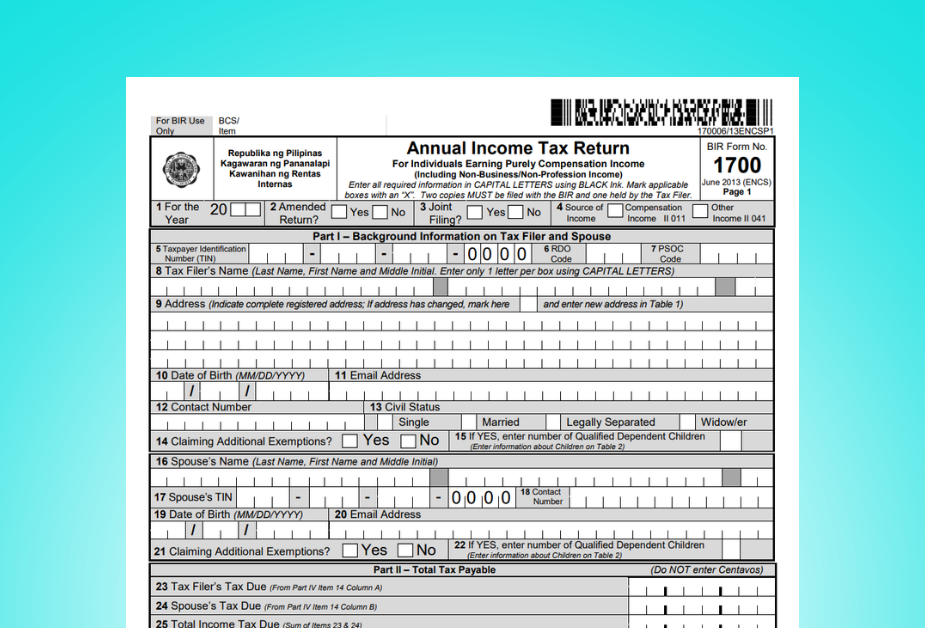

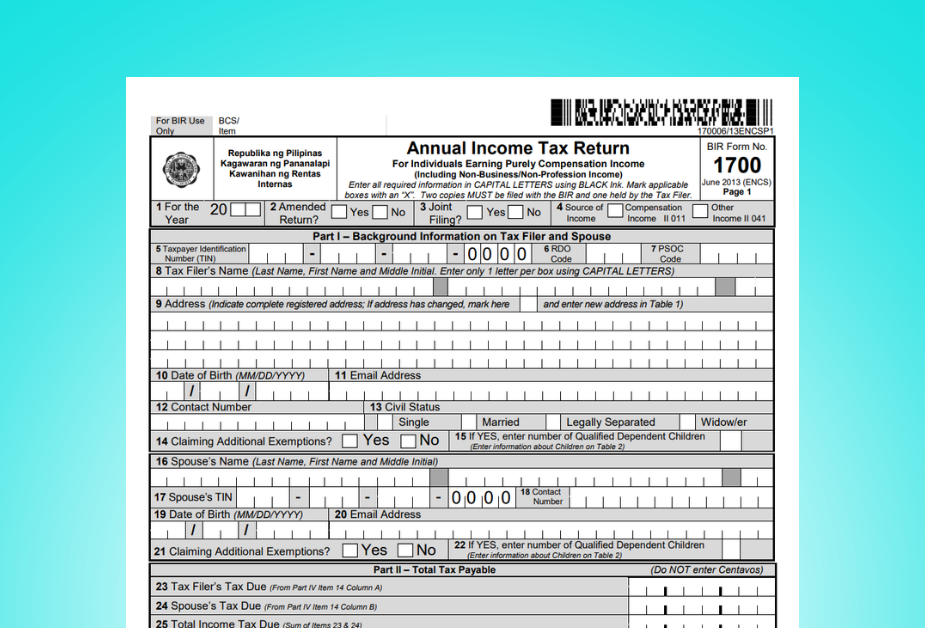

BIR Form 1700

Switched jobs? You must file BIR Form 1700 for your Annual Income Tax. Avoid penalties and minimize compliance risks with Taxumo. Just prepare your Form 2316 to file your 1700 online now.

