Whether you’re a freelancer or a business owner, obtaining a BIR registration certificate is a must for you.

Also known as BIR Form 2303 and Certificate of Registration (COR), this type of document gives you the legal rights to operate your business in the Philippines. All professionals licensed by the Philippine Regulatory Commission, Non-Licensed Professionals like freelancers and people with digital careers, sole proprietors, partnerships, corporations and cooperatives should have this sheet of paper, and should take care of it.

It provides you with Tax Identification Number (TIN) for your business, if you are a partnership, corporation or a cooperative. If you are a professional or a sole proprietor, your personal TIN is the one indicated in the Certificate of Registration. It also states the types of taxes you will settle.

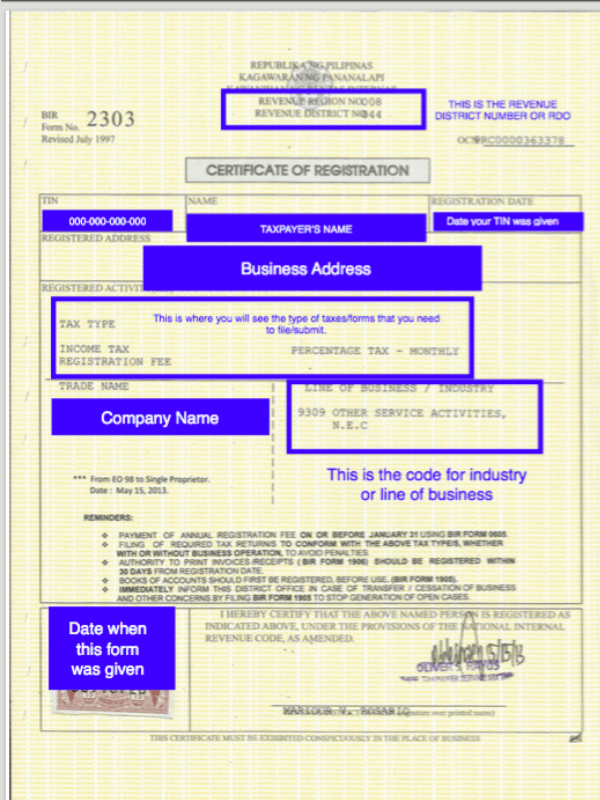

Here is a sample of a Certificate of Registration and its parts:

Many business owners are hesitant to register their ventures because the process can be expensive and time-consuming. But having a legitimate business is beneficial to your company and its growth.

Some people also think that once one registers, the BIR will know that they exist. But, in reality, once a Client withholds taxes and gives you a 2307 form or a Certificate of Creditable Tax Withheld at Source, BIR already expects you to pay taxes as a business. To know more about 2307 forms, check this link:

Helps build customer’s trust

Consumers tend to buy products from credible and trustworthy brands. And having a COR can help you gain your customer’s trust.

Say you’re running a coffee shop. When your business is registered, you are required to display the certificate and other forms in your establishment, such as the Mayor’s Permit, Sanitary Permit, Health Clearance, and Fire and Safety Inspection Certificate. These documents have the power to make your customers feel safe. They will be more confident to purchase your goods and recommend your establishment. This gives you the chance to attract more customers and gain more profit.

Gives you marketing advantage

When your business is legitimate, you’ll be more confident to market it, especially online. And in this digital age, being visible on the internet can give you a competitive advantage.

You can build your business website and set up marketing campaigns on different social media platforms without worrying about legal issues. This will boost your sales and give you the opportunity to recover the costs of your taxes.

Clients usually have a vendor accreditation process where they will require you to submit your COR (Form 2303) and other documents. Clients need these to be able to vet that you are a legit business and that they will be able to get an official receipt from you which they will need to log payment to you in their books. Remember that those who can issue official receipts catch the bigger clients!

Gives you a peace of mind

As an entrepreneur, there are several things in your mind. You think about your marketing strategy, your sales, and maintaining your business.

Securing a BIR registration certificate will give you one less thing to worry about. Remember, you can make your business invisible in the government’s records by not filing a Form 2303, but it doesn’t make you safe in the eyes of their inspectors.

