If you are a business owner, professional, OFW or a voluntary contributor, you are very well aware of the hassle of paying for your Social Security System (SSS) contributions.

Because if you were an employee before, you didn’t really have to think about all that because your employer took care of remitting your contributions for you by deducting it from your salary.

But now that you are considered by the SSS as an individually-paying member (self-employed, voluntary, non-working spouse, and OFW), you have to make the payments yourself.

List of Payment Facilities for SSS Transactions

As of this writing, the only means to pay for your SSS contributions are the following. (Taken from the SSS Facebook Page)

1. SSS Tellering Branches (120+ branches to date)

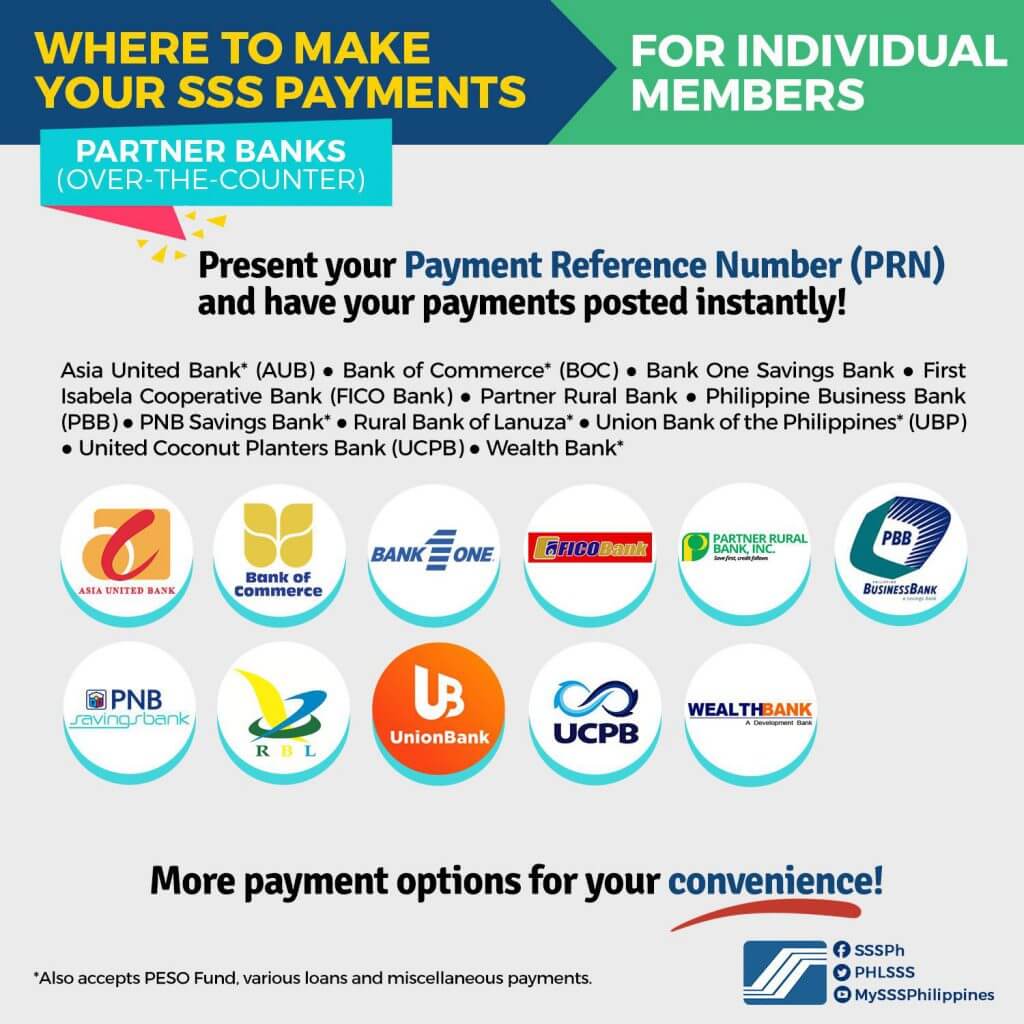

2. Partner Banks (Over-The-Counter)

- Asia United Bank* (AUB)

