Registering with the Online Registration and Update System (ORUS) at the Bureau of Internal Revenue (BIR) in the Philippines is a pivotal step for taxpayers aiming to manage their tax obligations online. This guide will walk you through the process of how to register at ORUS.BIR.GOV.PH, ensuring a smooth and straightforward experience.

*If you’re confused on how to set up your ORUS account, our team can help you!

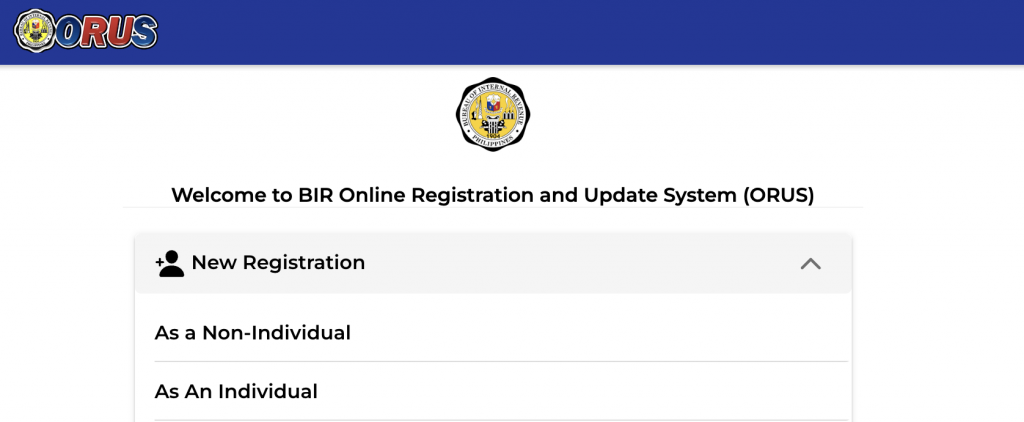

Step 1: Access the ORUS Website

Begin by navigating to the official Bureau of Internal Revenue ORUS website at ORUS.BIR.GOV.PH. Ensure you have a stable internet connection to prevent any disruptions during the registration process.

Step 2: Create an Account

- Choose between New Registration as a Non – Individual or as an individual.

- Here are the requirements if you are registering as an individual:

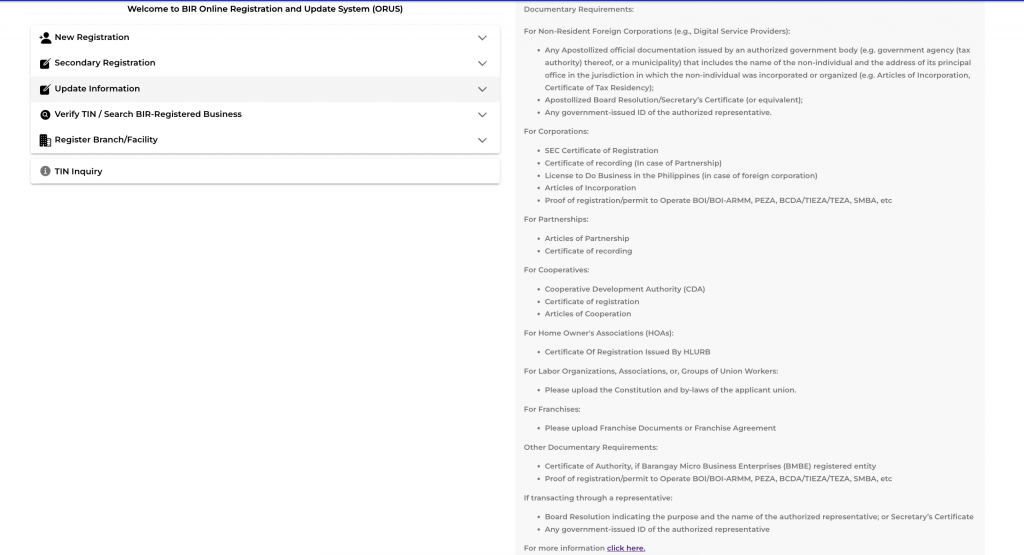

- Here are the documents if you are registering as a Non-Individual with the Bureau of Internal Revenue:

- Read the terms and conditions and agree

- Fill in the required fields with your personal information. It will ask you if you have or don’t have a TIN.

- Fill out the fields. It’s important that you take note of the email address that you will use since this is what BIR will log in their system.

