UPDATE! BIR recently released a new portal to submit your AFS submissions online! Woot! Kudos to you, BIR! Here’s a quick run through of the new AFS eSubmission Portal aka eAFS: How to submit attachments to Annual ITR using eAFS

It’s that time of the year! Tax Filing Season! Time to submit your annual ITR! 🙂

Now before we start, do know that you can already file your Annual ITR via Taxumo! As a starting point, you can read this FAQ article to find out how.

Once you’ve prepared the form via Taxumo, what do you need to do?

Step 1: Make sure you file your 1700/1701A/1701 ITR Form via eBIRForms.

If you selected “Prepare & File” when you filed through Taxumo, then Taxumo will take care of this step for you. Skip to Step 2.

If you have not, then you have to make sure you download the latest eBIRForms version from the BIR website and file an electronic copy of the form yourself. Do note that it only runs on Windows devices. If you’re on Mac or on Linux, you can use a shared PC that the RDO usually provides. If that PC’s down or does not have an internet connection… well… time to call a friend with a PC.

Step 2: Consolidate all the documents you need to submit along with your filing (in triplicate!)

The documents you need to submit along with your filing are:

- The 2307’s (withheld tax certificates) that you RECEIVED from clients (if any)

- The 2316’s (tax withheld from compensation) that you RECEIVED from your employer (if applicable)

- If you exceeded Php 3 Million gross revenue in the year, you also have to provide an audited financial statement:

Alright, one question that we get asked a lot is: “Do I need to submit an AIF?”

If you did NOT exceed Php 3 Million in gross revenue, then you do not have to submit an AIF. Section 232 of the National Internal Revenue Code (as amended by subsequent acts) states:

TITLE IX

COMPLIANCE REQUIREMENTS

(As amended by RA Nos. 9337 & 10021)CHAPTER I

KEEPING OF BOOKS OF ACCOUNTS AND RECORDSSEC. 232. Keeping of Books of Accounts. –

(A) Corporations, Companies, Partnerships or Persons Required to Keep Books of Accounts. – All corporations, companies, partnerships or persons required by law to pay internal revenue taxes shall keep and use relevant and appropriate set of bookkeeping records duly authorized by the Secretary of Finance wherein all transactions and results of operations are shown and from which all taxes due the Government may readily and accurately be ascertained and determined any time of the year. Provided, that corporations, companies, partnerships or persons whose gross annual sales, earnings, receipts or output exceed Three Million pesos (P3,000,000), shall have their books of accounts audited and examined yearly by independent Certified Public Accountants and their income tax returns accompanied with a duly accomplished Account Information Form(AIF) which shall contain, among others, information lifted from certified balance sheets, profit and loss statements, schedules listing income-producing properties and the corresponding income therefrom and other relevant statements.

If you have some free time and for some reason, you want to read the whole NIRC (we don’t judge), you can read it on the BIR website.

It pretty clearly states that (1) EVERYONE has to keep relevant and appropriate set of bookkeeping records and (2) if you exceed Php 3 Million in gross annual revenue, you have to have your books audited by an independent CPA AND your income tax return should be accompanied by a duly accomplished AIF.

Therefore, if you DON’T exceed Php 3 Million in gross revenue, you shouldn’t have to file an AIF.

