Without a doubt, tax compliance is an expensive, painstaking, and time-consuming task to do in the Philippines. The Philippine tax filing system just makes it too hard for us to accomplish all our tax-filing responsibilities on time. Regardless, we still bear the brunt by being severely penalized for failing to keep up with their stringent requirements and filing process.

But here’s a breath of fresh air for us, Filipinos. It is because of these that Taxumo came to be. Recognizing how tedious the filing process is, and how much of our precious time it eats, we devised an online tax filing platform that makes the process easier, convenient, and less time-consuming. No need to hire an accountant nor use a calculator to compute. All you need is a computer and a stable internet connection, and you’re good.

You just simply have to key in all pertinent information, and Taxumo will fix everything else for you. This is so all your time can go to things that really matter, such as your business, profession, and your family. Note that this guide is applicable to entrepreneurs, freelancers, and self-employed professionals.

The Standard BIR Filing Process:

a. Accomplish the BIR Registration process:

- Register your TIN.

- Submit the general registration requirements to your designated BIR-Revenue District Office.

- Have your BIR Form 0605 stamped by the officer-in-charge.

- Go to a BIR-authorized agent bank to pay for the P500.00 processing fee.

- Go back to the BIR RDO to present proof of payment

- Secure BIR Form 1906 or Authority to Print Invoices/Receipts (ATP) and 4 Books of Accounts

- Submit your ATP the attending officer.

- Secure columnar books and have them stamped by the guard. Skip this step if you are not a mixed-income owner.

- Submit 4 books of accounts to a BIR-authorized printing press. Go back after the processing time, which may take 5-10 days.

- Attend the scheduled taxpayer’s briefing

- Secure COR or BIR Form 2303

- Have your COR stamped.

After the last step of the 12-step process, you may now rejoice for you’ve survived the grueling BIR Registration process. That does not end there though. Having a COR is just a prerequisite before you get to file your taxes.

In need of BIR, Municipal Hall, or DTI processing assistance?

Taxumo can help you get started with your business registration!

Click here to learn more

b. Proceed to the BIR Filing Process

After accomplishing the BIR registration process, then you can already file your taxes. Here are the steps for the manual BIR filing process.