- Create a secure password that meets the ORUS requirements.

Step 3: Verify Your Email

- After submitting your registration form, check your email for a verification link from ORUS.BIR.GOV.PH.

- You will have 24 hours to verify your account.

- Click on the link to verify your account. If you don’t see the email, check your spam or junk folder.

Step 4: Log In to Your Account

- You will receive an email from BIR confirming that your registration has been approved.

- Return to the Bureau of Internal Revenue’s site: ORUS.BIR.GOV.PH and log in using the email and password you registered with.

- The first time you log in, you may be prompted to complete additional profile information.

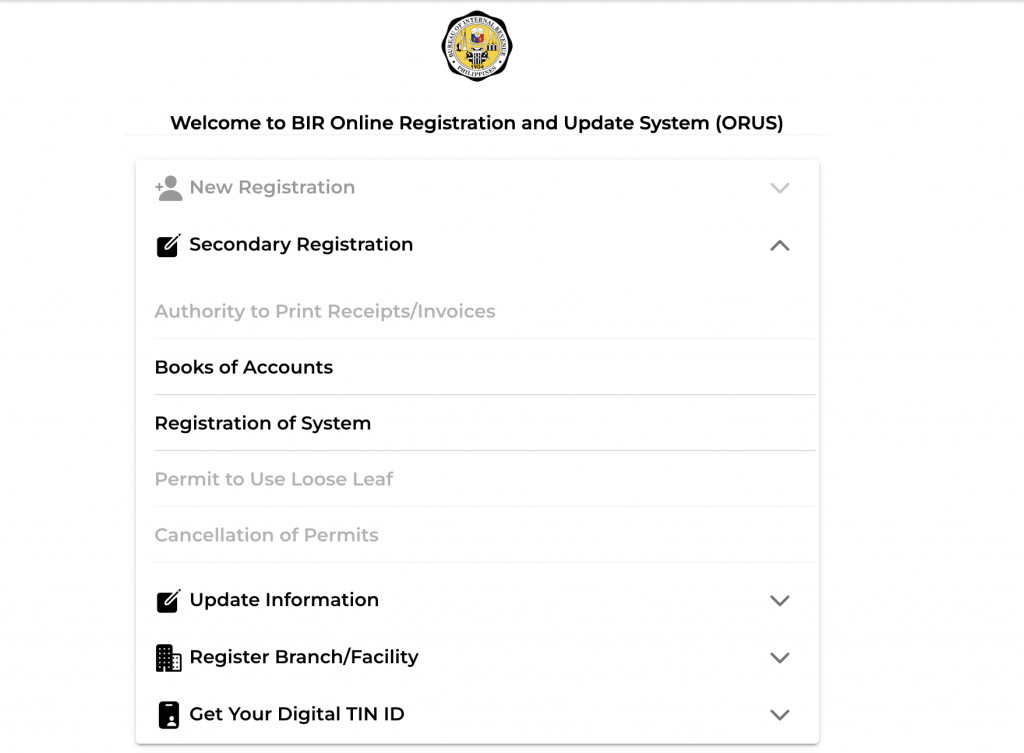

Step 5: Things that you can do in ORUS

- Once logged in, navigate through the different features. Those that are greyed our have already been done. The ones in black are the things that you can still do.

Additional Tips:

- Ensure all information entered is accurate and up-to-date to prevent any delays in the registration process.

- Regularly check your email and ORUS.BIR.GOV.PH account for any updates or required actions.

- If you encounter any issues, check out the FAQs section of ORUS.BIR.GOV.PH: https://orus.bir.gov.ph/faqs

- You can also visit your BIR RDO if you encounter any issues.

Already registered! What’s Next?

Congratulations on successfully completing your registration with the Online Registration and Update System (ORUS) at BIR! Now that you’re all set up with ORUS, the next step in managing your tax obligations is filing your taxes conveniently and efficiently.

One easy way to file your taxes is by using Taxumo, a user-friendly online platform designed to simplify the tax filing process for individuals and businesses. With Taxumo, you can streamline your tax filing experience, saving you time and effort.

This article (www.taxumo.com/blog/how-to-file-your-taxes-using-taxumo) can help you understand how to file taxes the easiest way with Taxumo.

Conclusion

Following these steps on how to register at ORUS.BIR.GOV.PH will facilitate a seamless registration process, allowing you to manage your tax obligations effectively. Embrace the convenience of digital tax administration and stay compliant with ease.