- Bank of Commerce* (BOC)

- Bank One Savings Bank

- First Isabela Cooperative Bank (FICO Bank)

- Partner Rural Bank

- Philippine Business Bank (PBB)

- PNB Savings Bank*

- Rural Bank of Lanuza*

- Union Bank of the Philippines* (UBP)

- United Coconut Planters Bank (UCPB)

- Wealth Bank*

*Also accepts PESO Fund, various loans and miscellaneous payments

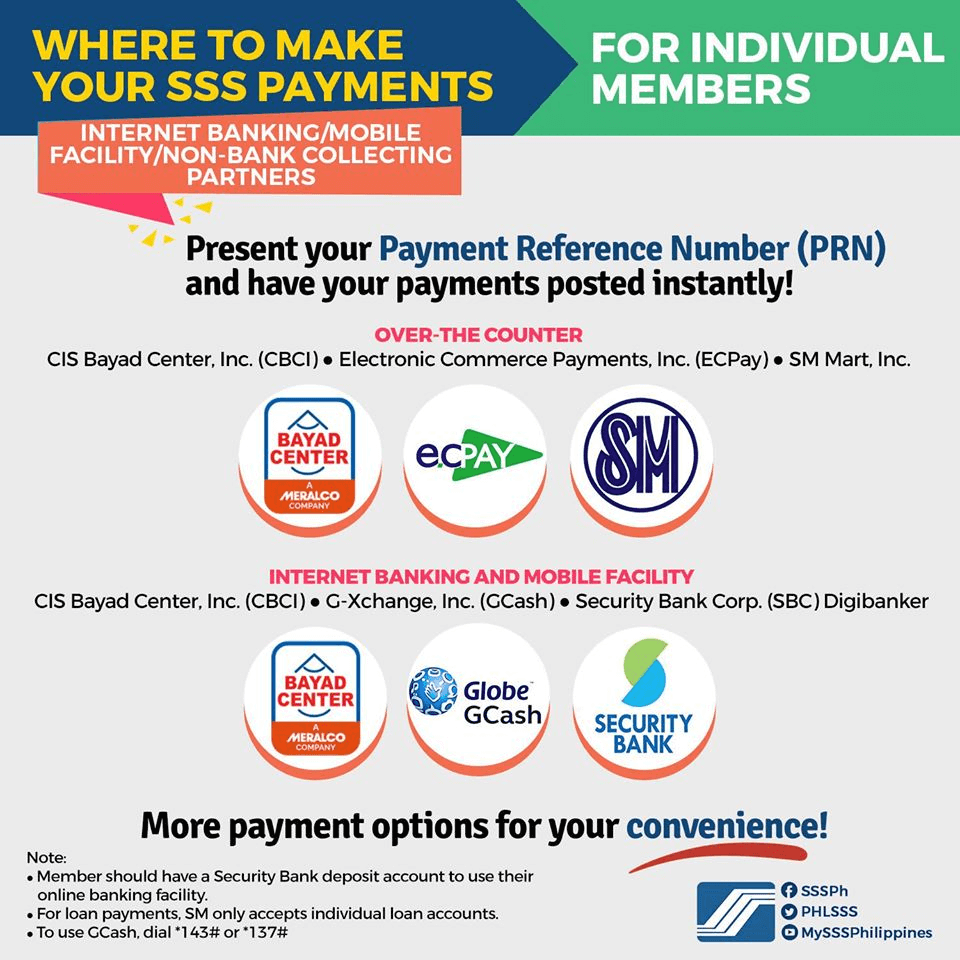

3. Non-Bank Collecting Partners

OVER-THE-COUNTER

- CIS Bayad Center, Inc. (CBCI)

- Electronic Commerce Payments, Inc. (ECPay)

- SM Mart, Inc.*

MOBILE FACILITY

- CIS Bayad Center, Inc. (CBCI)

- G-Xchange, Inc. (GCash)

*For loan payments, SM only accepts individual loan accounts.