Also, there are punishments for those who don’t register their businesses. When caught, you will have to pay a fine of P5,000 to P20,000 and serve 6 months to 2 years in prison.

Filing for a BIR Certificate of Registration can be time-consuming, but a business license is vital to your success. Besides, you have to know your obligations as an entrepreneur. Keep in mind that it’s wise to comply with the laws and regulations because it lets you focus on running and growing your business.

Need help with preparing and paying your taxes? Check out Taxumo’s website today and request a demo!

Good evening Sir /Madam, pag ang bir form 2303 line of business is wholesaling anong meaning niya. At paano malaman ang meaning ng mga line items n hindi nka elaborate.

Salamat po

I registered a business thru dti since 2021 but don’t get bir 2303 because it is not operational. Do I get a penalty if I tried to get BIR 2303 now? Thanks

Hello Cherry,

Yes, there should be penalty for late registration in BIR. It is best that you register your business to BIR as early as now while BIR is still not sending you a letter with penalty for late registration as there’s a possibility that the penalty fee will be higher by that time. 🙂

good afternoon po, I have some clarifications lang po to ask about sa BIR COR, ano pong dapat gawin ng present sk chairman ngayon if yung dating sk chairman namin ayaw po samin ibigay yung BIR COR kasi need po namin for open account, pwede po ba mag apply ulit yung present chairman?

thankyouuuu for your response.

Hello Laivel,

We should have one COR lang po per registered business or individual. If individual yung COR ni previous SK Chairman, kanya po yun na property. 🙂

Pwede ko po b I verify ang pinasang cert of tax registration ng client o ka deal ko kung legit?

Hi Ericson! You can check this at the BIR website. All you need to do is click on Chat with Revie (lower right of the page). Hope this helps! 🙂

Hello Ericson,

Good day!

You can verify po the registration of your client by simply entering their TIN and business name through this portal of BIR: https://orus.bir.gov.ph/search/businessname 🙂

Is this renewable yearly?

You have to pay a registration/renewal fee annually. BUT you don’t get a new COR/Form 2303. 🙂 You just make sure you keep your receipt/payment record.

Kailangan din po ba magbayad or magregister sa Bir yung mga employed na nagcecensus ngayon? And how much it cost? is it 500php?

Hi Sheryl, not exactly sure what you mean by census, pero kailangan na may TIN ang lahat ng employed. Kung fully employed naman (at hindi independent contractor), TIN lang ang kailangan. 🙂

I am an ESL Tutor. Independent contractor po ang nakalagay sa contract ko with the company. What documents should I get/ready to apply for COR po? Thank you so much.

Hi Lovely, you may check here: https://www.taxumo.com/business-registration/ If you have further questions, contact us at customercare@taxumo.com.

ok lang po ba na after cor mag file for business permit without physical store like sa online lang na wholesale, nasa house lang ang bodega

Hi Luanne! Since Mayor’s Permit is no longer a requirement to register a Sole Prop business with the BIR, yes you may do so. Though you need to register with your Local Government Unit as soon as you are done with your BIR registration so that you avoid paying penalties. Sharing with you these video playlist to know more about taxation and business registration as an online seller. https://www.youtube.com/playlist?list=PL656YE7ZsKWMFYRZL7JEvapCCcQZzt3CU

If you need further assistance just let us know. Thank you!

Hello, yung COR po namin is REGISTRATION FEE lang nakalagay sa tax type. So yun lang po dapat namin e settle annually? Or need din magbayad ng quarterly income tax?

Hello Rhodora,

Do you also have other registered businesses with BIR? Let us further discuss this via email. Please send us an email to customercare@taxumo.com.Thank you!

Hi! I read your blog, and it is very helpful. I have a question tho. I transferred from one RDO to another. Do I need to obtain a new COR from the new RDO or not necessarily? Thank you!

what if po need sa bank transactions yung COR, ano po yung ipapakita? what if nawala yung COR original formy, pwede na po ba yung receipt na nkabayad ka sa renewal yung ipapakita sa bank? thanks

Hello!