Certified by:

As seen on:

Trusted by our customers

Here are some of our customers that use Taxumo to file and pay their taxes.

“Been using Taxumo for over a year now. It saved our team hours of training; No more struggling with tracking deadlines and saving records manually. It also helps align our internal deadlines with client deadlines. Honestly, it removed a lot of anxiety from the process.”

Reena Lebanan

Happy Hive – Co-Working Spaces

“Taxumo makes filing easy… It saves me time by handling most of the tax work automatically. Taxumo ensures my tax forms are correct, and handles the tax calculations for me. I can file taxes online anytime an on time… The support team is always there to help.”

Gee Aquino

Ark Designs MZ – Printing Services

“Business is hard, but not impossible. Just find the right partners and tools, like Taxumo and their team. I don’t endorse lightly, but I was near breaking point but Taxumo saved my business from folding. Taxumo made it so easy for me to file taxes with their intuitive design, fast response, and expert advice.”

Hannah Granda

Sine Haraya Advertising Corp.

The most convenient way of filing your BIR Form 1700

Here’s why 100,000+ users all over the Philippines use Taxumo

Multiple Payment Channels

Skip the lines at the bank by paying through our different payment channels. Pay using credit/debit card, and installments!

Access Anytime, Anywhere

Taxumo is open 24×7 so you can take care of your taxes anytime, anywhere. Finally, you can file your taxes even if you’re on vacation!

Automatic Form Generation

The process to create forms and attachments are especially tedious. Taxumo will automatically create these for each filing.

Frequently Asked Questions

The BIR Form 1700 (Annual Income Tax for Individuals Earning Purely Compensation Income) is an Income Tax form required from employed individuals who had multiple employers within the same taxable year. The BIR mandates this return to be filed from every resident, resident aliens, and non-resident aliens earning compensation income (ex. salary, commissions) from the Philippines.

These individuals do not qualify for substituted filing (that is, when your employer files your taxes for you) and have to file this form on or before the 15th of April.

You’ll need to gather first your signed BIR Form 2316s from all employers you’ve worked for from that taxable year. If you do not have it, you need to ask these from your employers as they are required by the law to provide it. You’ll need this form attached when filing.

If your employer handed you a Form 2307 instead, you might want to double-check your contract as you were likely employed as an individual contractor.

For more details, check our how-to guide to filing your BIR Form 1700 here.

First, you’ll need to get the following details ready:

1. Tax Identification Number (TIN)

2. Revenue District Office (RDO) Code – There are several ways to get this: From your BIR Form 1901/1902/1903/1904/1905, through the BIR hotline, or by visiting your nearest RDO and requesting for your TIN verification slip.

3. BIR Form 2316

When you’ve gathered all the information above, fill up this form.

We’ll send you the invoice ASAP! If you have additional questions, you can reach us at customercare@taxumo.com.

Note that our deadline for this is on or before April 12th. If you file this beyond our deadline, we will only prepare this form for you; penalties and any tax payable will be computed by your RDO.

Service fee is Php2,000 (VAT-inclusive). This covers computation, filing, and remittance of your tax dues (if any).

Note that this is only the service fee and excludes any tax dues that you have to pay separately, which we will be computing once payment of service fee is confirmed.

For questions, you can get in touch with our live chat agents or send us an email at customercare@taxumo.com.

We can commit for same day processing and completion upon submission of all requirements.

Note: SLA will vary if there is a tax due pending for payment by the user.

Ready to make taxes easy?

Simplify your BIR tax filing with Taxumo! Get started for free or join our live demo to see how we simplify Philippine tax compliance for freelancers, business owners, and professionals.