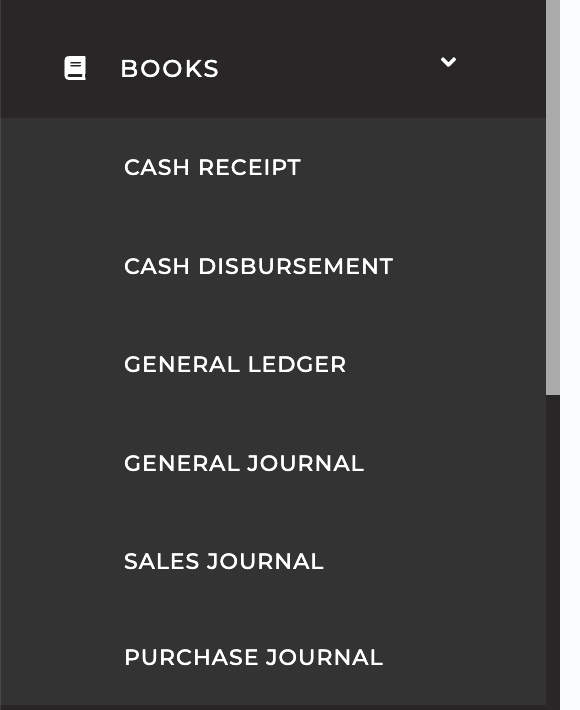

- System-generated Books of Accounts: Provide samples of the pages of your proposed books of accounts. In Taxumo, once you have a subscription plan, just go to the “BOOKS” tab.

And then generate a sample format / report for each of the books that you see in your Taxumo tab. By the way, for Non-Vat Entities, you will have lesser books to submit.

More information here: http://help.taxumo.com/en/articles/3054163-how-to-have-your-taxumo-books-of-accounts-accredited-as-your-looseleaf-books-of-accounts

Step 3: Registering or Logging into ORUS

Navigate to the ORUS portal on the BIR website. If you’re a new user, you’ll need to register by providing your Tax Identification Number (TIN), RDO Code, and other required information. Existing users can simply log in with their credentials.

Step 4: Submitting Your Application via ORUS

Once logged in, look for the section dedicated to Loose-Leaf Books of Accounts application. Upload the prepared documents, including the Letter of Intent, BIR Form 1900, and samples of your books of accounts. Ensure that all files are complete and clearly legible to avoid delays in processing.

Step 5: Monitoring Your Application Status

After submission, regularly check your ORUS account or email for updates regarding your application status. The BIR may also contact you for additional requirements or to inform you of the approval.

Step 6: Printing and Using Your Loose-Leaf Books of Accounts

Upon receiving approval, you can proceed to print your Loose-Leaf Books of Accounts. Remember, these must be registered with your RDO before usage. Keep all records up-to-date and ensure that they are readily available for inspection by BIR officials.

Understanding Recent Updates to Books of Accounts Registration

In light of the Bureau of Internal Revenue (BIR)’s recent updates, it’s crucial to be aware of the amendments made to the registration process of Books of Accounts, as outlined in Revenue Memorandum Circular (RMC) No. 3-2023. This circular modifies Section 2 of RMC No. 19-2019, mandating the online registration of all books of accounts through the BIR’s Online Registration and Update System (ORUS) facility. Following this procedure, the system generates a Quick Response (QR) code, providing evidence of registration.

RMC No. 3-2023 also clarifies the deadlines and frequency for registering different types of Books of Accounts, including manual, permanently bound loose-leaf, and computerized versions, as summarized below:

- For New Business Registrants with Manual Books of Accounts: These should be registered before the deadline for the submission of the first quarterly or annual income tax return, whichever is sooner. Subsequent registrations should occur once the pages of the previously registered books are fully utilized.

- For Existing Businesses or Subsequent Registrations:

- Manual Books of Accounts: You must register them before using, and subsequent registrations are necessary once the pages of earlier registered books are fully utilized.

- Permanently Bound Loose-Leaf Books of Accounts: Registration is due within 15 days following the end of the taxable year or within 15 days from the closure of business operations, subject to possible extension by the BIR upon the taxpayer’s request before this period expires. This is an annual requirement.

- Computerized Books of Accounts: Register your Computerized Books of Accounts within 30 days after the close of the taxable year or from the cessation of business operations. You can request an extension from the BIR before the deadline. This registration is also mandatory annually.

Notably, the circular specifies that it is unnecessary to register new sets of manual books of accounts annually. This update aims to streamline the registration process, moving away from the prior requirement for manual stamping of accounts for registration.

Conclusion

Applying for and submitting Loose-Leaf Books of Accounts via ORUS is a straightforward process that modernizes compliance for businesses in the Philippines. By following these steps and maintaining diligent records, you can meet your accounting and tax obligations efficiently. Always stay informed about any changes in BIR regulations to ensure that your accounting practices remain compliant.

More information here: https://mommyginger.com/permit-to-use-loose-leaf-using-taxumo.html

Pingback: BIR Tax Online Sellers - Is There An Easy Way To Do Taxes? | Taxumo - File & Pay Your Taxes in Minutes!