Is this for a bank loan? If yes, what they usually require is an ITR 🙂

Hi Taxumo, I have office and workshop where my fabrication is being done. They are in different place but within the same RDO. My question is Do I still need to Register my my Workshop. We lines of business is equipment fabrication.

Hi Carl, the safe answer is YES, get your office registered as the head office and your workshop as a branch. The reason is it makes sense for both to be registered because business is conducted in both venues. For the workshop, for example, the LGU will need to make sure the proper permits (fire, etc) are in place.

Don’t worry – in such a case, tax compliance is normally “consolidated” naman under the head office so it doesn’t make tax compliance more difficult. 🙂

When registering yourself as a business, is there any additional requirement if your source of funds is from a different country? (i.e. online freelancer that provides administrative services to a business registered in the USA.

Hi Kryss, nope! Process is completely the same. Some officers taking in your application are confused by what we do (internet ano?) so it’s possible that they might ask to see a contract. Otherwise, feel free to simplify what you do in “offline” terms — e.g. you do digital marketing (fb/seo/sem), just say you’re doing marketing consultancy. Doing some freelance seo writing, just say you’re a writer. 🙂

Hi sir,pag ma utang na pa sa bir at kumuha ng panibagong business pirmit,kailangan po b na bayaran munayong utang bago ma isyohanng bagong permit?

hi taxumo! I am a real estate broker and a freelancer, I have my COR for real estate broker, now my freelance client Manila vendor is asking for a COR software development, BIR told me I can update my COR, but I guess I don’t need to update it because I am still into real estate, can I register for a 2nd business for freelancer? how about the OR? Do I need to use the same OR for both real estate and freelancer? Or I need to request for ATP to print another OR specifically for freelancer? Thank you for your answer

First of all – love the hustle! Go go go!

With respect to your COR, you can go about it in 2 ways. First, you can get a new COR. That COR is going to be a branch, so tax wise, everything’s consolidated under the main branch. In other words, not that much more complicated esp if you’re using Taxumo. 😉 Second, you can also update your existing COR to include a new industry. For this option though, your mileage may vary a bit — some RDO officers are okay with this, while some will convince you to get a new one altogether. Important that you know that this is an option though so you can ask them about it when the discussion comes up. Good luck!

Thank you sir EJ! I see so 2 COR’s are possible, how about the OR? so I can use 1 OR for 2 businesses? Thanks again!

I believe you’ll need a separate set of OR booklets for the branch. 🙂 Likely though, di mo sya magagamit — ok lang yon. What’s important naman is that you report your income.

My new business was a trading which lines are agricultural products raw logs,food processing like peanutbutter, atchara and soya beans taho and tokwa . My resources are from Cooperatives and NGO with livelihood programs I am applying for BIR Registration. Was it non vat or vat oriented?

Good pm, Sir.

For updates made in the certificate of registration, like adding a new line of business, the COR shows date updated: 12 23 2019, is it safe to conclude that said date are both the effectivity and issuance date?

Thank you.

W

good morning po, pag sari sari store owner ka need pa po ba ng COR

Hi Lani, yes ma’am. We have heard of some sari sari stores na sinama sa tax mapping. Napenalty po sila.

Sir ang online business ba ay kailangan pang iregister?

Morning po sir.kailangan pa po mg online yong kukuha no BIR cergification po para po sa requarments ng solo parent?

Sir. Yung TIN number sa COR, pwede din ba gamitin ng owner kapag employed na siya sa private organization?or kukuha ng bagong TIN number?

Hello Aaron,

Same TIN. BIR does not issue a new TIN for individual tax payers. 🙂

Hi Sir,

How we can know expired date for the BIR Certificate of Registration

Hi Taxumo, I would just like to clarify if COR and OR are applicable to an employed professionals (e. g. Doctors, Accountants) not performing private practice? Given that they have their TIN. Thank you.

You don’t need to have a COR if you are employed.

