Terms & Conditions

The use of our service constitutes unequivocal agreement to the following terms and conditions.

Definitions

“Taxumo” refers both to the designation of the services of Taxumo Inc. including but not limited to any software or mechanism or process provided by Taxumo Inc. as well as to the corporation Taxumo Inc.

“Customer” to any person, natural or juridical or any entity recognized by law who uses the services of Taxumo.

Cost of Usage

The use of Taxumo is free for income entry, expense entry, receipt uploads, and withheld tax receipt certificate entry.

To avail of the tax filing functionalities of Taxumo, the user will need to subscribe to the following plans:

Taxumo Time Out (Formerly Lifeline)

Taxumo Lifeline was made for businesses that are non-operating. The system will automatically file forms that are selected by the user during setup. These forms will contain the relevant Taxpayer information as entered by the user but all other transaction related fields (e.g. income for relevant quarter, etc) will be set at 0. These forms will be filed on the deadline set by Taxumo. This service will be valid for one year from receipt of payment by Taxumo. These forms will automatically be filed on the appropriate deadlines without further input from the user. Use of Taxumo lifeline by the user is consent for Taxumo to file the selected forms for the user through the Taxumo system and the user waives any claim, right or action against Taxumo, its employees and/or agents which may arise from the use of Taxumo Lifeline.

Taxumo Subscription Plans:

- 8% Plan

- Micro Business Plan

- Small & Medium Business Plan

- Taxumo Time Out Plan (formerly Lifeline for non-operationg businesses)

All the terms below are applicable only to the 8% Plan, Micro Business, and Small & Medium Business Plans.

If a debit or credit card is used to avail of the subscription, the card will be charged the same amount on a periodic basis based on the subscription duration.

When purchasing a Quarterly, Annual, or 2-Year subscription, the user will be charged for the whole subscription’s worth on the date of purchase. When the user cancels their subscription, the plan will remain active until the date of expiration and, in the case of recurring subscriptions, will no longer be charged on the next billing date.

These subscriptions include access to the Books of Accounts report views, access to filing of government contributions such as SSS and PAG-IBIG, and access to Delegate Access functionalities.

The following user reports are available as part of the Books of Accounts functionality that approximate the following books of accounts:

– Cash Receipts Journal: A Cash receipts journal is a specialized accounting journal and it is referred to as the main entry book used in an accounting system to keep track of the sales of items when cash is received, by crediting sales and debiting cash and transactions related to receipts.

– Cash Disbursements Journal: A cash disbursement journal is a record kept by internal accountants of all financial expenditures made by a company before they are posted to the general ledger. Cash disbursement journals serve a number of functions, such as a source for recording tax write-offs and the categorization of other expenses.

– General Ledger: Master set of accounts that summarize all transactions occurring within an entity

– General Journal: Journal used in keeping a chronological record of financial transactions of a firm not belonging to other (special) journals, or where no special journal exists.

– Sales Journal: Ledger that details the VAT breakdown of each relevant income entered by the user. All income entries are booked against a Cash account.

– Purchase Journal: Ledger that details the VAT breakdown of each relevant expense entered by the user. All expense entries are booked against a Cash account.

These Books of Accounts reports are not substitutes for the books that a taxpayer needs to maintain. The user has to ensure that their books are kept updated as per BIR regulations. The User shall be responsible for the accuracy of all entries made in Taxumo. The User shall be liable for any and all incorrect or inaccurate entries in Taxumo. Taxumo shall not incur any liability for the use of the Books of Accounts reports functionality by the User.

The subscription accounts also provides an account delegation access that allows the user to define 2 delegate users. Delegate users are able to do the following transactions for the company:

– Enter income/expense transactions

– Enter withheld entries

– Edit the company profile

– Submit and pay for tax filings

Taxumo shall not incur any liability for the use of the account delegation functionality. The User takes full responsibility for any and all actions taken by the delegates.