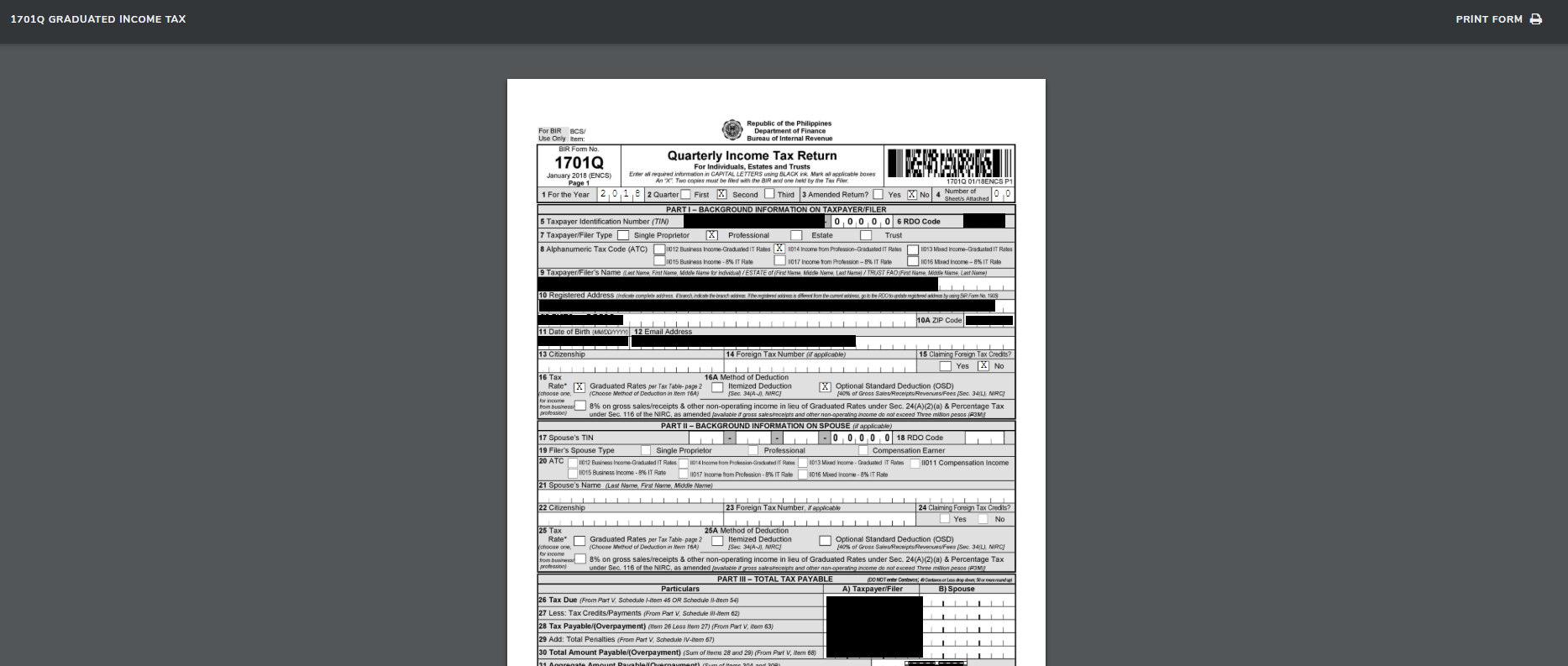

- Obtain a copy of the BIR Form you opt to pay. You can secure a copy either online or at the BIR-RDO.

- Fill it out.

- Prepare the required attachments, specific to which BIR Form you opt to pay.

- Go to the BIR-Authorized Agent Bank to submit the duly-filled BIR Form together with the required documents. Pay the designated amount and processing fee.

- Secure a copy of the duly stamped and validated form, which will be given to you by the representative. This will serve as your proof of payment.

How to File Your Taxes Using Taxumo: From Registering to Filing

As we can see above, the standard process is definitely as complicated as it seems. Now, here’s how you can file your taxes through Taxumo. It’s condensed in just three steps:

STEP 1: Sign up to the Taxumo platform.

First, create an account for Taxumo by filling in all pertinent information. After creating an account, wait for a confirmation, which will be sent to your email account, so check on your email to confirm.

Assuming you’ve already created an account, edited and filled up your profile, sign in to the Taxumo platform.

NOTE: Prepare a scanned copy of your Certificate of Registration, which you’ll have to attach as you edit your profile.