Hi Sir. hindi ba ma aapektuhan ang tax amount ko as employee if mag register ako ng small business?

hi sir Ej, may several rooms ako ng apartment and properly registered as single proprietor and non vat at 8% and plano ko magpatayo pa sa ibang location ,tanong ko lang if kailangan ko ba ng second COR para sa bagong units?

If I have a business tin po then I applied as govt worker, do I need new TIN po ba or just use the busiens sTIN? Salamat po

What if I franchise a business that is already registered to BIR , Do I need to register my store as a different business? Thank you

Hi, where can I find complete list of Line of Business / Industry with description?

Hello po Sir, if I am working as Freelance Virtual Assistant po, and have basic salary of 25000 monthly will I be paying tax na po ba?

Hello. In our BIR 2303, it states that among our registered activities is WITHHOLDING TAX – FINAL but I never filed any return for that because we do not have any final tax withheld or any transaction subject to that. My question is, is it okay not to file 0619F and 1601FQ or should I have filed zero returns for final withholding tax because it is among our registered acitivities?

Hi Taxumo

I already have an existing TIN number as an employee for a company, I’m also a health insurance agent on the side and they are requiring that I get a COR 2303, which BIR form should I use to register?

Thank you.

Arjan

Hi Sir, Good day! question lang if pwede ko ba iregister ung business ko na House leasing/rent as form 2303 para maging valid lang ung business thanks.

I want to put my own small eloading business and it requires docs like bir 2303 .. may I know how much it cost and the requirements?

I have 2 new branches but I have not paid my taxes yet. Can I still register the other branches without the taxes paid yet?

Thanks!

Gud eve sir madam im a balut vendor gusto ko mgkuha ng COR ano po ang requirements?

Good afternoon, sir.

May employeer po ako , sila ang naglakad po nung BIR 2316 ko po. Ngayon, may part-time company ako and they are requiring me to get BIR 2303. Ang kaso po nasa Makati ang address ko pati nung employeer ko po eh nasa Cebu po ako TEMPORARILY dahil sa pandemic. Yung sa part-time ko po sabi dapat yung BIR 2303 is dapat daw po sa Cebu. Paano po yun? paano ko po makukuha yung 2303 ko po? magkaka-conflict po ba ako? Thank you so much po.

Hello po, ask ko lang po, I am employed here in the Metro Manila, and planning to engage trading business in the province as sole proprietor, do I need to transfer (RDO) my TIN here in metro manila to province?

thank yhou

May I know how to determine from BIR Form 2303 if the registered entity is partnership or corporation?

Hi I just want to ask. What are the responsibility of 2303 holder like whay are the forms needs to be submitted annually, monthly, quarterly. Like for example the nontransaction fillings im not sure of the term. Hiw much is the penalty if i failed to submit those files regularly.

Thanks

Sir, may small business po ako at mag oonline consultant na din ngayon. Kailangan ko daw po iupdate ang COR to include the consulting firm. Paano po iyon at ano po ang requirements? Salamat po.

Hi Taxumo, I am part timer agent. Then I received my first commission. Do I need to file COR for VAT? Can you tell me more and what should I do?

Hello, may I ask how can you market your professional services if you are registered in BIR as a professional? Can you use a “brand name” instead of your full name? Given that you are not registered as a sole prop with a trade name.

We are a US based firm that will be contracting with an entity in the Philippines. We do not have nor will we be establishing an office in the Philippines. We have a TAX clearance already. Can you please confirm that the COR is only if you are establishing an office/address in the Philippines. All our work will be done remotely or through travel on-site.

Hi po! Ask ko lang po sana if ever may error sa mismong face ng COR like nagkamali sila sa Company Name ng spelling (example: should be: UMBRELLA CORPORATION actual: EMBRALLA CORPPORATION )and after 2 or 3 yrs pa bago napansin, need po bang ipacorrect sa BIR yung mismong COR??

I have updated my COR just recently. Now there are two line of businesses under my form 2303. One is under garments shop and the other is delivery services under the same COR. Should I file my taxes (VAT 2550M 2550Q and ITR) separately?

Hi, what will be the punishment if BIR 2303 is forgotten to display but we are registered?