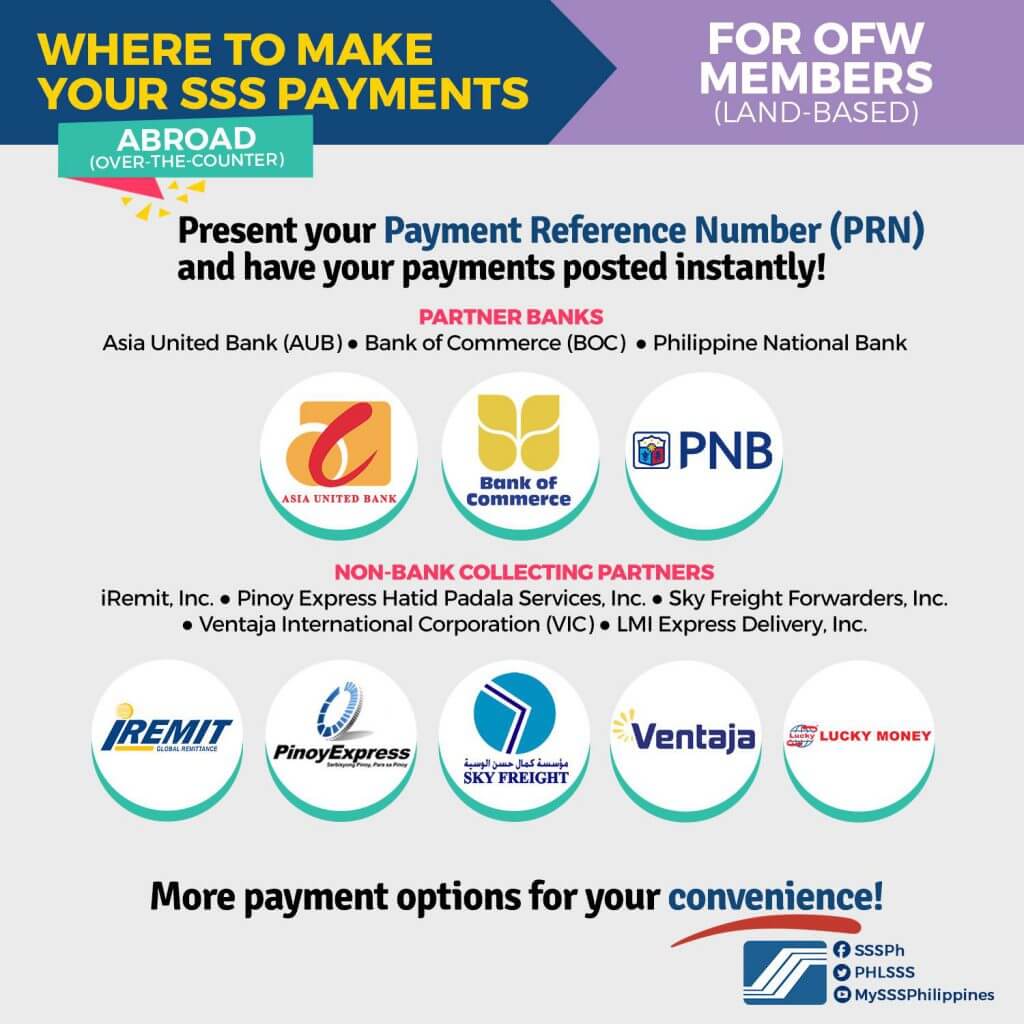

4. Abroad Over-The-Counter (for OFWs)

- Asia United Bank (AUB)

- Bank of Commerce (BOC)

- Philippine National Bank

- iRemit, Inc.

- Pinoy Express Hatid Padala Services, Inc.

- Sky Freight Forwarders, Inc.

- Ventaja International Corporation (VIC)

- LMI Express Delivery, Inc.

(To get the latest and most updated payment channels, feel free to visit the SSS Facebook page.)

It is very important to note, however, that you need to get a Payment Reference Number (PRN) first before you pay at any of the payment channels mentioned above.

What is a PRN and why do I need to get that to pay any SSS transaction?

The Payment Reference Number or PRN is simply a system-generated number that the SSS provides and that members use as reference whenever they pay for their contribution.