Paano ba gumawa ng tin number

Hello Nathaniel,

Pwede po tayo mag process ng TIN registration through BIR’s eREG portal. Just click this link: https://ereg.bir.gov.ph/init.do;jsessionid=220D07B623E2B69AADA02F69BB0FCC32?app=ereg

How po? I’ve been trying..

For concerns regarding ORUS, you can go po to the nearest RDO (Revenue District Office). 😀 They can assist you there.

may dadalhin po bang mga docs if magpapa assist sa RDO? di kasi ako maka proceed sa online registration maam. Thank you

Hi Yenz! Bring three copies of this: https://www.bir.gov.ph/images/bir_files/internal_communications_2/RMCs/2022%20RMCs/RMC%20No.%20122-2022%20S1905-RUS.pdf 🙂

Vat payer po ako ano po dapat yong hawak na book of accnt?

Hello Merlyn,

Here’s a summary of the books for VAT-registered businesses:

General Journal: Records all business transactions in order of date using “debit” and “credit.”

General Ledger: Summarises all journal entries by account to show ending balances.

Cash Receipt Journal: Records cash sales and collections of receivables.

Cash Disbursement Journal: Records cash payments for expenses and payables.

Sales Journal: Records credit sales (amounts receivable from customers).

Purchase Journal: Records credit purchases (amounts payable to suppliers).

Hello, can’t register sa ORUS “TIN DOES NOT MATCH RECORDS” daw. Nag-try ako pumunta sa RDO pero hindi niya rin alam kung bakit di ako maka-register tama naman daw ang details based sa system nila.

paano mgkuha Ng tin number

Mam paano kumuha nang T. I. N number mam kaylangan kupo kase sa pag alpy nang trabaho mam Sana mam matulogan nio ako

Bakit hindi ako Maka create ng

Account sa bir or orus

Paano po kumuha ng TIN ID online po, at paano po makapasok sa website ng orus

Hi Roel! First step po is to go to your BIR Revenue District office and tell them na magreregister ka for ORUS. Fill this out po pagpunta mo doon: https://www.bir.gov.ph/images/bir_files/internal_communications_2/RMCs/2022%20RMCs/RMC%20No.%20122-2022%20S1905-RUS.pdf Then follow na these steps sa article namin.

Pwede po pagingi Ng link sa 1902

Hello Marie,

Here po: https://bir-cdn.bir.gov.ph/local/pdf/1902%20Jul%202021%20ENCS%20-%20Final.pdf 🙂

Magpa I’d po sana ako kase po wala akong valid I’d paano po salamat 🙏

Hi mam’am, paano po kumuha Ng TIN ID online po?

Thank you!

Sana mabigyan ako ng tin number po

Hello Janibem,

For TIN application po, this should be processed directly sa RDO ninyo. 🙂

Kuha ako ng bagong I’d ng tin

Nawala number ko

Paano ba mag Register sa tin

Tin Id

Tin id

i. need E Tin copy

I want to get a TIN no.how can I get po!plz.help me.

Hello Po Good day!! Paano Po ba magkuha aNg tin # through online Po . I have already tin # Po and I’ll forget the Tin # Po how to get in online Po.? Thank you so much PO ❤️

Paano po makakuha ng tin number

I need Tin ID

Nagawan na po ako ng tin ng hr pero on process pa ito wala pa nakalagay na number paano ko ito malaman ang tin number

Hi Rejane! Please visit bir.govv.ph and chat with Revie, the robot that pops up 🙂 Press mo yung TIN Inquiry. Hope this helps!

Saan makikita ang tin number

Hello Mae,

You can check your TIN information with your RDO po. 🙂

Sana mabigyan po aku ng tin # po…maraming salamat po

Very impressive

Paano po pag gumawa ako ng Digital TIN ? Ma kakakuha pa kaya ako ng mismong ID sa mismong office nila gamit yung digital tin ko?

Pag po ba nag register thru digital TIN , if ever gusto ko mag ka TIN ID makukuha ki mismo sa RDO?

Can’t proceed

Hi Po..may TikTok shop Po aq..paano Po aq mk kuha Ng certificate of registration para Po ma open ko Ang yellow basket ko..

Hi Irene!

Pwede niyo po icheck yung services namin to help you register your business and get your COR. Bisitahin niyo lang po itong page na ito: https://marketplace.taxumo.com/.

