The Tax Reform for Acceleration and Inclusion (more popularly known as TRAIN, less popularly known as RA No. 10963) has been signed. This has opened up more options for Individuals, SME’s, Professionals, and Freelancers when it comes to paying taxes.

TRAIN’s New Tax Option

In particular, TRAIN gives us a new 8% Gross Receipt Tax that you can choose to file instead of filing the Percentage & Income Taxes. This is an intriguing choice as it definitely makes computing easier. Just multiply your total income (above 250K) by 8%! Then I asked myself, yes it’s easy but is it cheaper? Will I get out ahead if I just opt to pay 8%?

How It Works

You see, the more business expenses you have, the less you have to pay for your Income Tax. The 3% Percentage Tax is a given but if you’re in a business that has a low margin / high cost of sales, then the 8% Tax will definitely eat up into your margin.

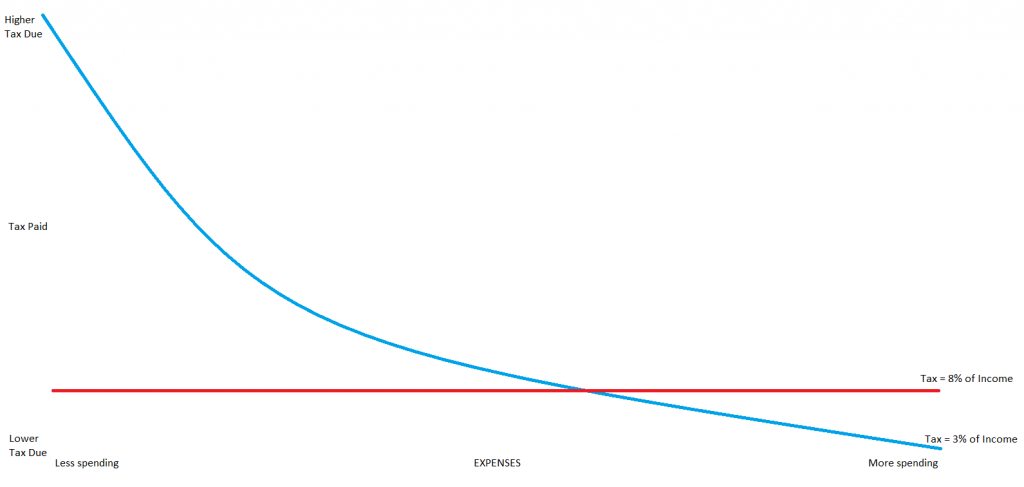

To illustrate, this is a sample chart of the 8% Tax (red) versus Percentage + Income Tax (blue):

The x-axis here is the amount of spending you incur. Notice the blue line going down? It shows how your income tax goes down when you spend more, finally flatlining into the 3% percentage tax rate. The intersection of the 2 lines corresponds to the volume of expenses at which Percentage + Income Tax (aka Graduated Income Tax Rate) becomes more economical/optimal than 8% tax.

So how do we get that point? We got you covered. We made a calculator! To use it, enter your monthly income. It’ll compute for you at what point of spending TRAIN’s 8% Tax becomes more expensive:

So, based on this calculator, if you find that the 8% Income Flat Tax Rate is best, it would be helpful to check the other articles below:

How to Avail of the 8% Income Tax Rate on Gross Sales/Receipts

Thank you for sharing this. I just want to clarify. If we opt for the 8% flat tax,(assuming that our gross sales/ receipts do not exceed 3 million), do we only file our ITR only once a year? We no longer have to pay the monthly percentage tax nor the quarterly Income tax? And the 8% tax is after deducting the P250,000?

But if we do not use the 8% tax, then we still pay both the percentage tax monthly and the quarterly income tax? Under this option, when do we deduct the P250,000? Is it only during the Fourth quarter Income tax? If so, if we paid taxes during the first to third quarterly Income tax but our total for the year did not exceed P250,000, do we just request for refund?

Please advise. Thank you very much!

Hi Jo! Thanks for leaving a comment. As of today (1/18) we’re still waiting for the Implementing Rules & Regulations (IRR) from the BIR for these particular changes so these are still subject to change. To answer your questions:

In my case, I filed and paid my Jan 2018 3% percentage tax just to make sure I will not be delinquent comes due date. Will this payment I made be deductible and how, once a more clearer IRR is issued?

Thanks

The BIR has recently issued an advisory saying that Percentage Tax is now quarterly. Now if you paid 2551M before, that’s something that will need clarification from the BIR. For Taxumo users who have paid their 2551M for Jan 2018, however, they are “safe” because we have procedures that allow us to deduct the payment they have made previously to the quarterly due.