This is a requirement by the SSS as part of its Real-Time Processing of Contributions (RTPC) program — which ensures that contributions being paid by its members are posted immediately to their records and allows members to avail of their benefits as SSS members without delay.

Recently, the SSS has also made mandatory the use of the Payment Reference Number for paying SSS loans. This will take effect on April 1, 2021.

How to generate a Payment Reference Number (PRN) the old way

Before, to get generate this PRN, members would either have to:

- Go to the SSS website (you have to register first)

- Visit one of their branches

- Call the SSS helpline at 920-6446 to 55 (Mondays to Fridays only) or

- Email them at PRNHelpline@sss.gov.ph.

This could take a while before you get your PRN, and as mentioned earlier, you can’t pay your SSS contribution or loan without that.

Imagine, having to go to a different channel just to get a PRN. Why not do it all in one go?

How to generate a Payment Reference Number and pay your SSS Contributions online all in one go

With Taxumo, you can now generate a PRN and pay your Social Security System (SSS) contributions online at the same time, on the same screen, in just a few clicks.

No need for you to generate a PRN from other sources (MySSS, helpline, email or text) just to make a payment.

How to Generate a SSS PRN and Pay Your SSS Contributions Online with Taxumo

Here are the steps to generate a PRN and pay your SSS transaction through Taxumo.

11 Easy Steps to Pay Your SSS Contributions and Generate PRNs Online

1. Create a Taxumo account or log-in to your Taxumo account at www.taxumo.com. Since Taxumo is an online tax filing platform, you will need to register your business details first before proceeding to the next step.

