If you employ a few people, you know how much of a process it can be to file BIR 1601C Form every month. And the more employees you have, the more complicated it all gets.

With MSMEs in the Philippines employing an average of 3 people per business, we decided that something had to be done. As a business owner, you shouldn’t get bogged down filling out long forms and manually computing the tax dues each time. Your time is better spent on more productive tasks that have a direct impact on your business’s growth. And, even if someone else does it for you, wouldn’t you rather have them work on more worthwhile tasks as well?

To solve this problem, we have made the process of filing your BIR 1601C Form easier and definitely hassle-free! Like all the other forms you can file on Taxumo, all you have to do is enter all your salary expenses and let our platform do all the heavy lifting for you.

But first, what’s BIR 1601C Form?

To those who don’t know what BIR Form 1601C is, it’s a form you have to file each month when you have employees. And the exact name the BIR gave this form is the Monthly Remittance Return of Income Taxes Withheld on Compensation.

Despite the complicated name, the reason why you have to file this form is that you have to withhold a certain amount from your employees’ salary for income tax purposes. Think of this as paying your employees’ income tax in advance.

And that’s BIR Form 1601C in a nutshell.

More time saving, more time growing

We want to move you away from filling out forms manually to make you more productive in your business. And so, we’ve developed new workflows to help you save time filing your BIR Form 1601C.

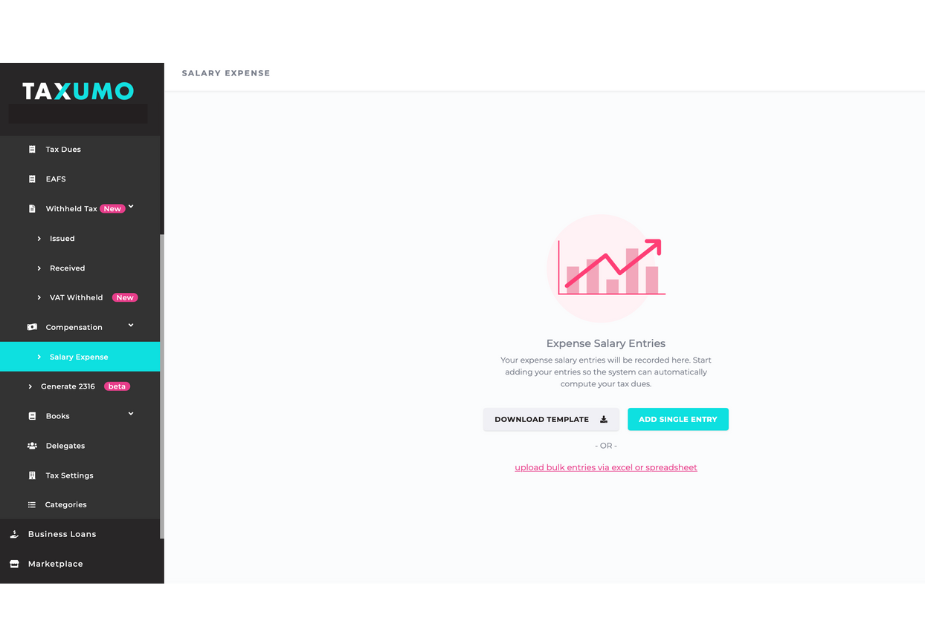

Compensation Tab

Now you can see all your salary expenses in a single tab on the Taxumo dashboard. This gives you an instant view of all your employees’ salaries in one single click.