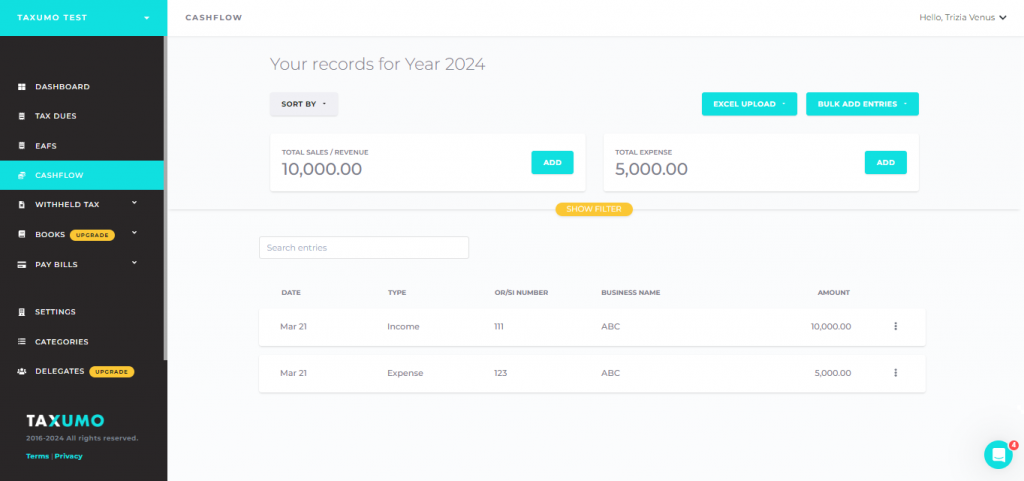

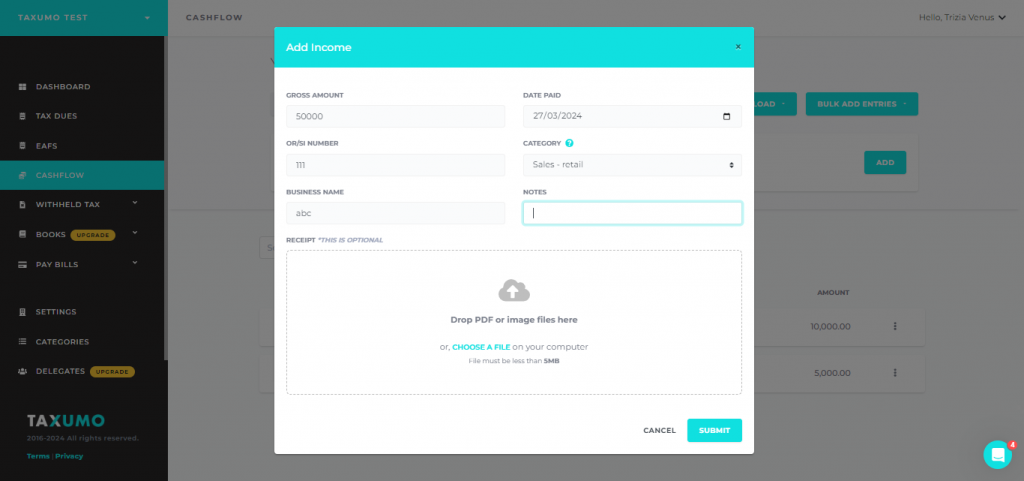

STEP 2: Fill in all pertinent information, including your income and expense.

Next, fill in all pertinent information, including your income and expense. To do this, go to the Cashflow section on the left corner. It will show you the records for the year.

NOTE: Don’t forget to have a scanned copy of your receipts ready, since you’ll have to attach this as you enter your income and expense. Furthermore, make sure to review your entries before proceeding.

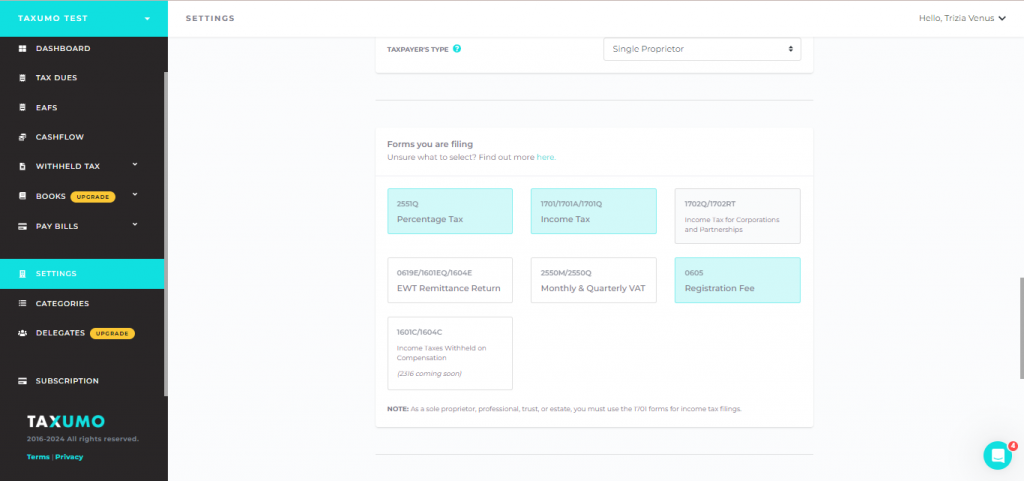

To file your taxes, click on the forms you opt to file on the “Company” Section on the left corner. These are automatically computed based on the income and expense you’ve entered.