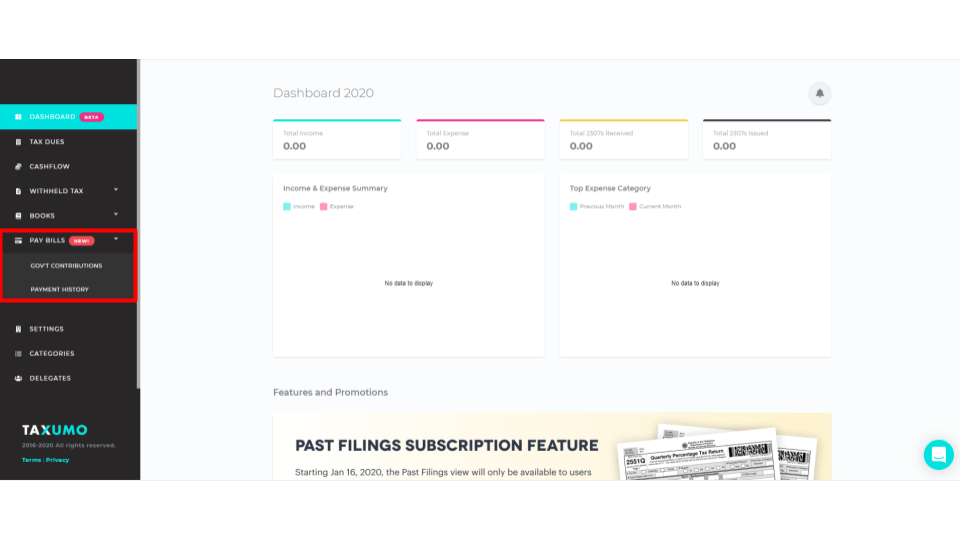

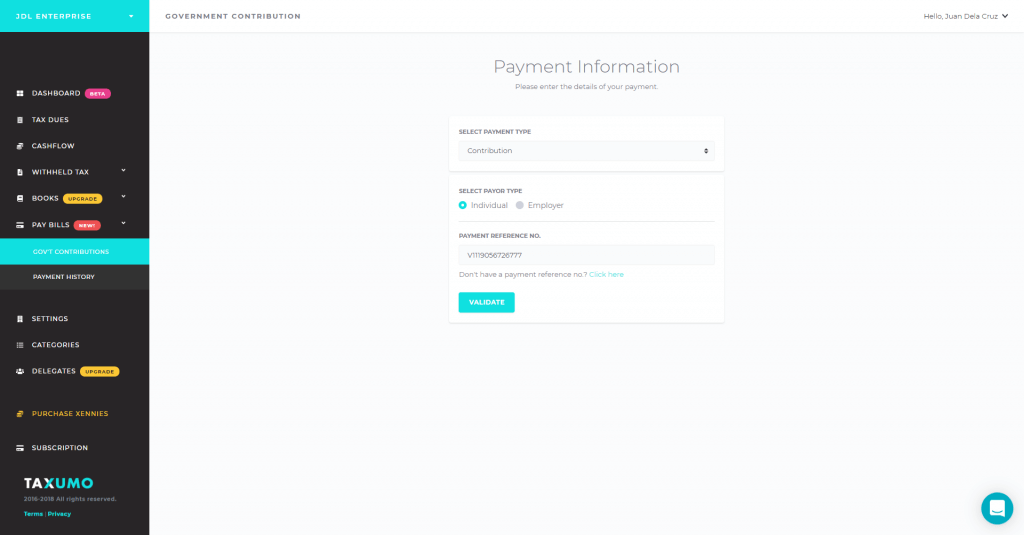

2. Choose Pay Bills and then Gov’t Contributions on the left sidebar

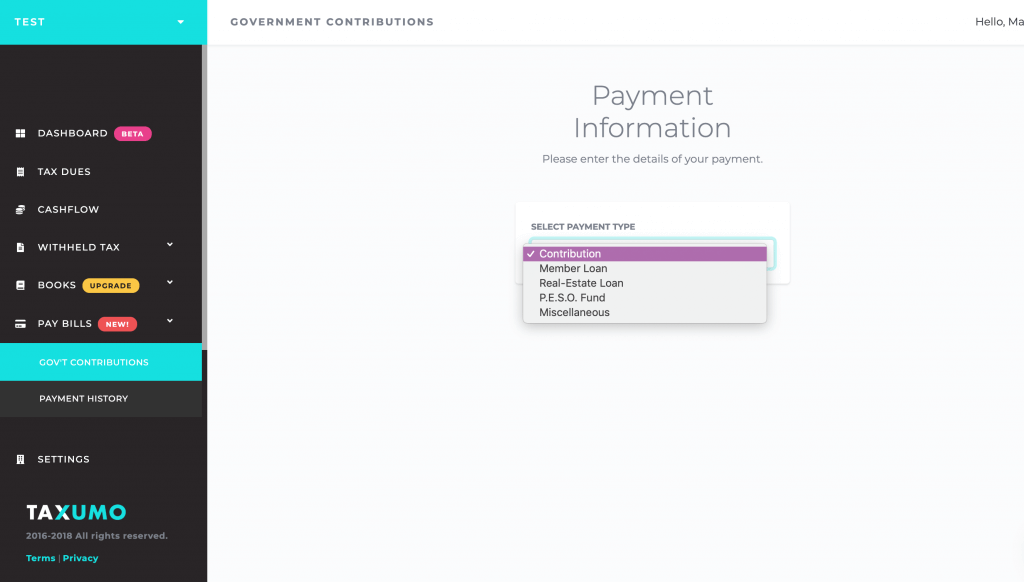

3. Select the Payment Type

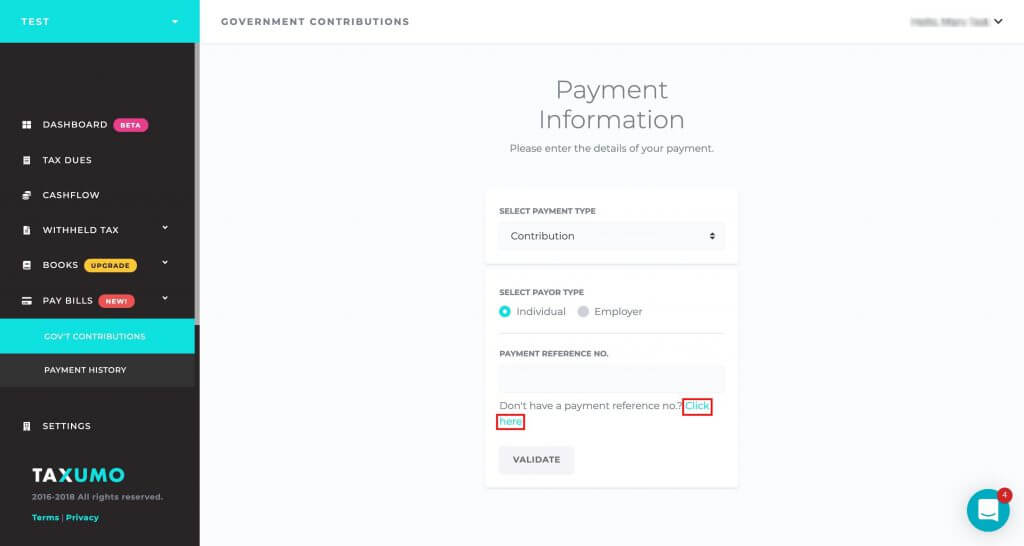

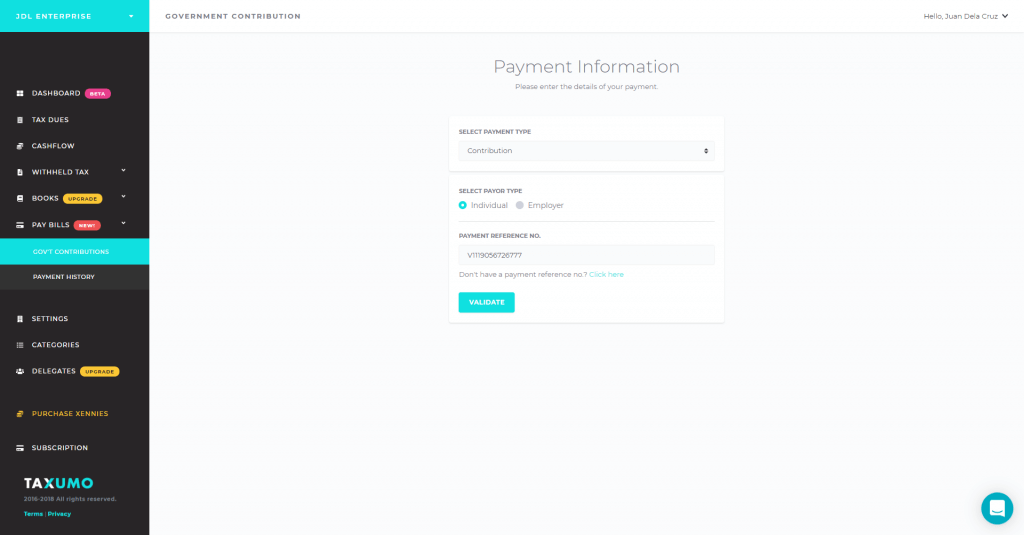

4. Select Payor Type

5. Enter your Payment Reference Number (PRN) if you have one

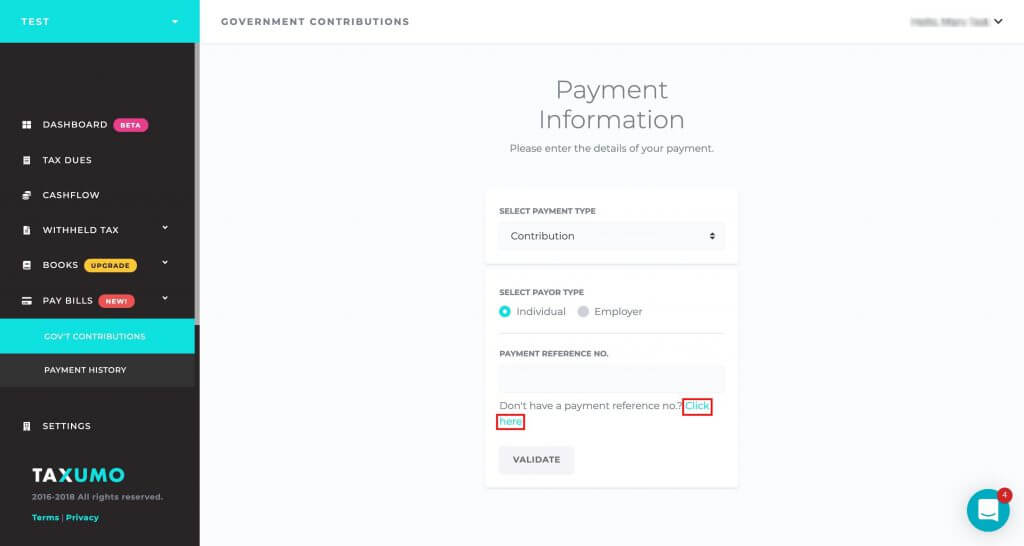

6. If you don’t have a Payment Reference Number, choose Click Here to generate one.

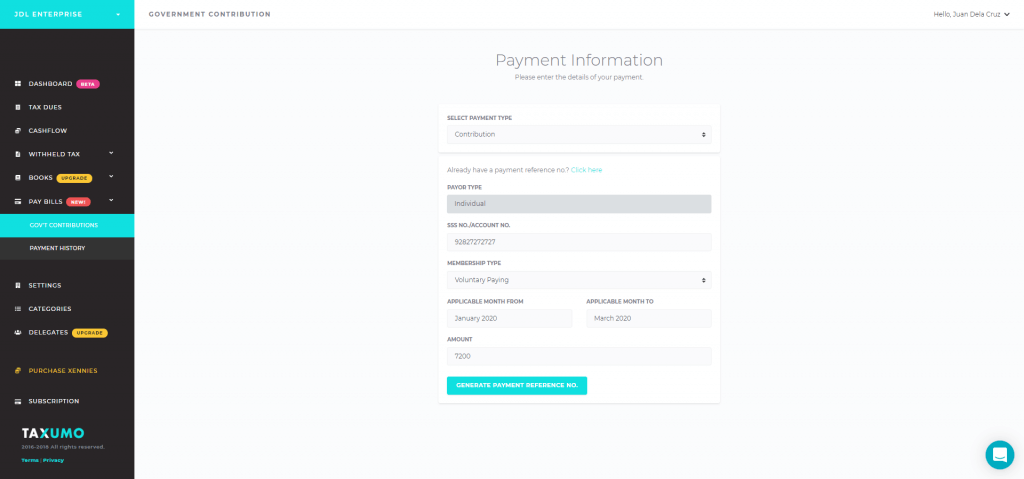

7. Fill out the necessary fields and then click Generate Payment Reference No.

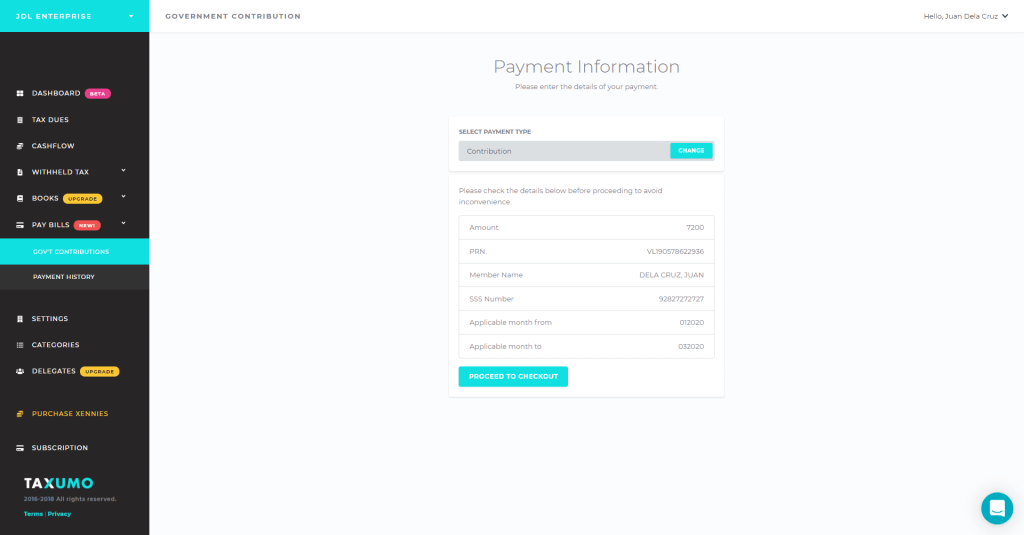

8. Click Validate to validate the PRN