The use of Taxumo is only limited to allowing the use of Taxumo software for the processing of tax payments and the transmission thereof to the Bureau of Internal Revenue and does not include the processing of any refunds or any appearance or representation before any entity exercising judicial or quasi judicial power including a court of law or other similar actions. Cancellation of subscriptions to any of Taxumo’s plans will revoke all access rights of the user to all Taxumo services and any related data stored therein. Expiration of subscription to any of Taxumo’s plans will revoke all access rights of the user to all Taxumo services and related data stored therein. For concerns on data privacy, you may refer to Taxumo’s Privacy Policy.

Update: Effective June 2, 2025, the minimum billing term for all (except the Taxumo Lifeline / Time Out Plan) is quarterly. Monthly plans will no longer be available. The Taxumo Lifeline / Time Out Plan will remain available under annual billing only.

Schedule of Charges

Quarterly, annual, and 2-year subscriptions will be charged on the same day as the initial subscription date. These recurring subscriptions require a debit or credit card and will be charged the same amount per billing cycle.

If no credit/debit card is available, users may prepay for quarterly, annual, or 2-year plans. Monthly subscriptions will no longer be offered after June 2, 2025. The Taxumo Lifeline / Time Out Plan will only be offered under annual billing.

If a recurring card payment fails after 3 attempts within a 9 day period from subscription expiration, the subscription will be canceled.

Cancellation and Expiration of Subscriptions

Canceling an active subscription means the user will lose access to their tax-related data at the end of the subscription period. This includes filings and payment records. To reactivate, the user must re-subscribe under the new pricing available at the time of re-subscription.

Expiration of a subscription without renewal will also revoke access to all Taxumo services and related data, in accordance with the data privacy policy.

Subscription Upgrade

Any subscription upgrade must be done ten (10) days before the termination date of the current subscription to avail of an upgrade credit which shall be a prorated amount of the existing subscription. This will not extend the termination date of the subscription.

Any subscription upgrade done less than ten (10) days before the termination date of the current subscription will not be allowed to avail the upgrade credit mentioned in the previous section. This will extend the termination date of the subscription reckoned from availment of subscription upgrade.

Our Guarantee

Taxumo guarantees that it will use its best endeavors to aggregate or summarize financial data, according to the specifications of the customer for the tax due of its users under Philippine Law.

Taxumo will compute the tax to be paid based on the tax rules and regulations of the Philippines. All computations will be based on the information and documentation provided by its customers and in line with the legal entitlements and obligations of the customer within the tax law of the Philippines from which the tax due is being paid for.

Where there is a change in the applicable tax law in the Philippines from which the tax due is being paid for, or in the interpretation or implementation of the rules and laws by the tax authorities of the Philippines. The decision of the exact value of any tax amount due or amount owed is left to the discretion of the relevant Tax Authority without liability to Taxumo.

Taxumo will submit the tax dues, the tax forms and the payment to the tax authority of the Philippines as expediently as possible, subject to the provision of the necessary documents by the customers and the efficient processing of the documentation by the relevant tax office.

Customer’s Guarantee

By using Taxumo, the customer guarantees the accuracy and authenticity of any data or information that it may have provided to Taxumo or should have provided to Taxumo.

The Customer shall not use Taxumo for any improper, illegal or illicit purpose, Taxumo shall not be liable for any and all damage occurring from such.

Power of Attorney

The Customer’s submission of information for tax estimation, equates to signing a Special Power of Attorney permitting and authorizing Taxumo Inc to estimate his/her tax dues and payments, and to pay/file/submit tax dues and payments to the Bureau of Internal Revenue in any legally acceptable manner such as but not limited to electronic or ephemeral transmission (e.g. GCash) or through any agent which Taxumo may use for this purpose.