Alamin niyo din po if magreregister po kayo as sole proprietor, professional, or corporation. Para sa iba pang katanungan mag email lang po at customercare@taxumo.com

Online application po

How to update my BIR record

Paano PO mkakuha nang TIN # PO.sana mtulongan nyo nman ako Ma’am/Sir

Panu gumawa ng tin#

How to apply online registration

Hindi nakaka gawa ng bir account

Bakit ?

At Hindi na gumagawa ng TIN Ang bir ? Dahil ba online registration na pero kahit online registration Hindi talaga ako maka gawa at bakit????ok naman lahat ah

Bakit eror ang lumalabas kapag nag reregister ako? At kailangan ng ibang email?

How to get TIN number

need kopo magka tin id

Paano po malamn na okay napo ang apply sa tin id po new apply po

Hello Farida,

You can check po with your nearest RDO regarding sa application ng TIN 🙂

How to rigester tin id

Hello Andrie,

You can check po with your nearest RDO regarding sa application ng TIN 🙂

How can I get a TIN number online?

Paano ba mkapag register ngaun ng tin number online

hindi ako maka pasok sa krus bir registration.. paano po kaya gagawin ko?

Hello Sherly,

It is best to contact your RDO to resolve this matter po. 🙂

How to update culomnar note book?

Hi Lorelie,

We have a feature in Taxumo under “Books” where you can check the proper format for your columnar books. Make sure to enter your income and expenses first on our cashflow, then click on “Books” and enter the dates that you need to report to your books. Then you can handwrite down directly to your columnar books the generated information from the taxumo books.

You can sign up for free here: https://www.taxumo.com/

Di ako maka pasok paano mag register

Hi po pano mag register ng books accounts using the online

Hi Matlyn,

I hope you’re doing well! You can refer to this article for guidance on registering your books of account: ORUS Guide on How to Register Your Books of Account.

Let me know if you have any questions!

None

Ano po yung link ng Registration update sheet po?

Pagama kog T.I.N Number

Pano gumawa nang tin I D

Pano po gumawa ng tin number

Pano po mag registerd ng TIN NUMBER

Ma’am patolong man Po Kung paano mag registration ng bir o

Kasi Wala pa Po akung bir tin id

New

d ako maka log in ang hirap

How to get pin number

Tin ID

Plsss cooperate

Send my email address

Tin number

DIGITAL ID

I want to get a TIN

sana po matulongan mo po ako sir

Pano po ma verify yong number ng tin

How can i get orus online form

Hello Hermie,

To register in ORUS, just go to https://orus.bir.gov.ph/home. 🙂

Mag register ako sa ORUS

Thanks for the update, Jerico! Kindly follow the step by step process lang po from this article and if you encounter an error related to information verification, it is best to coordinate this directly to BIR. Feel free to contact them at 8538-3200 or send an email to contact_us@bir.gov.ph. 🙂

Paano Po .. mag pa I’d sa tin number sa online

Hello Glydel,

You should create an account po muna sa ORUS. Once may account na po, an option to get a digital ID will appear po pag naka login na kayo. 🙂

Paano kumuha ng tin number tro online po salamat

Hello Salvador,

As of now, the TIN application should be done directly sa ating RDO as the online portal for TIN application is currently down until further notice. 🙂

Pano kumuha Ng tin number tro online Po salamatttt

How to update my BIR record

Pre employment registration

lagi pong offline ang website ng orus, any idea po kung may nakapagregister na ulit for new application para makakuha ng TIN No.? i tried it more than 3 weeks hindi po ako makaregister.

I want to register for a new TIN.

Thank you, Taxumo – for making almost everything in my taxation journey such a pleasant experience (far from what I expect if I do it on my own)! You guys made it so easy! I can’t wait to start a sub with you once everything is complete with my registration! I am grateful for your services!

Thank you so much for your kinds words, Greggy! We’ll always be here to support you! 🙂

Paano po online registration sa bir

Make a bir id

Online Registration for Tin ID Numbee

Hope I can get my tin number

Ano po ba dapat ko na gawin nawala po kasi yung TIN ID kopo, kabisado ko pa naman po ang aking TIN ID. And also ask ko lang po taga Laguna po ko then yung una ko pong pag register ay sa Taguig pwede po ba sa Laguna na lang ako magpa TIN ID? Thank you po sa response.