9. You will see a Confirmation screen. If details are correct, click Proceed to Checkout

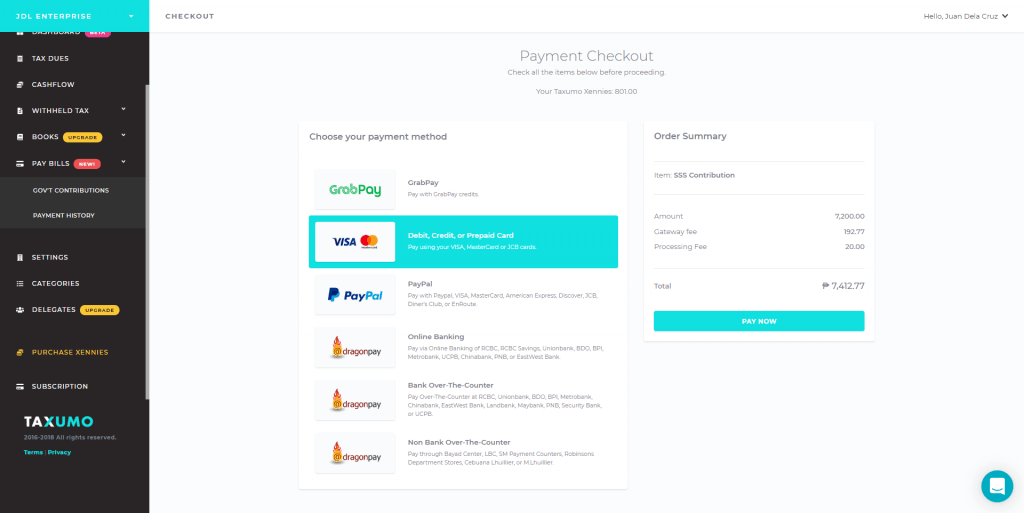

10. Choose a payment method (Credit/Debit card, Paypal, GrabPay, Over The Counter and Non-Bank Payment Centers) and click Pay Now

11. If your payment is accepted, you will see a Success Page and an email notification from Taxumo

And that is how easy it is to generate an SSS Payment Reference Number (PRN) and pay online all in one go with Taxumo.

P.S. If you don’t plan on filing taxes anytime soon, you can turn off your tax filing email notifications under the settings tab.

Word of caution. I checked the SSS website and articles online and as of this date this is not listed as an accredited payment channel.