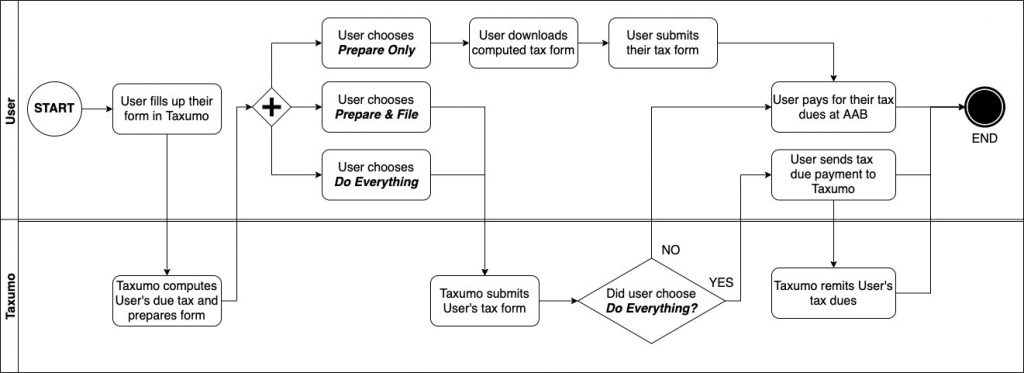

The Customer may opt to have Taxumo prepare the tax form only, prepare and file the form or prepare and file and pay. (Do everything)

Taxumo shall not be responsible for any damage or penalty for the failure of the Client to properly indicate if Taxumo shall prepare the tax form only, prepare and file the form or prepare and file and pay on their behalf.

The options for Taxumo to prepare the tax form only, prepare and file the form or prepare and file and pay. (Do everything) are included as part of every valid taxumo subscription.

The Customer understands that Taxumo will issue tax computation based on the data that has been given and by receipt of the Customer’s uploaded supporting documents. The Customer understands that receipt of completed documentation authorizes Taxumo to submit the Customer’s application to the relevant tax office. No cancelation of any submission to any tax authority can be done by the Customer once it has provided the information and documentation needed.

Storage and Access to Previous Filings

Access to “Past Filings,” which includes past filed forms, confirmation from filed forms, submitted attachments, confirmation from submitted attachments, past data, and all locked tabs prior to subscribing is and will only be accessible if you have a current and active subscription plan. This is in accordance to our data privacy policy that all accounts without an active subscription plan will be archived and can only be retrieved by the head of engineering with the approval of our data privacy officer.

Emails

All emails to the customer will be sent to the email address provided by the customer at registration. Taxumo will expect that the customer will ensure there is sufficient space in his/her inbox to receive all emails and that the customer checks his/her email regularly – regularly being about three times a week. Taxumo shall not be held liable for any damage due to the customer’s failure or inability to receive any communication, written or electronic.

Communications

By signing up to Taxumo and completing the necessary documentation, the Customer agrees to be added to Taxumo’s mailing list. You can opt out of receiving any further correspondence by turning off your email notifications in your Taxumo account’s Settings page.

If notification settings are turned on, Taxumo will advise current and past customers of: relevant provisions, revised provisions or memorandums from the respective tax authorities, all new services that they may avail of with Taxumo, all new services and promos offered by Taxumo and associated companies and deadlines and reminders that may be relevant to the taxpayer.

Amendments to Terms & Conditions

From time to time, Taxumo may amend or add to these Terms and Conditions should the need arise. Changes will be posted on the web-site. The Customer shall be responsible for checking for any amendment done to the Terms and Conditions.

Agreement

The submission of registration to Taxumo, by web, post, hand, fax, or email, constitutes agreement to these Terms & Conditions, including amendments thereto, by the customer.

Confidentiality and Data Handling

Taxumo ensures that all client information is held as private and confidential. Information collected in writing and/or verbally for tax return and tax dues filing services can and may be used for internal auditing purposes by Taxumo. If in case the Bureau of Internal Revenue requests for data beyond the normal requirements / documentation that is submitted, we will refer them to the customer. We will only respond to requests for information from the authorized customer unless required by law.

Refund Policy for Tax Payments

Taxumo shall not process any refund of taxes remitted to the Bureau of Internal Revenue.

