In this article, we will talk about the Revenue Memorandum Circular No. 60-2020. This memo details the obligations that business owners need to comply with when they are conducting their business using electronic platforms. Read through as we flesh out the details of the memo.

What is the purpose of RMC 60-2020?

The RMC 60-2020 was issued by the BIR to require business owners who are conducting business using digital channels to register, file, and pay their taxes with the BIR. Aside from this, the memo states that newly-registered businesses will have to voluntarily declare their past transactions and pay the appropriate taxes associated with their income.

Who are these persons doing business using electronic platforms? Am I included in those?

If you are selling anything online through different marketplaces like Lazada or Shopee, then you are a person doing business in electric platforms and you’ll need to register. Aside from this, those online sellers who are embracing their passion and selling on social media or messenger groups are also considered as persons doing business using digital channels, and hence need to register. Furthermore, included in the persons doing business using electronic platforms are professionals and freelancers who are getting clients from different freelancing sites on the internet. They are also required to register.

What is the deadline for registration? Do I get penalties if I don’t do it?

Online businesses can register and update their records until July 31, 2020. This is also the deadline for filing and payment of the necessary taxes for your past transactions. There will be no penalties incurred if the registration, filing, and payment are done on the specified date. However, this deadline is only applicable for newly registered taxpayers who are getting new certificates of registration (COR) for their business.

I have already registered. What are the other things I need to do?

Online businesses are advised to comply with the tax laws of the Philippines by doing the following:

- Issue BIR registered Sales Invoice or Official Receipt for every sale or transaction that you provide to customers.

- Maintain a record of your business transactions using registered Books of Accounts and other accounting records

- Withhold taxes to your suppliers, if applicable

- File the required tax forms for your business on-time

- Pay the required taxes for your business on-time

I want to register my business. What are the requirements that I need to prepare?

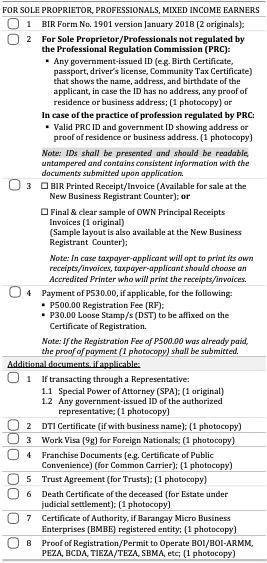

The BIR has released a streamlined checklist of requirements for registration following RMC 57-2020.

Following are the list of requirements for professionals, sole-proprietors, and mixed-income earners:

I don’t have time to register. Can Taxumo help me with my registration?

The answer is a resounding YES! Taxumo can help you with your business registration. The areas covered by the service are Metro Manila together with some cities in Cavite, Laguna, and Batangas. You may send us an email at bizreg@taxumo.com to start your business registration. For more details, you may visit the Taxumo Business Registration Page here.

Registered my business with BIR during the last qtr of 2020. I’m a non-VAT sole-prop business that earns less than P250,000 annually.

1. This means I am not required to file any tax return, correct? I just have to pay the yearly registration fee?

2. I still have to issue my non-VAT Sales Invoices to my customers, correct?

Sorry I’m so confused hahaha

Pingback: RMC 97-2021: How It Impacts Social Media Influencers