Hi po! Check nyo muna and verify sa website ng BIR. Just go to Bir.gov.ph and then may lalabas po sa lower right na “chat with Revie”. May TIn Validation po dun 🙂

Then sa transfer ng RDO, you can refer to this article: https://www.taxumo.com/blog/how-to-transfer-rdo-form-1905/

Hope this helps!

Gusto ko mag online ng TIN NUMBER PARA SAAKING TATAY AT NANAY

Hi , First time Job seeker po ako and nag register na and need po ng verification from email pero until now Wala pa Kong na rerecieve. I also check spam message and everything pero Wala pa din po. Nag try ako sa Isang website Ng BIR to resend email pero right now hindi daw po existing Yung email. Do I need to register again? Medyo natatakot po ako Kasi may penalty po na 1k pag may double tin

Paano po makakuha ng tin number

Hello, I registered on ORUS without an existing TIN under E.0. 98 but the option “Get Your Digital TIN ID” is unavailable. How should I proceed?

Hi there! You can check with the BIR as ORUS is their system 🙂

same with me, there is no ‘Get your digital tin Id” available

Hello. Is it possible to register tin online using passport po as ID? Kasi po ang hinihingi lang sa website is yun national ID.

Your passport is an official government document so that should be allowed. 🙂

hi mam ask ko lng kung tatlo po hawak kong buisness din need po ba tig iisang email or kht isa lang for ORUS?

Hello Cheryl,

If you manage three businesses, you can use a single email address for all your BIR transactions and ORUS accounts. However, ensure that each business has its own separate BIR registration and records.

Hello, I registered on ORUS without an existing TIN under E.0. 98 but the option “Get Your Digital TIN ID” is unavailable. How should I proceed?

BAKIT HINDI MAOPEN PAGDATING SA BIR FORM 1904 PAANO MAKAFILL UP DI NAMAN MAOPEN ,, ANO BA USELESS LANG LINK NIYO??????

Hi Alberto! Are you talking about the link inside ORUS? Might be best to let BIR know about this. To help you out, here is the link to the form 1904: https://www.bir.gov.ph/images/bir_files/taxpayers_service_programs_and_monitoring_1/1904%20January%202018%20ENCS%20final_copy.pdf

Hello! Does this mean po ba no need na pumunta sa BIR para magprocess ng Business Permit and filing ng taxes?

Example po ako as freelancer (virtual assistant)

Hello Mary,

Good day!

The official registration po for your case as a Freelancer should still be done personally sa inyong RDO. Then the ORUS registration is for your other compliance such as your books of accounts. 🙂

Hi. How do I get a TIN verification slip online needed by companies for pre employment? Is it available in ORUS? My RDO is in the province therefore it would be hard to travel just to get a TIN verification slip 🙁

Hi Daniel,

You can try using the TIN Verification portal of BIR.

https://orus.bir.gov.ph/search/tinverification

Hope this helps! 🙂

Hi po, I am first time register in TIN ORUS, paano po ba i update ang mga personal information ko dun?

Hello Joniel,

Good day!

If you wish to update your TIN information, you should go to the TRRA portal instead: https://www.bir.gov.ph/trraportal/ 🙂

How to avail BIR id online po?

Pano mag register sa orus first time po pag napunta sa bir.gov.ph iba naman nalabas pano makakapag fill up kung hindi naman open

I want to get tin

Hello Nel,

Good day!

For TIN application, this requires you to personally acquire one from your Revenue District Office. The BIR requires personal appearance to maintain the confidentiality of tax information. Officials at the RDO will assist you with the necessary details and ensure compliance with BIR regulations. 🙂

PAANO PO TONG NAGREGISTER AKO SA ORUS PERO CORPORATION NI REGISTER KO PAGKATAPOS KO MAGCLICK SA REGISTER MAY LALABAS NA NO RECORD EXIST PO.

Hello Sanny,

Good day!

For this one, it is best to coordinate this with the BIR na po. Feel free to contact them at 8538-3200 or send an email to contact_us@bir.gov.ph. 🙂

How to register tin number.

Hello Emma,

Currently, TIN registration should be done directly to your RDO. 🙂

Hello good day.

Ask lang po. Nakapag register napo Kasi ako sa ORUS then nakapag log in nadin po.

Do I still need to proceed pa po ba sa secondary registration to get my tin number.?

Hello Wilma,

For TIN registration po, this should be processed sa RDO mismo if wala pa tayong TIN. Secondary Registration are applicable for branch registrations po. 🙂

Hi Ma’am.

