The Bureau of Internal Revenue (BIR) of the Philippines has recently enacted Revenue Regulation No. 8-2024, marking a significant shift in the BIR taxpayer classification system. This regulation, effective from March 22, 2024, aligns with the provisions of Section 21(b) of the National Internal Revenue Code of 1997, as amended by Republic Act No. 11976, also known as the “Ease of Paying Taxes Act.” This update provides a structured framework to classify taxpayers more systematically, ensuring each group meets its tax obligations accurately and efficiently.

New Classification System: A Closer Look

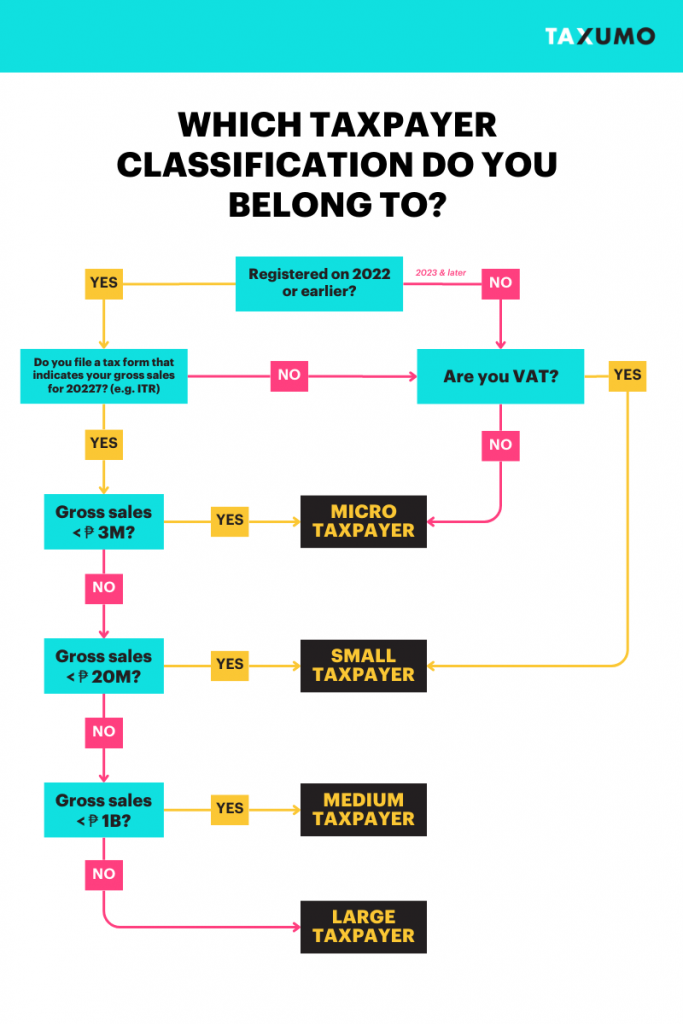

The latest BIR taxpayer classification is detailed in RR No. 8-2024 and categorizes taxpayers based on their annual gross sales, defining clear thresholds that separate different groups:

- Micro Taxpayer: Less than PHP 3,000,000 in gross sales.

- Small Taxpayer: Between PHP 3,000,000 and less than PHP 20,000,000 in gross sales.

- Medium Taxpayer: Between PHP 20,000,000 and less than PHP 1,000,000,000 in gross sales.

- Large Taxpayer: PHP 1,000,000,000 and above in gross sales.

This classification system is crucial as it dictates the specific tax responsibilities and filing requirements for each category of taxpayer, thereby tailoring the tax compliance process to the scale of their operations.

Important: Gross sales are calculated net of VAT, focusing solely on business income which includes trade, business activities, or professional practices, excluding other types of income such as compensation from employment (for mixed income earners) or passive income.

Registration and Reclassification Processes

For entities who have been registered last 2022 and prior years, you shall be classified using your gross revenue for 2022. If you have been a customer of Taxumo for the entire year of 2022, you can check your 2022 ITR filing.

Go to the Past Filings tab and look for your 2022 Filings.

Look for your Annual ITR form and look for the item that says Sales / Revenues:

In the illustration above, the taxpayer earned Php 1,688,181 in gross revenue and will be classified as a Micro Taxpayer.

Under the new system, entities registering for the first time post-implementation will be classified based on their initial gross sales declaration during registration. This classification will remain unless changes in their business size necessitate a reclassification to a different category.

Here is a diagram that you can refer to:

For existing businesses, reclassification will occur when their gross sales grow or shrink past the set thresholds. The BIR will notify taxpayers of their new classification through a formal procedure, which will be detailed further in upcoming revenue issuances.

Implications of BIR Taxpayer Classification

The restructured classification system under RR No. 8-2024 simplifies understanding tax obligations tailored to the size and scale of a business. It ensures that smaller entities are not overwhelmed by the same requirements as larger corporations, facilitating a fairer and more equitable tax system.

Taxpayers should be proactive in understanding where they fall within this classification system and remain vigilant about any potential shifts in their category due to changes in their business income. This vigilance is crucial as transitioning into a different classification can significantly alter their tax filing routines and obligations.

Key Takeaways and Compliance Advice

Taxpayers are encouraged to review their current business income levels and prepare for potential reclassification. Staying informed about your classification status is essential for maintaining compliance with BIR regulations and avoiding any penalties associated with misclassification.

To stay updated on any changes or further specifications regarding BIR taxpayer classification, taxpayers should regularly check the BIR website or consult with tax professionals. Compliance is not just about meeting legal requirements; it’s about contributing responsibly to the nation’s development through the proper channels.

This strategic update in taxpayer classification underscores the BIR’s commitment to enhancing the tax filing experience, promoting fairness, and ensuring all businesses can meet their obligations with clarity and confidence.

Pingback: Easy way to check your Taxpayer Classification | Taxumo - File & Pay Your Taxes in Minutes!