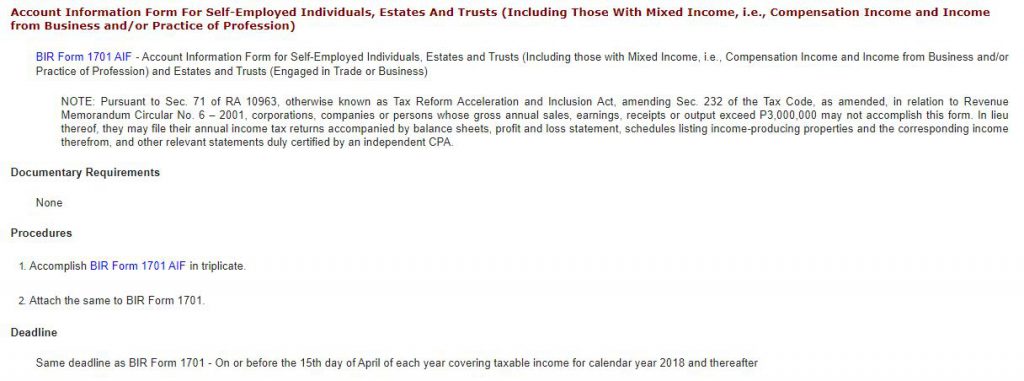

If you DID exceed Php 3 Million, there is also this nugget of information on the BIR website:

See the Note? It says that if you exceed Php 3 Million, then you may choose to not accomplish the AIF. Instead, you have to attach your balance sheets, profit and loss statements, schedules listing income-producing properties, and the corresponding income therefrom and other relevant statements duly certified by an independent CPA. In other words, you can submit your Audited Financial Statements (AFS).

Writer’s Note: If you do know any information that says otherwise, please tell us and we’ll be more than happy to update this article!

Step 3: Submit your documents

Step 3a: If you don’t have to pay anything (your payable is zero or negative), submit your annual ITR along with the attachments to your RDO.

This is pretty straightforward, just bring your documents to the RDO, have them stamped. Remember to bring 3 copies of EVERYTHING. Have the receiving officer stamp everything!

Step 3b: If you DO have to pay something, submit your annual ITR along with the attachments to your RDO’s Authorized Agent Bank (AAB).

This is even more straightforward. Again, bring 3 copies of EVERYTHING, and submit your forms to the bank. There’s a unique form you have to fill out for BIR remittances, so be sure to ask for that form from the guard. Line up and pay!

For your information: here is the list of AABs. Note that you CANNOT pay at any branch of the bank. You have to pay at the designated branch of the RDO.

Step 4: Relax. Watch Avengers Endgame or something.

Finally! Let the music play!!!

Hopefully, we are helping make tax filing easier and less convoluted for you with these articles. That’s the same philosophy we follow when we created Taxumo — the same philosophy that guides us until today. We’re continuously evolving, making sure that Taxumo is a tax compliance solution that’s easy and painless. If you haven’t signed up yet, give us a shot: sign up now!

I would like to inq. about the 1 time payment for the filing of 1701 joint filing.

You can reach me thru 09178609305 or frandojefferson16@yahoo.com.

Hi Jef! We sent you an email 🙂

Hi. Does taxumo also make Financial statements as attachment? We have a BMBE certificate as well.

I’m an insurance agent deriving income 100% solely from my profession. So if i do not have to pay anything, should I have brought my documents (1701A plus all my 2307) to BIR to be received and stamped? Coz i filed it using eBIRforms, now how do i file the attachments?

Hello Marce,

Good day!

You may submit your attachments via eAFS instead. Note that the eAFS is a separate system that BIR launched last 2020, you may access it here: https://eafs.bir.gov.ph/eafs/

Here’s the step-by-step guide on how you can submit your attachments thru eAFS webpage: http://help.taxumo.com/en/articles/4196871-submission-of-attachments-via-the-eafs-submission-portal

Let us know if you need further help. 🙂

Can I still submit my attachment for the previous years? I started filling through ebirforms last 2020 and I’ve never submitted my attachments to my RDO.

Hello Vany,

Certainly, you can still submit attachments for previous years. Follow these steps:

1. Gather required attachments for each year.

2. Review and update your eBIRForms filing.

3. Contact your RDO for submission process.

4. Submit attachments as guided.

5. Be aware of possible penalties.

Completing this ensures accurate and complete filings.

Hope this helps😊

Cheers,

Millicent

Is the form submitted to the bank need to be stamped by the bank? I’m referring to the 1701A.

Thank you