Hi,

Yesterday, I opened the form 2551Q for the first time and see how it looks like. I tried to “test fill” those fields especially the amount fields. I cannot find the ATC PT010, therefore I was not successful.

Thanks,

Hi Tusing, are you speaking about eBIRForms? I believe the BIR has not yet updated that. However, Taxumo is ready ahead of schedule – you can file 2551Q through us with the proper tax codes already. 🙂 Try us out at https://www.taxumo.com

Hi EJ, Your article has been very helpful for new freelancers such as me. Thank you. My problem is I didn’t file my monthly percentage tax on Jan 20, 2018 because of the circulating news that we only had to do it quarterly. I even went my way of checking it with the Officer of the day on my RDO. However, my COR has not been updated yet. According to some news, we have to update our COR first before the quarterly filing can be applied to us. Shall I be penalized for not paying my January monthly percentage tax ?

Hi Richelle, you’re welcome! The filing due on Jan 20, 2018 – that covers December 2017 – is definitely still under the pre-TRAIN tax regime. So you should have filed a monthly percentage tax return then. 🙁 As per an advisory released by the BIR, those previously filing monthly are now all expected to file quarterly instead. Note that you can file late filings through Taxumo — we even compute your penalties for you! Give us a try at https://www.taxumo.com. Send us a note via the chat button and we’ll help you get sorted. 🙂

Sir just wanted to ask what is the procedure to file the 8% tax. Do I file monthly with no transaction? And how about quarterly? When to pay the 8% tax?

Hi Jovic, as of today, Feb 5 2018, the BIR has yet to release the Implementing Rules & Regulations re: this. In short – we still don’t know how to opt in for this method. Indications show, however, that there will be a quarterly filing for the 8% Tax.

Thank you for this article.

I have three questions:

1) I am confused about the 3% tax (PT010) because of the President’s veto. So to clarify, if we opt for the flat 8% GRT, does this mean we don’t need to pay the PT010, despite the veto?

2) I am a consultant. My monthly income is variable, and my client withholds 8% of my professional fees every 15th & 30th. How will I know if the 8% GRT is best for me?

3) The deadline for the monthly percentage tax for January is on Feb 20. In the absence of the new IRR, should I pay the PT010?

Thank you in advance and regards.

Hi Jig,

1. Yes, that is our understanding: 8% GRT replaces BOTH Income Tax + Percentage Tax. However, the BIR has yet to release an advisory/IRR regarding this.

2. To determine if 8% would be best for you, you can use the calculator that we created: https://blog.taxumo.com/tax-savings/new-options-tax-reform-train/

3. Filing a 2551M while waiting for the IRR would be the prudent thing to do.

Hope that helps!

Thanks!

I was told that if you opt to file the 8%, if you are using the ebirforms you need to file the percentage tax online as no transaction. And you dont have to pay. This is to make sure you have no missed transactions or “open case”. Am i right? Then wait for the quarterly income tax filing.

Because of the veto… I want to know also if my gross income exceeded 250,000, do i start paying percentage tax plus the 8% income tax? If yes, when do i start filing the percentage tax? Is it only after i reached the 250,000?

On your previous question whether you have to file 0%, no IRR yet on that. With Taxumo though, we take care of these uncertainties so you don’t have to worry about them. We’ll tell you what to file when to file them. 🙂

On another note; we used to have this Optional Standard Deduction and Itemized Deduction. Will these 2 be obsolete under the TRAIN LAW? I have opted for the OSD before as this is simpler to do. What will happen now if you file the form 1701Q, granting it to be continued?

Thanks

Hi Tusing! OSD and Itemized Deduction still exist. OSD, for instance, may still be a viable option for someone who’s not eligible for 8% (earning about P3,000,000). No change to the process with TRAIN. However do note that if you opt for 8%, the Itemized/OSD discussion doesn’t really apply anymore.

Hello,

(I don’t know what happened to my previous comments).

Anyway, effective Mar 14,I have opted for the 8%. I have opted for this as this easier and less work.

I was told the following:

No more 2551m and 2551q for me. Instead I will be using 1701q and 1701.

In filing 1701q, the 250k will be applied on a “deminishing balance”. Ex. I have 50k on 1st qtr less 250k, the 200 K will be applied in the 2nd qtr. and so on.

The forms are not yet updated hence I cannot “test fill”

Please advise if there are new IRR ?

Thanks

There is an RR released for Income Tax – [RR No 08-2018]. With [Taxumo] the forms are filled out automatically and we carry out the data from your previous submission (if done via Taxumo) to the next one so it vastly simplifies things. 🙂

Hi Sir,

I am a lessor for my space rental business.I just want to know .if the 8% GRT ang basis ko bale ndi na po mababawas sa ITR ko ung ung paid ng with holding agent ko monthly just flat na pong excess sa 250k times 8%?Thanks po.