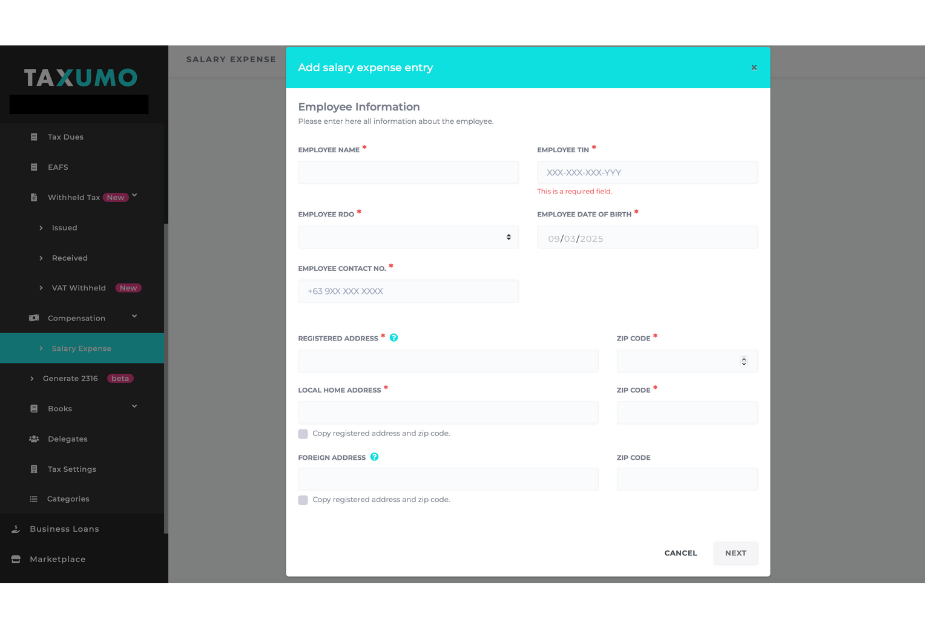

Automatic Withholding Tax Calculation

We ask for all the relevant information regarding your employees’ salaries and benefits so that your withholding tax is computed automatically and correctly. This information will also be used to auto-generate the BIR Form 1601C.

Duplicate Expense Feature

Do you have two or more employees with the same salary and benefits? Or, do you want to enter an employee’s salary that’s the same as the previous month? After that, you can easily duplicate entries, so you won’t have to enter the same information again!

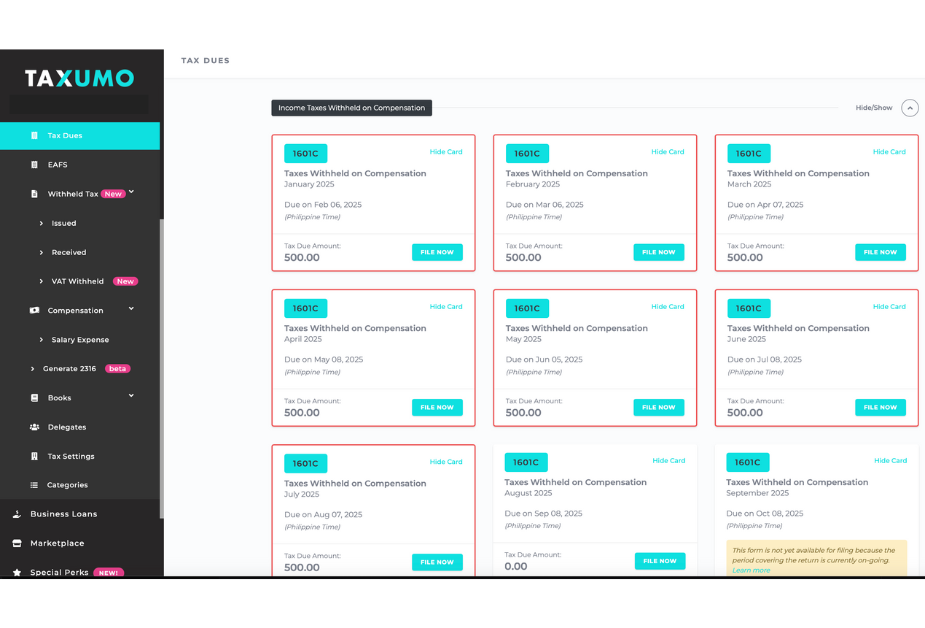

Real-Time Tax Calculation & Auto-Generated Tax Forms

Once you enter your salary expense, it immediately appears in your filing, and we automatically generate your BIR Form 1601C. Say goodbye to long, boring forms, we take care of them for you!