Hi, just wondering how can someone identify his tax type? for example im owner of 6 branches of milk tea. what kind of tax type should i file? and what kind of business tax should i file?

HI! I lost my 2303 copy for my consultancy service, and also found out that my taxes were not properly filed by my assistant. How do I update my BIR status and at the same time, get a copy of my 2303? Thanks!

You may get another copy at your RDO and also you may check what forms you missed to file.

Hi po, I’m on retail online shop, ok lang po ba i post sa online shop ko yung CoR? (since sa bahay lang naman operation ko, wala naman makakakita kung i display ko sa dingding namin), if yes, ano yung mga details na dapat ko i mask at hindi dapat ipakita sa public? Thank you.

hi Paano po mag file ng Tax if online content creator po ako yung company base in the US and mag 1year ako sa work ko na ganito on February 2022. Ano po dapat una gawin ?

Hi! We’d love to assist you by sending us an email at customercare@taxumo.com. 🙂

Hello, pa help po. Hndi ko po alam yung tungkol sa quarterly ng income tax return, and then deadline daw po is november 15, 2021. december 18, 2021 na po ngayon. first timer po ako sa freelancing and september 2021 ako nag start sa work ko. dapat po ba nag file ako nung 1701Q nung november 15, 2021? or pwede pong sa 1st quarter na ng 2022 po ako mag file? pahelp po.

Hi Anjanette, since September ka pa nag-register sa BIR which falls under Q3 of 2021, yes dapat nag-file ka last November. With Taxumo you can still file it. Simply sign-up here – https://www.taxumo.com/ and send us a message so we can assist you at customercare@taxumo.com.

Hi! My mother owns a Sari Sari Store and this January she paid her Business Permit for this year. She needs to have an ITR daw po. WHat form should we use for last year’s sales? Thanks in advance.

You may file your Annual ITR through us. Our customer advocates would be happy to assist you just send us a message at customercare@taxumo.com. 🙂

In the 2307 form for a branch, should the name be the trade name or individual name?

Hello,

Are you pertaining to the form 2302 or the form 2307? 🙂

Hello po, I am a full-time employee at may TIN at may BIR Form 2316 po ako from my employer then magaapply po ako as an ESL teacher and isa po sa requirements ay COR, need ko pa po ba tlaga kumuha ng COR?

Hello Zhe,

Yes, you need to have the form 2303 or certificate of Registration. You may download our infographic guide for registering as a non licensed/licensed professional here via this page: https://www.taxumo.com/business-registration/.

Let me know if you need further help 🙂

Hi sir, I am opening a new business. seperate from my old. Do I need a new COR or can I use the old one for a new business even if the nature is different? Thank you

Hello!

If the nature of business is different, you should apply for a new COR. But it is BEST if you can verify or discuss this with your RDO as well.

Thank you!

Hi po! Required po bang magfile ng 1601FQ kahit wala sa COR? Kasi po hinihingan kami ng BIR ng 1601FQ Form pero pinakita ko yung COR na walang 1601FQ tapos ang sabi nya is required daw yun kahit wala sa COR.

I urgently need a clarification w/my TIN issues.

1) I found out that the tax ID number I have long been using for employment is invalid when I tried to verify through the eBIRForms. However, previous companies I had worked for were able to deduct from my salaries and I was issued the 2316. How were they able to do that? Is the 1905 form the right one to use to update/fix this issue? I need to make sure that I report my correct TIN to my new employer. I am sure the BIR has my correct TIN corresponding to my name but how come they have the invalid TIN when they issue the 2316?

Hello Consolacion,

Great day!

It is best if you can coordinate with your RDO regarding this so that you can verify directly with them as to why your TIN no. is invalid.

Kapag Private Company (Networking )po ba kailangan talaga magfile ng 2303 kaming mga member kasi hinohold po nila ang aming cheke kapag di kami nagfile ng 2303

Hello Rowell,

Yes you have to since you are earning an income. You may access our infographic guide on how you may register as a non-licensed/licensed professional via this link:

https://www.taxumo.com/business-registration/

Can I just put photocopies of the original certificates on display of my store, instead of the original? Or is that a violation?