Hi Norina, creditable taxes withheld are still credited to your tax dues. 🙂

Hello,

I’ve just read this Supplemental Tax Advisory on this Percentage Tax, 2551Q.

I don’t see any rate inside this form 2551Q for percentage tax similar to 2551M which is 3%.

Is this particular form to be updated also?

Hi Tusing, are you speaking about eBIRForms? I believe the BIR has not yet updated that. However, with Taxumo, we are all set for the submission of 2551Q. You can submit and pay through us instead! Try us out at https://www.taxumo.com 🙂

Sir, how is the computation of mixed income earners? If i opt for the 8% tax will i still deduct 250k from the gross receipts from business?

Hi Mary Ann, no – mixed Income Earners DO NOT deduct 250K when computing the tax due for their business. You can read more about that in our latest article regarding the 8% Gross Income Tax Rate.

Is the IRR already available? So how much is the average homebased freelancer (who doesn’t exceed 250,000 per year) need to pay monthly? 🙂

Hi Joanna, the BIR has been releasing it in short bursts. Here’s our latest article on the 8% Income Tax Rate with updates from the most recent RR’s.

Hi! is the 8% withholding tax the 8% flat tax rate?

Hi Sanova – nope that’s different. The 8% withholding tax are tax credits you can use as deduction when you file/remit your income tax. It’s a common misconception that some people have that since their customer withheld 8% then they’ve already paid taxes — that is NOT the case at all. You will still have to file a tax return on top of this!

Is there a procedure to follow if we opt to use the 8% tax rate? I heard we need to change certificate of registration from monthly non vat to 8% tax rate?

Hi Josephine, hot off the press: How to Avail of the 8% Income Tax Rate Option on Gross Sales/Receipts. In this article, I talked about how to opt in and what you need to and keep in mind.

Hi Sir. I work in an insurance company that is already under liquidation. I work as a contractual employee under what the Insurance Commission calls “Special Project.”My contract is renewed on a monthly frequency. What is the tax rate/ percentage that’s deductible from my income? I heard that for such kind of job, tax rate should just be 8%. Please let me know where I can find the provision for such tax rate under the TRAIN law. Thank you so much.

Hi Monalisa! It sounds like you’re working as a freelance professional, as is the case with most financial advisors and insurance agents. You may want to read this article by MommyGinger as it explains how taxation works in the context of a freelancer/professional. After that, you can read up about how the 8% Income Tax Rate Option can work for you.

Hi Sir Just want to know about 8% tax for the BMBE? I am confused if we need to file gross sales receiot every quarter?

Hi Paul! BMBE is exempted from paying income taxes although you do have to file – and yes, this filing of 1701Q is done quarterly. You will have to pay percentage taxes with BMBE though. Now having said that, I’m not exactly clear on the implications of TRAIN on BMBE enterprised — it may be best to ask the BIR customer assistance division (981-7003 / 981-7020) to understand how BMBE works with the 8% Income Tax Rate option.

im a consultant. i get my salary every 15 and end of month already deducted with 8% withholding tax

if i choose 8%

1. do i need to file quarterly or only annually

2. example my gross is 1000000 for a year. i received 920000 because they already withhold the 8% which is 80000

1000000 – 250000 = 750000

750000 x 0.08 = 60000

do i need to pay another 60000 to bir OR the 80000 previously withheld is deductable meaning 60000-80000 = -20000 (credit)

so do i pay 60000 or nothing (with -20000 credit)

thanks

Hi Michael! No details yet on how regular it’s going to be BUT our sources do indicate that it will most likely be quarterly. With regards to your computation, the 80,000 withheld is deducted from your tax due of 60,000. So that means you have overpayment of 20,000!

With Taxumo, you’ll always have visibility on how much your tax dues are with our real time tax calculator, helping you streamline your cashflow in the future. Try us out now at https://www.taxumo.com

Good Day!

Can a VAT-registered professional avail of 8% GRT?

Hi Sharon! Yes you can BUT you will need to change your registration to NON-VAT first. You can read more about this in our new article: How to Avail of the 8% Income Tax Rate on Gross Sales/Receipts

Once you’ve updated your registration, you can use Taxumo to start filing your taxes. 🙂

Hi. EJ, your article is very helpful, may I ask if I received a total annual income Php335,735.00 from sole practice of profession under the Nurse Deployment Project of DOH what is the most prudent thing to do since I still have Php29,000 tax refund from 2017. Thank you.

Hi Marie Helen, it would depend on your expenses. If your expenses reach the amount mentioned in the calculator, then 8% may not be the optimal choice for you. 🙂 You may want to try out [Taxumo] – your tax dues are computed in real time so you always know how much you’re supposed to pay.

