Managing taxes online has never been simpler. With Taxumo, a leading online tax preparation and filing service (and a BIR accredited tax software provider), you have the power to handle your taxes with ease. In this guide, we’re focusing on how to streamline your tax season using Maya Tax Payments in tandem with Taxumo’s efficient platform.

First off, let’s learn more about Taxumo.

Understanding Taxumo’s Subscription Plans

After you get a Taxumo subscription plan, which is worth every peso, you can start filing and paying taxes. You’ll notice that Taxumo’s tax deadline is earlier than BIR’s. An example is that for the April 15 deadline, Taxumo’s deadline is on April 11.

With an active subscription plan, Taxumo offers three primary options that cater to various needs—from preparing your taxes to paying them:

Prep Only: Ideal for those who just want to ensure their tax computations are spot on or for those who just want to see how much taxes will they need to file to the Bureau of Internal Revenue. Taxumo’s interface allows you to prepare your tax forms with confidence. Taxumo will not submit the filing to BIR.

Prep and File: This is the next level for filers who want Taxumo to not only prepare but also e-file their taxes directly to the Bureau of Internal Revenue (BIR). With this option, the filings are submitted to BIR and you also get a confirmation from them that they have received the filing. This confirmation is uploaded into your Taxumo account (access it via the Past Filings tab under tax dues tab).

This option is also ideal for those who want Taxumo to file it before the BIR deadline and the user will just look for other ways and means to pay for the tax dues (if there are any).

Pro Tip: If you have Taxumo “prep and file” your tax form and it’s still prior to the BIR tax deadline, you may untick the penalty computation button at the end of the summary page in Taxumo. This will notify Taxumo that it should still proceed in submitting the form, even without the penalty computation.

For payment options, this is where you can use Maya’s app to handle your tax payments with ease.

Prep, File, and Pay: The ultimate plan for a fully integrated tax filing experience. Aside from preparing and filing your tax form, Taxumo offers a wide variety of payment options to choose from. These available payment options are accessible via Taxumo. Note that if you are choosing this option, please be sure that you pay on or before the Tax deadline.

If you opt to use these payment channels available in Taxumo and it’s beyond the Taxumo tax deadline, the BIR penalty computations will be shown. Please note that you cannot untick the penalty computations if you plan to pay via Taxumo’s payment channels.

Step-by-Step Guide to Preparing and Filing Taxes with Taxumo

Step 1: Sign up or log into your Taxumo account.

Step 2: Input or encode data. In the Cash Flow tab, encode your sales and expense. In the Withheld tax tab, encode your 2307 forms (if applicable). In the Compensation tab, encode employee details (if applicable).

Step 3: Go to the Tax Dues tab and file your taxes. Choose the tax form (represented by a box; one box = one tax form) and check/fill in your details. Taxumo’s system calculates your taxes automatically. Choose between “Pre Only”, “Prep and File” or “Prep, File, and Pay” option. If you want to use Maya Tax Payments, choose the prep and file option.

Step 4: Submit your tax return electronically to the BIR, all within Taxumo’s dashboard.

How to Make Maya Tax Payments

About Maya: Before diving into the payment process, let’s introduce Maya. It’s a digital wallet designed for effortless online transactions, including tax payments. Safe and swift, it’s the modern way to pay.

Step 1: Log in to your Maya account. Check that your Maya account is ready to go. It should be verified, with enough funds to cover your tax payment. Amount is specified in the form that you filed in Taxumo.