Taxumo shall not be liable for any erroneously or incorrectly paid tax by the Customer to the Bureau of Internal Revenue, the refund of which shall be subject to SEC. 229 of the National Internal Revenue Code as required by Philippine Law 1.

Refund Policy for Taxumo Fees

Any change of mind by the customer is not a valid cause for a refund.

Any tax filing through the use of the software, constitutes full use of Taxumo.

Taxumo will handle refunds on a case to case basis upon submission of sufficient proof of any defect of the software. Refunds will only be provided through Xennies or Taxumo Credits.

Taxumo will repair the software without cost to the customer upon any notice of malfunction.

Cancellation and/or expiration of subscriptions regardless of reasoning will result in cancellation of credits earned.

Any credits earned are non-refundable and may not be converted to cash nor may it be used for tax remittances.

Waiver of Liability

The customer holds Taxumo free from any liability, which might result from the customer’s actions, inactions or negligence in the use of Taxumo. The customer understands that Taxumo is not an accredited tax practioner of the Bureau of Internal Revenue and is not required to be accredited as such. The service that Taxumo provides is limited and may cause damage to the customer. The customer despite such warning agrees to use Taxumo. The customer hereby waives any and all claims against Taxumo, which may arise, from the customer’s own assumption of risk. The customer understands that using Taxumo is engaging in an activity that involves risk of serious and severe social and/or economic losses including but not limited to the payment of fines, issuance of sanctions or imprisonment, further, that there may be other unknown risks not reasonably foreseeable at this time. The customer assumes all the foregoing risk and accepts personal responsibility and the resulting financial obligation for the damages following such serious and severe social and/or economic losses. The customer hereby waives all rights and claims, releases, discharges, and pledges not to sue Taxumo based on the foregoing. The customer holds Taxumo free from any and all liability from the service that it has provided to the customer. The customer shall not institute any suit or proceeding for any and all damage that the customer might receive from the use of Taxumo.

The customer agrees that Taxumo shall not be accountable for any damage or tax liability due to the customer.

In addition to the waiver of liability in the preceeding article Taxumo is not responsible for the following:

the customer has provided information which is fraudulent, false, inaccurate, incorrect, insufficient or misleading in any way;

the customer has submitted beyond the deadline specified by Taxumo, which is at least three work days before the tax deadline as specified in the tax calendar of the Bureau of Internal Revenue; the customer has penalties or surcharges incurred prior to using Taxumo. We will only process tax dues and payments that are due moving forward from the date of registration in our system; the customer owes money to the tax authority; the taxing authority has different information on its system than that provided by the customer; the information from the taxing authority that the customer has provided contains incorrect details that led to incorrect tax dues; Taxumo shall not be liable for any and all tax liability due to the customer including but not limited to surcharges and penalties due to late filing done by Taxumo.

Venue

Any dispute arising out of or in connection with this agreement, including any question regarding its existence, validity or termination shall be referred to and finally resolved by litigation in the proper court sitting in Makati City, Philippines to the exclusion of all other tribunals. By virtue of this agreement, the Parties irrevocably waive: (a) any defense of improper venue which any party may now or hereafter have, as well as to the enforcement of the judgment of said courts, (b) any objection to the laying of the venue in the courts of Makati City, Philippines, and (c) any claim that the dispute has been brought in an inconvenient forum. Each party hereto submits itself and its property to the jurisdiction of the proper courts in any such action.

Customer Feedback

Should the customer like to query the quality of service delivered at any time, he/she is invited to email us at cs@taxumo.com

Taxumo Loans

Taxumo Loan is a feature designed to simplify loan applications for eligible users wherein they can securely share relevant financial data with trusted loan providers. By using this feature, users acknowledge and agree to the terms and conditions provided here.

Eligibility

- Loans are available exclusively to active Taxumo subscribers and those who have had an active subscription in the past.

- Taxumo only partners with financial institutions and entities that are regulated by the Securities and Exchange Commission (SEC) and which hold a Certificate of Authority to Operate a Lending Company.