Hi! Im all confused with the computation what if the annual gross is only 650,000 how to compute the tax using the two method? Thanks

Hi Rachel, you may want to use [Taxumo]. It automatically computes your tax dues so you can see how much you need to file in real time. 🙂

Hi, i filed 2551m for tax period feb 2018 but the bank declined and suggested to file 2551q instead. Is this correct if bir had no irr yet released. Need your help pls.

Yes, this is correct. You may want to try filing through [Taxumo]. The process is much simpler and we update Taxumo with the latest released RR’s so you’re sure that you’re filing the correct forms & filings. 🙂

I am a space lessor.

What tax type do i need to pay quarterly, is it 2551Q or 1701Q?

Depends on your COR. Most likely both.

Hi EJ, assuming my monthly salary is P50,000 making my gross in the whole year 2018 P600,000, if I will choose the 8% method, can I subtract the P250,000 in the 1st quarter? So it will be like this:

1st quarter taxable income: 150,000 – 250,000 = -100,000 = 0 taxable income with 100,000 credit.

2nd quarter: 150,000 + 0 (1st quarter income) – 100,000 (credit) = 50,000 x 0.08 = 4,000 (tax for 2nd quarter)

3rd quarter: 150,000 + 50,000 (2nd quarter income) = 200,000 x 0.08 = 16,000 – 4,000 (previous tax) = 12,000 (tax for 3rd quarter)

Annual income tax for 2018: 150,000 + 200,000 (3rd quarter income) = 350,000 x 0.08 = 28,000 – 4,000 (2nd quarter tax) – 12,000 (3rd quarter tax) = 12,000

Total tax paid = 4,000 + 12,000 + 12,000 = 28,000 = ((650000 – 250000) x 0.08)

The reason I ask about deducting the 250,000 in the 1st quarter is to avoid paying more (then having a credit) when I compute the annual income tax.

Thanks

So there are still no memoranda/rules/ciculars on how to file the 8% Flat Income Tax Rate – whether it will be a different form or they’ll adapt the 1701Q form (likely) so I can’t say for certain. However, most likely, it would be similar to what you did above with the exception that the 250K is deducted every quarter:

Q1: 150K – 250K = -100,000

Q2: 150K (Q2) + 150K (Q2) – 250K = 50K * 0.08

and so on.

Again, this is really just speculation at this point until we have those sweet sweet RR’s released. 🙂

Hi Taxumo. I will be filing my taxes for the first time as a freelancer, and I was all set to opt for the percentage+income tax (OSD) mode. However, I read about the 8% gross receipts tax and now I’m slightly confused as to which is more cost-efficient for me. I am a non-VAT registered taxpayer, and my Q1 gross receipts did not exceed P17,000; I will assume that this figure will be the same for the next three quarters of the current taxable year. So which tax should I be filing? Thanks.

Try out the calculator above! Which is more cost optimal for you depends on how much you spend to offset the “normal” income tax. You can see at what point of expenses that is by using the calculator above.

Pingback: How to Properly Accomplish and File the BIR form 1701Q

Hi Sir. I am a freelancer and opted for voluntary contribution to mandatory deductions (SSS, PHIIC, HDMF). I am planning to open PERA, which has tax benefits. Will all of these (+ 250K) be deductible from earnings before computing 8% tax? Thank you.

Hi Sir. I am a freelancer and opted for voluntary contribution to mandatory deductions (SSS, PHIIC, HDMF). I am planning to open PERA, which has tax benefits. Will all of these be deductible from earnings before computing 8% tax? Thank you.

Is the 250,000 deduction applied quarterly or is it applied only when the annual tax return is filed?

Hi Ej,

Good day. I got COR for my hardware business last November 2020 but I had my business opened only in January 2021. Do I still have to file 1701 in ebirforms for the taxable year 2020?? Thank you.

windsor

I don’t think so Sir. what happened to me is I started filing after I got my ATP /receipt. not after I got my COR. I believe you are considered in business once you have all the necessary docs na and the last Item was the receipt

Hi Sir, I have a question. First time to file the 1701Q 1st quarter last May 5th. the expenses reciept that I have do I submit this to BIR? or just keep this with me?

Pingback: How To File Your Annual ITR (1701, 1701A & 1700) | Updated For 2021

Pingback: Brand New 2551Q Form (Quarterly Percentage Tax) with 8% Opt In | Taxumo - File & Pay Your Taxes in Minutes!

Pingback: File and Pay your Income Tax Return for 2018 (1701) via Taxumo! | Taxumo - File & Pay Your Taxes in Minutes!

Pingback: How to Avail of the 8% Income Tax Rate on Gross Sales/Receipts