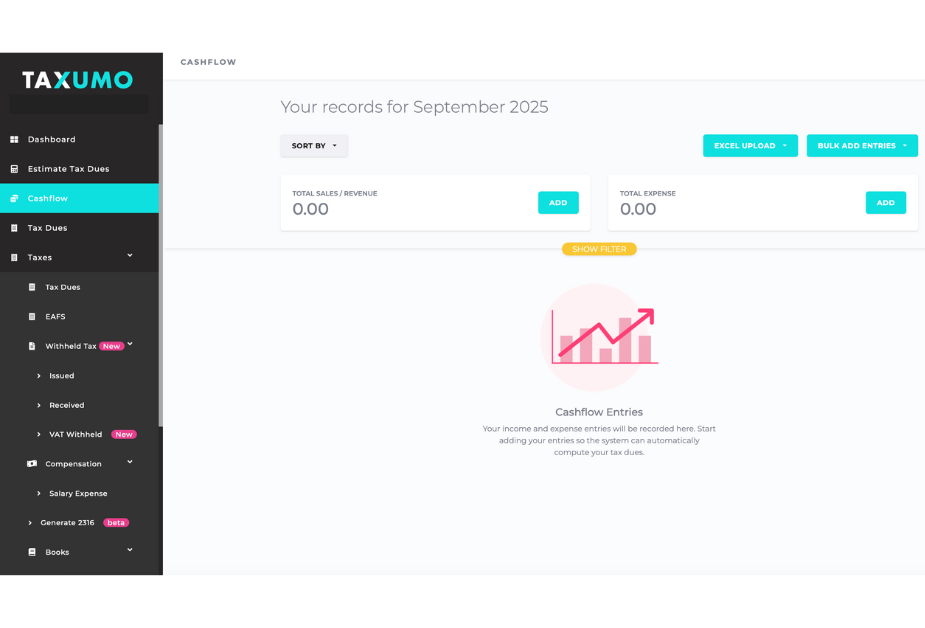

Cashflow Sync

All your salary expense entries will automatically sync up with the rest of your cash flow. And we’ll use this information to compute for your other tax filings such as your Quarterly and Annual Income Tax Returns.

How do I get this feature?

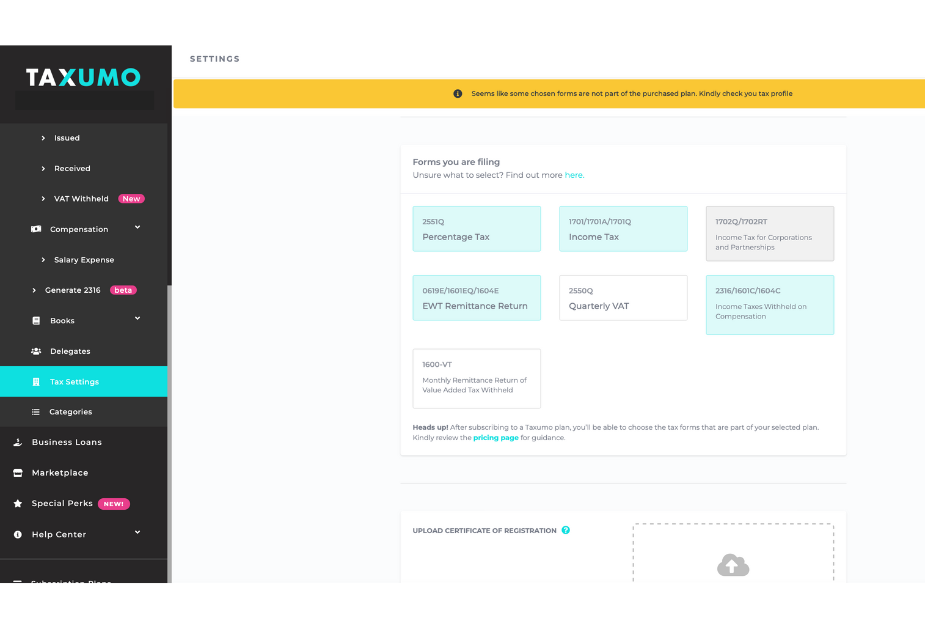

It’s really simple! Just go to your account settings, select “1601C” on the list of forms, and save changes.

On which plan is this available?

Well, the great news is that anyone can try this feature even during the free trial! However, to actually file and pay your 1601C forms to the BIR, you’ll need to be on either the Micro Business or the Small and Medium Business Plan.

You can visit our pricing page to see what other functionalities are available on these plans.

If you want to try this out yourself, you can sign up for a FREE Taxumo account now!

what if I submitted/filed 1601C with incorrect month for an inactive company with no amount due? I submitted 09/2023 instead of 08/2023. kindly advise

Hello Jhez,

Good day!

You can simply file an amendment and correct your recent 1601C filing. 🙂