As a professional or business owner, understanding the intricacies of taxes that affect your earnings is crucial. One such tax that often prompts questions is the “professional fees withholding tax.” This withholding tax applies to earnings from professional services, and its management can significantly impact your financial health. Here’s everything you need to know about professional fees withholding tax and how Taxumo is your ideal partner in handling it.

What is Professional Fees Withholding Tax?

It is a form of income tax deducted at source by the payer (Client / Customer) who engages the services of a professional if that payer is a withholding tax agent. If the payer has a Certificate of Registration with this, they need to withhold from their payments to different suppliers.

This tax is applicable to freelancers, consultants, and any individuals providing professional services. The concept is simple: when you provide a service, the entity or person paying for your service deducts a certain percentage of your fee as tax before paying you the remaining amount. The client remits the deducted amount to the Bureau of Internal Revenue on your behalf.

Who Needs to Pay It?

If you offer professional services such as digital services, legal advice, medical consultancy, architectural design, engineering, accountancy, or any other professional service, withholding tax likely applies to you if your client MUST withhold it. We refer to these clients or payers as Withholding Tax Agents.

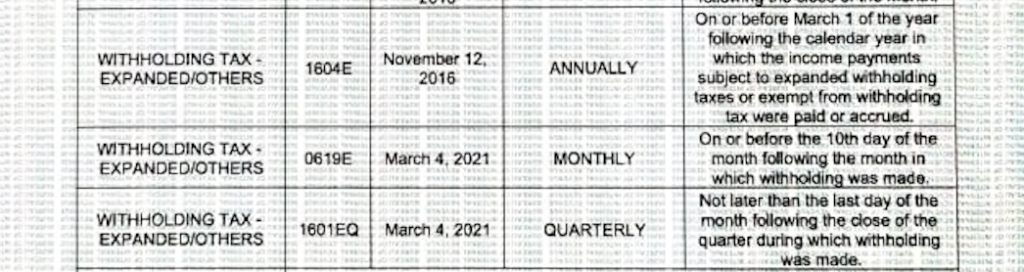

Moreover, these clients must send a list of the individuals and businesses from whom they have withheld payments. They submit this list, which includes the taxpayer’s names and their Tax Identification Number (TIN), to the Bureau of Internal Revenue (BIR) on a quarterly basis. This list, known as the Quarterly Alphalist of Payees (QAP), serves as one of the required “attachments.”

This tax mechanism automatically allocates a portion of your earnings to your tax liabilities, thereby simplifying tax compliance. The payer or client evidences these withheld taxes by issuing a form called a 2307 form or Certificate of Creditable Tax Withheld to the professional. It also enables tax authorities to track who is earning income and the expected taxes from them.

How Taxumo Can Help

Navigating through the complexities of withholding taxes can be daunting. Here’s where Taxumo comes in:

- Automated Tax Calculations: Taxumo simplifies your tax calculations. Our platform automatically computes your tax dues, taking into consideration the professional fees withholding tax. The system does this by reading the 2307 forms that you encoded into Taxumo, and considering these when it computes your tax dues, ensuring accuracy and compliance.

- Streamlined Payments: With Taxumo, you can easily remit your taxes online without needing to visit a bank or the tax bureau. This saves you valuable time and energy.

- Compliance Monitoring: Our dashboard allows you to monitor your tax status in real-time, ensuring you’re always compliant with the tax regulations.

- Expert Support: Have questions or need personalized advice? Taxumo’s team of tax experts is here to support you, providing professional advice tailored to your specific situation. To connect with Taxumo CPA partners, visit and book at https://www.taxumo.com/taxumo-consult/.

Maximizing Your Earnings with Taxumo

Understanding, tracking and efficiently managing your professional fees withholding tax can lead to better financial planning and management of your earnings. With Taxumo, you have a partner that not only assists in managing this specific tax but also empowers you to take control of your overall tax responsibilities.

Professional fees withholding tax is an integral part of tax compliance for professionals and business owners. Leverage Taxumo’s comprehensive suite of tax management services so you can ensure that your tax obligations are handled accurately and efficiently. You will be able to focus more on growing your business and less on tax complexities.

To know more about withholding tax, visit: https://www.bir.gov.ph/index.php/tax-information/withholding-tax.html

Got any more questions? Feel free to chat with Taxumo via the chat button or email customercare@taxumo.com

Ready to do Taxes the easy way? Become a #MauTax today and try Taxumo for Free

Pingback: BIR Form 2307: The Key to Proper Tax Credit for Filipino Professionals & Businesses | Taxumo - File & Pay Your Taxes in Minutes!