After accomplishing this and confirming the correctness of the information you’ve entered, you’ll be redirected to the section that shows the incurred tax due amount plus the processing fee. The autogenerated tax form will also appear below it.

STEP 3: Pay at your own convenience via our available and convenient payment channels.

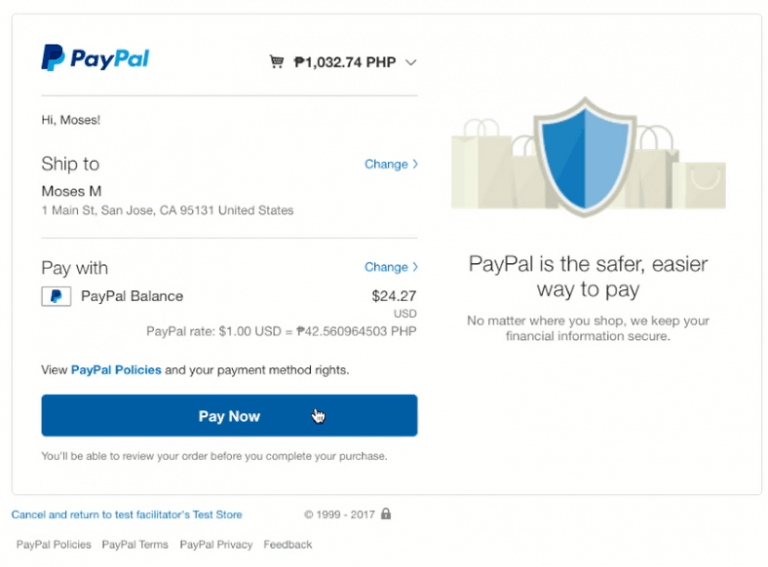

By clicking on “Pay Now,” you will redirected to the actual payment option, which, in this case, is Paypal.

If not Paypal, however, you may also opt to pay via our other convenient payment channels. These include Unionbank, RCBC, EON, GCash, and Dragonpay.

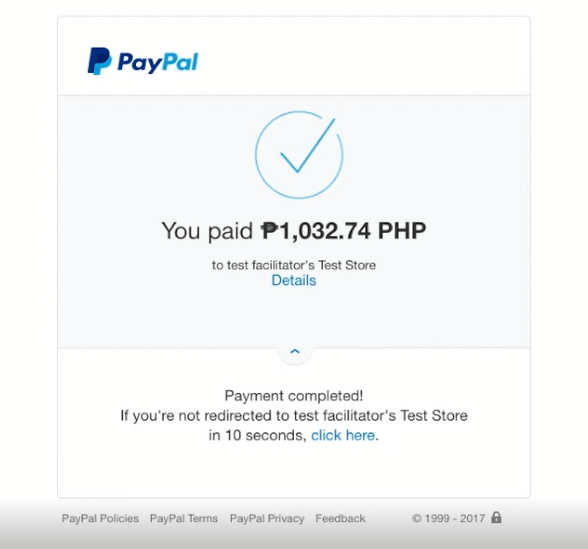

In just a few seconds, you should be taken back to Taxumo. You’ll see that your payment is successful.

The next step will all be on Taxumo. We will submit and pay to the BIR on your behalf. That’s it. There’s no longer a need to go through long queues to the bank nor to the BIR Revenue District Office. This is because everything will be done online.

And so what’s supposed to be a 2-3 hour time, it’d take if you go through the manual tax filing process, can be done in just a few minutes. You can sit and breathe comfortably. Certainly, you are assured of an on-time tax form filing and payment, spending your time worrying less about your tax dues.

Pingback: How to Register at ORUS.BIR.GOV.PH: A Step-by-Step Guide | Taxumo - File & Pay Your Taxes in Minutes!

Pingback: How to File Your Annual Income Tax Return Digitally

Pingback: BIR Tax Online Sellers - Is There An Easy Way To Do Taxes? | Taxumo - File & Pay Your Taxes in Minutes!