Ask ko lang po regarding donors tax. May approved na po kaming onet computation. pwede po bang mabayad over the counter for the accredited bank? Kailangan daw po makapag online kami before June 5, 2024 dahil may penalty po iyon kapag nag lapse. Saan po ba akong mag online? sa orus po ba para sa 1800 form. On line po ba i submit yong 1800 forms? Pumasok po kasi under eCAR yong claims namin. Please help naman po.

Thank you very much and hoping for your response regarding this matter.

Hello Cris,

Yes, you can pay the donor’s tax over the counter at accredited banks. However, it is important to ensure that this payment method is accepted by the specific bank you are dealing with. For the filing po pwede po kayo mag file ng form 1800 sa eBIRForms or EFPS portal. 🙂

I have no comment

This step-by-step guide on registering at ORUS.BIR.GOV.PH makes the process straightforward and easy to follow. It’s a valuable resource for anyone looking to navigate the registration efficiently.

Hi! Im trying to register po sa ORUS kaso Email address not found daw. Yung email address naman na nireregeister ko yung gingamit ko tuwing ngffile po ako online, pano ko po kaya sya maayos? salamat!

Hello Hazel,

Best to contact your RDO on this one to fix this concern po. 🙂

Do we have way of retrieving old TIN number through online?

Hello Amorlina,

It is best to contact the BIR for this process as this involves personal information. 🙂

Get tin #

Tin number

Hello Christian,

To obtain a Tax Identification Number (TIN), you must visit a Revenue District Office (RDO) in person. The BIR requires personal appearance to maintain the confidentiality of tax information. Officials at the RDO will assist you with the necessary details and ensure compliance with BIR regulations. 🙂

Hello, magreregister po ako online para makakuha ng id kaso “email address not found”.

Need pa daw i update yung contact information sa RDO. Nakakasad 😔 Nung galing ako sa bir office pinapa online nalang saken kasi wala daw don yung magrerelease ng id.

Hello Eunice,

I’m sorry to hear about the trouble you’re having. It sounds like you need to update your contact information at your RDO to proceed with the online registration. Here’s what you can do:

Visit Your RDO: Go to your Revenue District Office (RDO) and update your contact information. This should resolve the “email address not found” issue.

Follow Up on Your ID: Once your contact info is updated, you should be able to complete the online registration for your ID.

Hi po ask ko lang po, may TIN no. na po ako since 2021. Automatic po ba na naopen account yun pag nag register ka? And Pano ko po malalaman if may penalty ako? Kase po dko din po alam if naclose yung account ko?.

Hello Jairel,

If you have had a TIN number since 2021, it usually means an account was opened for you upon registration.

To check if your account is active and if you have any penalties, you can:

Visit the BIR RDO: Go to the Revenue District Office (RDO) where you registered your TIN. They can provide information on your account status and any outstanding penalties.

Contact BIR: You can also call the BIR hotline or use their online services to inquire about your account status and check for any penalties.

Online Services: If you have registered for BIR’s online services, you can log in to your account to check your status and any potential penalties.

I hope this helps.

Good

bakit po napakahirap magregister d2 sa Orus.bir.gov.ph kahit my existing TIN number kana pagkaclick ng PROCEED laging sinasabi no record found bakit ganyan sobra hirap mula pa kanina umaga ako try ng try hindi ako makapagregister!!!!

Hi po, i tried to register but a message with error code ER102 popped up.

New account registration

How to access the online application ?

Hello John,

You may access this via https://www.bir.gov.ph/eServices.

Thank you!

Hi,

Employer here.

After linking employee in ORUS, status po is “FOR REGISTRATION”. What should be our next step po? How long does it take to have TIN no. issued to our employee?

Thank you.

Pano po mag registered tin ID

Paano mag register pag may dati ka ng tin #?

How to register tIN ID

Hi, What are the tax requirements for foreign artists performing in the Philippines and local artists performing abroad? thank you

I have been a government employee for 22 years now and have been using the same TIN all throughout my service, however upon verification my TIN number is not on record. What to do po?

Pano po gumawa ng tin id?

nagreregister po ako pero bakit po ang lumalabas no record of head office in our system

Good day ! Paano Naman po kung nakapag registered na sa ORUS pero Ang next step ay Hindi ko pa alam kung paano I print out un.

Hi.

Maam may tin id na po ako.

Pero need po ng company yung papel.

Hnd ko po alam kung anong tawag doon.

Saan ko po pwdng makuha.?