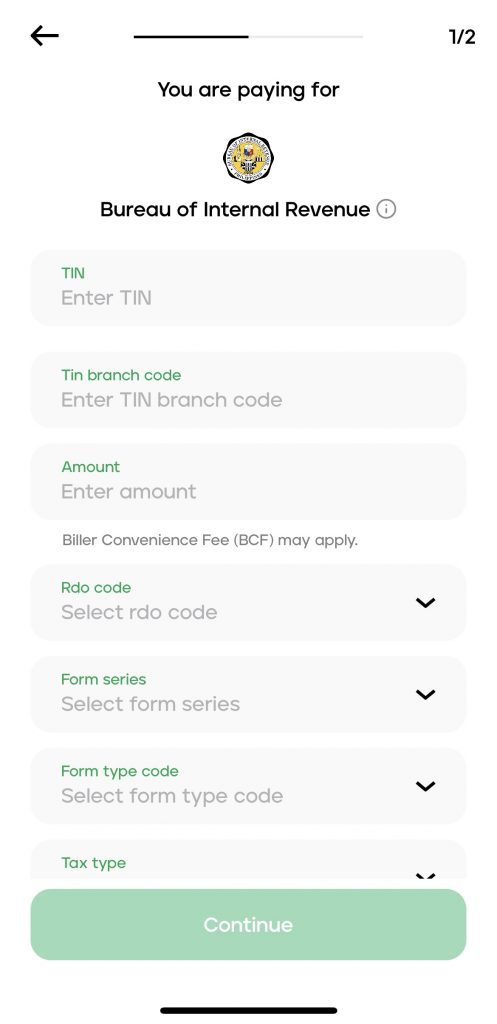

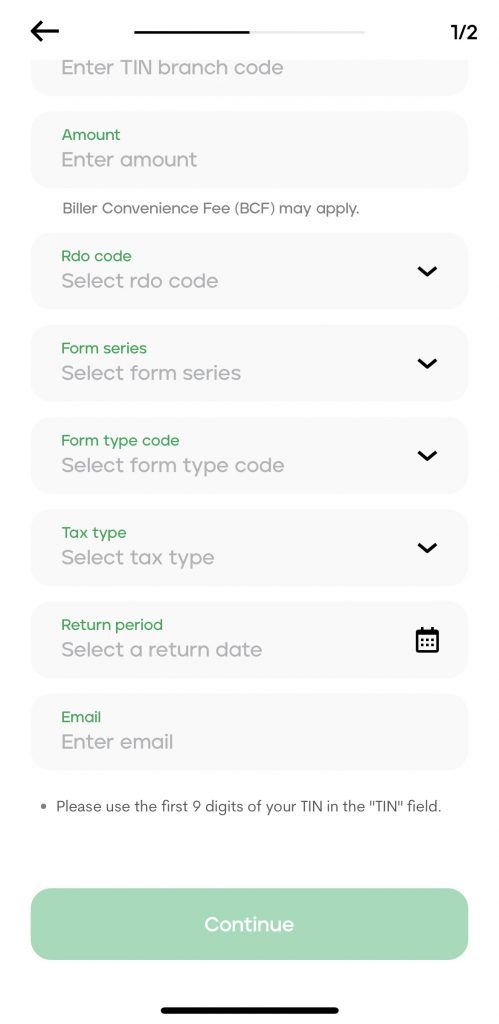

Step 2: Go to Bills on Maya and choose Government and then choose Bureau of Internal Revenue.

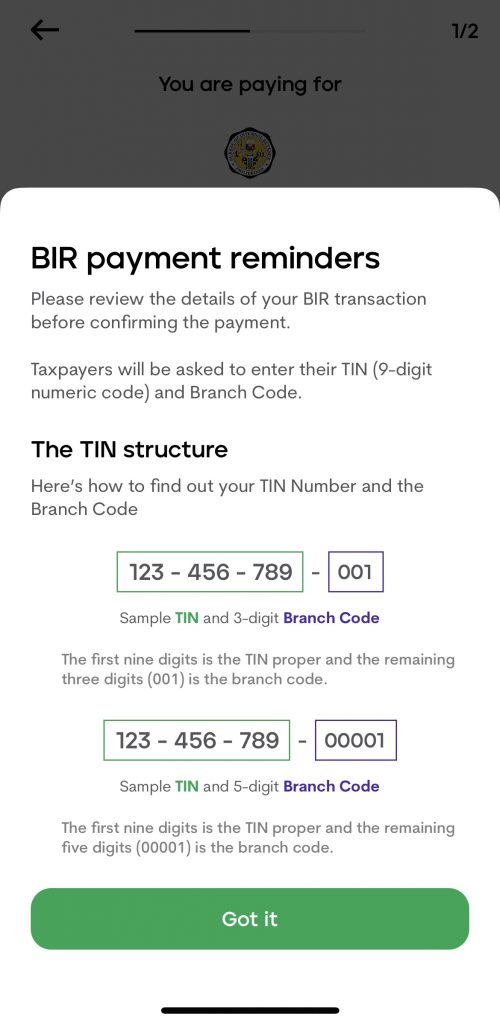

Step 3: Fill out these details.

Step 4: Confirm and complete your payment. Maya’s security measures ensure a trustworthy process. They will give you a transaction confirmation after.

Conclusion

Taxumo and Maya are transforming the way taxes are managed. This partnership simplifies the process, allowing you to prepare, file, and pay your taxes with just a few clicks. With Maya Tax Payments, you’re choosing a stress-free path to tax compliance.

Start your journey with Taxumo today and embrace the convenience of Maya Tax Payments. Sign up to Taxumo for FREE and effortlessly manage your taxes. Join the community of satisfied taxpayers who have streamlined their tax filing experience.

Want to learn more about tax refunds?