8% Plan

For non-VAT individuals who opted for the 8% income tax rate and only need to file income tax.

2,699/Quarter

2,499/Quarter SAVE 7%

1,374/Quarter SAVE 49%

Included Forms & Attachments:

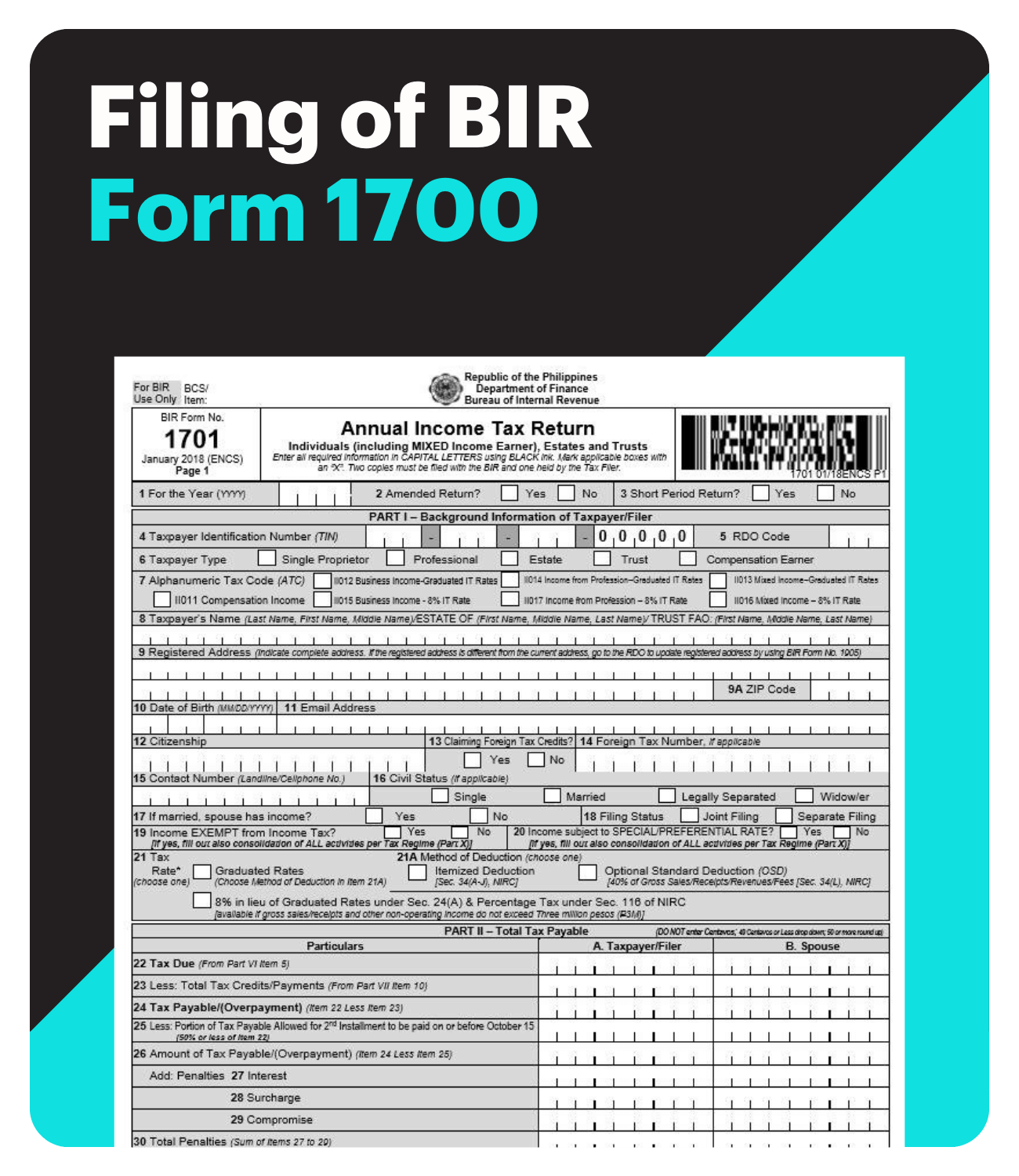

1701Q 1701A (AITR) 0605 2551Q SAWT

1701Q 1701A (AITR) 0605 2551Q SAWT

Micro Plan

For Non-VAT individuals under graduated rates who withhold taxes for suppliers and/or employees.

4,995/Quarter

3,248/Quarter SAVE 35%

2,124/Quarter SAVE 57%

Included Forms & Attachments:

1701Q 1701A (AITR) 2551Q (Percentage Tax) 0619E 1601EQ 1604E 1601C 1604C 0605 1600-VT SAWT QAP

1701Q 1701A (AITR) 2551Q (Percentage Tax) 0619E 1601EQ 1604E 1601C 1604C 0605 1600-VT SAWT QAP

SMB Plan

For VAT individuals and for Non-VAT or VAT Partnerships or Corporations.

6,995/Quarter

4,248/Quarter SAVE 39%

2,749/Quarter SAVE 61%

Included Forms & Attachments:

1701 1701A 1701Q 1702RT 1702RT (AITR) 1702Q 1600-VT 2550Q (VAT Return) 1601EQ 1604E 1601C 1604C 0619E 0605 2551Q (Percentage Tax) SAWT SLSP

1701 1701A 1701Q 1702RT 1702RT (AITR) 1702Q 1600-VT 2550Q (VAT Return) 1601EQ 1604E 1601C 1604C 0619E 0605 2551Q (Percentage Tax) SAWT SLSP