Ty.

Pano po magregister sa ORUS ng branch.

Pano po if walang option na Get your Digital ID after ki mag Log in sa ORUS po? Thank you for your help 😊

Panomag regester nang tin number

new online registration to get a tin id

Hello po gusto mag online but hindi po ako maka online pwede po patulong need ko po sa ng tin sa trabaho po . Salamat

How to register invoices to orus?

Pano po makakuha ng panibagong copy ng Tin ID kase nawala po Yong original ko na tin ID.

Thank you.

I already have a TIN but I want to have a TIN ID. Please help on how to go about it.

papaano bang mag create ng account para makakuha ako ng on line ID

need lng sa work

Nag register po ako sa ORUS, kaso ang naka lagay TIN number does not match, tapos second time INACTIVE daw TIN number ko, pero yung nag TIN verification ako, ACTIVE naman status sa TIN ko. sa pag register lang talaga sa ORUS ang problema ko. Thanks

How to verefy my tin no.?

Hi Arnel!

Please visit bir.govv.ph and chat with Revie, the robot that pops up 🙂

Registration

My problem is. During the enrollment in the sign up or create an account in Orus. Upon clicking the “register” button. It pops up the word “yoir email address is already registered. Try another email”

Attempted many times. The same result. My understanding is, it is suggestive to use our email that will also serves as our username. So i did the instructions.

Moving on. Since ot pops up the same answer. I’d try to use my another email. And it pops up after clicking ” your email is not registered.

I’ve yroed many times.

Can you please help me. Those informations are correctly encoded. Whats the problem in this.

Pls help me thru the email I provided. I badly need my ID to pair for my other government ID so I can get my final pay.

Thank you so much

Hi Reggie! Some of the clients who encountered this needed to go to the BIR RDO to check on this. If you need assistance, check this out: https://marketplace.taxumo.com/products/orus-registration-of-bir-books-of-accounts

hi mam Iris,

Still I cant open the SPPMPC ORUS ACCOUNT, the Taxpayer Information Registration is successfully updated already but still I can’t open it. thank you.

Hello,

Good Day..

How doI register at Orus as a freelancer po?

I have several friends with business po kasi and in behalf of them am doing the tax filing and compliance.

Thanks

How to create tin id

Hi!!! My bookkeeper is asking me to go to my RDO to create an ORUS account and needs to be processed at my RDO. Do I really need to go to my RDO or I can do this online? Thanks for the help!

Hi Carina! We have a service for that here: https://marketplace.taxumo.com/products/orus-registration-of-bir-books-of-accounts

How to get tin no. in orus? I already have orus account and still waiting for my tin no.?

How can I get TIN No. in orus? I already have Orus account and still waiting for the bir to give me a tin no..how will I know if bir already give me tin no.?

Hi! I already registered in ORUS and according to my local BIR, I should register online to get a TIN. But when I am trying to get registered for an individual TIN, I can’t find the proceed button or forms to continue.

Paano po magkuha ng tin ID #.ano po mga requirements

Paano po magkuha ng tin ID # ano po mga requirements.

HOW TO UPDATE MY EMAIL?

Paano makuha Ang tin I’d number

good day! I just finished creating my account, but walang nakalagay na tin, branch code, and rdo code. ano po ang pwede kong gawin?

Hello Erica,

You can check po with your nearest RDO regarding sa concern niyo po 🙂

hello maam ,pede ba MAGSUBMIT NG MGA REQUIREMENT for CoR DITO SA ORUS WEBSITE?

Hello po Mary! You may contact BIR through the Customer Assistance Division (formerly BIR Contact Center) at Hotline No. (02) 8538-3200 or send an email to contact_us@bir.gov.ph regarding your inquiry 🙂

Pingback: How to Get COR (Certificate of Registration) from BIR [2025 Guide]

Nice

Digital Tin ID

How to get freelance license? Do you have a link?

Hi Jem,

In order to operate as a freelancer here in the Philippines, you need to undergo the process of registering as a Freelancer from DTI, LGU, and BIR (to get your business permits and certificate of registration)

If you need any assistance, feel free to check out our services for business registration here: https://marketplace.taxumo.com

If you have any questions, feel free to email customercare@taxumo.com

How to get TIN number

Hi Reynel,

Kindly check with your nearest RDO on how to claim your TIN number.

how to create tin idk

Hindi ko pa nakukuha tin id ko pano ba yun Makita sa online