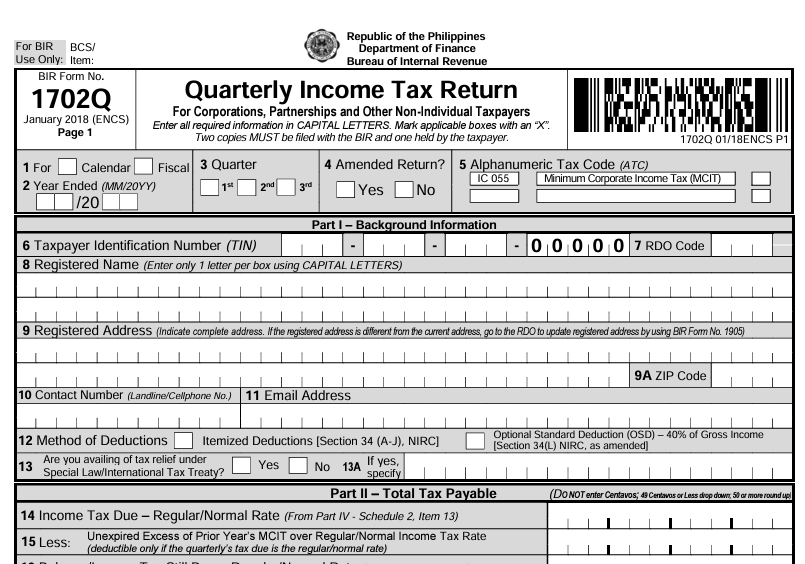

BIR Form 1702Q — What is this? Firstly, know that there are different classifications of Income Taxes here in the Philippines, and the Income Tax form that you need to file varies on your Taxpayer type whether if you’re a Non-VAT or VAT filer — this step is very crucial for you to understand because there’s a difference on the forms that Non-VAT and VAT files for Income Tax Returns. But in this article, we’ll discuss with you BIR Form 1702Q and its functions.

So.. What is 1702Q and who needs to file it?

Who should file the BIR Form 1702Q, also known as the Quarterly Income Tax Return?

Every corporation, partnership, joint stock company, joint account, and association—except for foreign corporations not doing business in the Philippines and certain joint ventures focused on construction or energy—must file an accurate income tax return as required by law. This includes government-owned companies and agencies as well.

General professional partnerships, which are groups of professionals like lawyers or doctors working together, also need to file a tax return. This document should list their total income, deductions, and provide details such as the names, tax identification numbers, addresses, and shares of income for each partner.

Unlike other businesses, these professional partnerships do not need to file tax returns every quarter. Instead, they only need to file once a year using Form 1702, and include their Audited Financial Statements with that annual return.

By using 1702Q, BIR tracks the income collected coming from these entities.

When and how do we file for 1702Q ?

This income tax return form is filed every quarter of the taxable year. The usual process in filing 1702Q are as follows:

- Filing: Submit three copies of the completed 1702Q form. You can obtain the form from the BIR or download it online.

- Attachments: Filing 1702Q also requires submitting necessary attachments to help substantiate the tax calculations on the tax form. Here are the list of attachments for 1702Q:

- Certificate of Income Payments not Subject to Withholding Tax (BIR Form No. 2304)

- Certificate of Creditable Tax Withheld at Source (BIR Form No. 2307)

- Duly approved Tax Debit Memo Certificate of Tax Treaty relief (if applicable)

- Summary Alphalist of Withholding Agents of Income Payments Subjected to Withholding Tax at Source (SAWT)

- Proof of other payment/s (if applicable)

3. Payment: Tax amount due should be paid upon tax filing. It can either be paid through AAB, RDO, or eFPS

- AAB: Pay during filing. You’ll receive an Electronic Revenue Official Receipt (eROR).

- RDO: If filing directly with the RCO/City/Municipal Treasurer, make the payment there. They will issue an eROR.

- Electronically (EFPS taxpayers): Follow the deadlines set by BIR for electronic filing and payment.

What makes it different when you file your 1702Q through Taxumo?

Filing 1702Q with ease

We all get rattled when trying to figure out how to fill out the forms and to calculate your tax dues based on your tax type. It’s also time-consuming to gather and consolidate the attachments needed for your 1702Q filing.

But Taxumo makes it all easier for you. Simply input your income and expenses, then Taxumo does the rest. It calculates your 1702Q tax dues, and also allows you to file and pay directly through the app, eliminating trips to banks and RDO offices. Taxumo also generates your attachment based on the income and expenses that you provided.

(Pro-tip: if you have a list of your income and expenses in a sheet, you can upload it in bulk — no need to input the transactions one by one)

Taxumo also ensures that you’ll comply with your 1702Q on time – Taxumo’s deadline is 2 days ahead of BIR deadline.

Has this ever happened between you and your accountant?

Using Taxumo also lessens the burden of knowing the tax payables a few days before the deadline. This ensures you and your accountant are aligned on the transactions of your taxes, and lessens the back and forth between you and your accountant, reducing miscommunication. This also saves both you and your accountant time on tax filing.

Keeping Up-to-Date with BIR Regulations

Do you remember the sudden announcement of the CREATE Act by BIR in April 2021? This meant changes to the way BIR Form 1702Q is calculated. If you were filing at that time, it could have been confusing: what exactly is the CREATE Act, and how does it affect my tax computation under the new percentages? Thankfully, Taxumo keeps up with all BIR updates and ensures our forms are always align with the latest BIR Regulations (RRs). Even if unforeseen changes in regulations arise in the future, rest assured that Taxumo will comply to updates in a speed.

(Note: Taxumo has updated 1702Q based on the current regulation this 2024)

If you’re considering on making a change on your tax filing process, you can book a FREE onboarding session with our team to learn how to file for your 1702Q

You can file with confidence, knowing the information and calculations you provide are accurate. No more spending hours researching or questioning if you’re filling the right information in your form.