Hello Sitti,

Our recommendation is that you display the original Certificate of Registration on your store.

Hi, pano po pag hindi po nakuha ung COR. After 1 yr tsaka lang po sinabi nung partner ko na hindi nya pa nakukuha COR. Makukuha pa po kaya yun?

Hello Alex,

You may try to ask your RDO about this 🙂

Very informative, but I wanna ask if I can do everything online?

Hello!

As of now, the business registration has to be directly done with your RDO but we do have CPA partners who can assist you with the registration. If you’re interested, you can send us an email via customercare@taxumo.com.

Thank you!

May I know po the BIR definition of Extension offices of a corporation. were planning to register our branch to extension office?

Hello DIm,

Do you mean to register your office as a branch po ba? Foreign company po ba yung main office?

Hi! Ask lang po if pano po kumuha ng certified true copy of BIR 2303?

Hello Yen,

Good day!

Under what classification po yung plan ninyo iregister sa BIR? Is it Self-Employed, Sole Proprietor, Partnership or Corporation po?

Hi how if i open the second store that taken place in same barangay as the first one, is it still need to register the new one ?

Hello Morgan,

Yes, you should have the second store registered even if it is in the same Barangay as your first store. 🙂

Hi, what if sa BIR 2303 hindi po nakareflect ang tax type like 1601C and 0605 ano po ang gagawin?

The company will start its operation on July 2023 and the BIR registration was made Feb 2023.

Hello Nhels,

Good day!

If you have employees po, then you may check your RDO and ask them to add the form 1601C on your COR. For 0605 Registration Fee naman po, dapat po meron sya sa COR upon issuance. Best to coordinate this to your RDO din po so they can check and add it sa COR nyo po. 🙂

I’m an online freelancer and I just registered as professional-general, no DTI, Percentage Tax. Pwede po ba ako gumawa Ng website at iba Yung pangalan Ng website ko sa registered business name ko?

Hello Charlene,

Yes, you can create a website with a different name from your registered business name by using a trade name. A trade name allows you to operate under a different name while still being recognized as part of your registered business. This will give you the flexibility to choose a website name that aligns with your branding or target audience. However, it’s important to ensure that you comply with any legal requirements or regulations regarding trade names in your jurisdiction. It’s recommended to consult with a legal professional or business advisor to ensure you follow the proper procedures for registering a trade name.

Hello- I am a freelance graphic artist and had my COR since 2018. I currently have another business as sole proprietor and would like to know if I have to apply for another COR or can this be consolidated? Can I use the same TIN?

Hi Maria! You can ask your RDO if they can consolidate. If the nature of the businessese are way different from each other, usually, they issue different CORs with different branch codes at the end of your tin. But, again, it depends on what the RDO will suggest you do.

hi Taxumo..may apartment po ako at nakaregister na po sa BIR…tapos this year nakabili po ako ng dalawa pong apartment ulit at ipaparegister ko po,.. branch po ba mangyayare nun or pede na yun isama sa dating COR ko?

Good day!

Ang start of filing ko po ay June 19, 2023 , no need na ako magfile ng 1st quarter dba ng 1701 Q and 2251 Q po.

Hello Dhen,

Good day!

Yes, that is correct po! Your first filing po is for Q2 of 2023 na. Our deadline for Q2 filing is on August 11, 2023 na po so please make sure that you are able to file your forms on time. 🙂

I have 2 businesses, both Non–VAT under sole proprietorship. The COR of my Toga Rental business indicates ANNUAL REGISTRATION (0605) only. Does that mean that’s the onlyvtax I am obliged to pay?

Hello Benjo,

Good day!

It means you can consolidate your filings for both of your businesses while the payment for BIR registration renewal will should be done separately. 🙂

hi, i own a small milktea shop and i want to register it to foodpanda/grab but it requires BIR2023. who will shoulder the VAT for this case wherein my price ranges only fom 39-59 per cups.

Hello Denden,

Good day!