Purpose of the Loan Tab

- The goal of this feature is to streamline the loan application process by allowing Taxumo’s partner lending institutions to access user data, subject to prescribed guidelines, which is necessary for their accurate assessment of eligibility and efficient processing of approvals.

- Taxumo does not offer, underwrite, or guarantee any loans. The decision to approve or reject an application shall rest solely with the lending provider.

Data Sharing and Consent

- When a user clicks on the “Apply” button for a loan provider, they explicitly consent to Taxumo securely sharing their information with that specific provider.

- The data shared may include, but are not limited to:

- User account settings

- Tax filing history and records

- Other relevant financial data required by the loan provider to assess eligibility.

- The user also grants consent for the loan provider to inform Taxumo about:

- The status of the loan application (e.g., approved or rejected).

- Loan disbursement details (if applicable) for documentation and tracking within Taxumo.

User Responsibilities and Acknowledgments

- Users acknowledge that Taxumo does not have control over the approval, interest rates, terms, or repayment conditions set and prescribed by the third-party loan providers. It is the user’s sole responsibility to review the terms of any loan agreement before proceeding with any of the steps and clicking on further external links or portals.

- Users must ensure that their information are accurate and up to date to improve their chances of loan eligibility.

- Any disputes regarding loan terms, repayments, or other related matters must be resolved directly with the loan provider.

Data Security and Privacy

- Taxumo values personal data privacy and security and ensures that user information is shared only with consent and exclusively for the loan application process.

- Taxumo and its lending partners comply with the Data Privacy Act of 2012 (RA 10173) and other relevant privacy regulations.

- User data will not be shared with third parties beyond the selected loan provider.

Disclaimers and Limitations

- Taxumo does not guarantee loan approvals and shall not be responsible for any decisions made and enforced by loan providers.

- Taxumo shall not be liable for any losses, damages, or disputes arising from a user’s engagement with loan providers.

- Users are advised to carefully read and understand the loan terms, interest rates, and repayment obligations before applying.

Amendments and Updates

- Taxumo reserves the right to modify or update these terms at any time. Users will be notified of significant changes through appropriate channels.

- Continued use of the Loan Tab after updates implies the users’ acceptance of the revised terms and full knowledge of the rights and obligations attached thereto.

Addendum: Pricing Change Notice

Existing plan holders on active recurring credit/debit card payments will maintain their current pricing as long as they remain subscribed. Users who wish to lock in current pricing without a card may prepay for a longer-term plan before June 2, 2025.

1Recovery of Tax Erroneously or Illegally Collected – no suit or proceeding shall be maintained in any court for the recovery of any national internal revenue tax hereafter alleged to have been erroneously or illegally assessed or collected, or of any penalty claimed to have been collected without authority, of any sum alleged to have been excessively or in any manner wrongfully collected without authority, or of any sum alleged to have been excessively or in any manner wrongfully collected, until a claim for refund or credit has been duly filed with the Commissioner; but such suit or proceeding may be maintained, whether or not such tax, penalty, or sum has been paid under protest or duress. In any case, no such suit or proceeding shall be filed after the expiration of two (2) years from the date of payment of the tax or penalty regardless of any supervening cause that may arise after payment: Provided, however, That the Commissioner may, even without a written claim therefor, refund or credit any tax, where on the face of the return upon which payment was made, such payment appears clearly to have been erroneously paid.

Certificate of Registration – Use of Taxumo does not require uploading a Certificate of Registration. Taxumo does not verify or authenticate the entries of any information gathered from the Certificate of Registration nor does Taxumo verify or authenticate the Certificate of Registration in any way whatsoever. Taxumo in no way shall be liable for any erroneous filing or filings with improper entries of information done by the user through the system either intentional or by negligence. Use of Taxumo for any and all illegal purposes is not allowed and shall be dealt with in accordance with the law. The User agrees that any and all liability which may arise from the use of Taxumo shall be for their own account and shall hold Taxumo free from any and all liability.