If this is a small business with gross sales not more than 3M per year, then you are not considered as a VAT taxpayer yet. 🙂

Yung TIN po ba as individual ay same as TIN ng sole proprietorship na business?

Hello Elle,

Good day!

Yes po, your TIN as an individual will be used as your TIN din po if magreregister kayo as sole proprietor sa BIR since we can only have 1 TIN per individual. 🙂

I am a financial advisor from an insurance company. If kukuha po ako ng COR ano po ang mga requirements at magkano po ang estimated amount to pay po? Thank you.

Hi Karl,

Good day!

Thank you for reaching out to us. 😊

Let me share with you an article written by our COO, Ginger Arboleda. This article will answer freelancers’ frequently asked questions. https://mommyginger.com/freelancers-questions-taxation-answered.html. You may also check on the attached guide on how to register as a professional or non-licensed professional.

https://drive.google.com/file/d/1-B-sWecmyrTOAfP_HsARKIydvgk-5qad/view?usp=sharing

Thank you! 🙂

Hello po,

i would like to ask if ano po pwede gawin kapag mag apply nang new COR. since 2018 po meron na ko COR i have small business then eventually nag non operational(2mos lang ang itinagal nya) na sya due to family matter/financially. so now ang tanong ko po pwede po ulit ako mag apply nang new for may online bussiness ko ? thank you

Hi there! Before you can get a new COR kasi, BIR will check if you have open cases (mga taxes na hindi mo na file). Check this out for more information: https://youtu.be/3YOj-s13wAc?si=BwpDV6hxO440KJvA We have this new series in Taxumo’s Youtube channel called Lagot or Lusot and the first episode gives clarity to your question 🙂

Good day!

Anong site pwede mag download ng BIR 2303 Form?

Thanks

Good day!

Anong site pwede mag download ng BIR 2303 Form?

for corporation po.

Thanks

Hello Albert,

Good day!

Let me share with you an article written by our COO, Ginger Arboleda. This article will answer freelancers’ frequently asked questions. https://mommyginger.com/freelancers-questions-taxation-answered.html. You may also check on the attached guide on how to register as a professional or non-licensed professional.

https://drive.google.com/file/d/1-B-sWecmyrTOAfP_HsARKIydvgk-5qad/view

Thank you! 🙂

Pingback: How To Update Your Profile On Taxumo | Taxumo Blog

Tanong ko lang po if kailangan bang kumuha ng Certificate of Registration ang barangay.

Hello Marilyn,

No need 🙂

If the company has an affiliate company thus it need to have a separate Certificate of Registration?

Hello Arwin,

Yes it should have a separate COR. You can have it registered as a branch too. 🙂

pwede puba kumuha ng BIR COR kahit saang branch po ? like nasa bulacan po yung Shop ko then sa edsa caloocan branch po ako pupunta

Hello Gizelle,

No, you need to obtain your BIR Certificate of Registration (COR) from the BIR Revenue District Office (RDO) that has jurisdiction over the location of your business.

If your shop is in Bulacan, you need to go to the RDO that covers Bulacan to apply for your COR. You cannot apply at a different branch, such as the EDSA Caloocan branch, because it does not have jurisdiction over your business location.

To find the correct RDO, you can check the BIR website or call their helpdesk for more information.

Hello po

I’m managing a PCSO outlet under my mom’s name. The local PCSO office recently told us (monday august 5, 2024) that we need to process our COR so we can submit a OR along with our weekly reports to PCSO. My question is, is it BIR form 2303 that we need? Should I also register authority to print receipts and invoices, and also register books of accounts?

Hi Lance,

Yes, your business should undergo the process of Business Registration. As for the Form 2303, ATP, invoice, and books of accounts – this will be issued during the process of BIR Registration.

Hi Lance,

To legalize the operation of the business you will be required to get a COR, authority to print invoices, and books of accounts

Click this link here: https://marketplace.taxumo.com/ to register your business and get your BIR Registration Certificate and other things necessary for your business.

Make sure po to identify whether you’ll be registering your business as sole-proprietor or corporation. Para po sa ibang katanungan mag email lang po at customercare@taxumo.com