Oh no, I thought this is legit.

Thanks for the warning.

You’re welcome, Cora!

Gud am please help me how to proceed in payment of sss loan?

how to pay my SSS loan online?

How to pay may sss i have no new prn ti my sss

Hello Theahoney,

Here are the steps on generating PRN through Taxumo:

Select payor type Individual.

Click the link beside Don’t have payment reference no.?

Fill up the fields.

Click Generate payment reference no. button.

Hope this helps 🙂

Can we pay corporate account loans in taxumo?

How to pay loan restructuring program in online transaction?

Right now, SSS loan payments can’t be paid on Taxumo. We’re working on getting that returned though so hopefully next time you try, you can pay already. Try it out!

Can we pay loan restructuring program at Union Bank online banking?

How to pay my Sss and how to get a ID SSS

Hi Frilyn, hopefully the article has helped you understand how to pay your SSS. Do tell us if you have a particular question about the article. 🙂

Hi! Just want to ask the particulars about paying my SSS on my own for a short period of time.

I will be transferring to a different company and they won’t be paying my government taxes not until after I am 6 months employed with them.

Is there a pause on that PRN? Or should I provide that to my employer once they are in charge on paying it for me?

I’m from Oman, how legit can this TAXUMO be a online SSS contribution receiver?

Is this mandated by SSS itself?

Please enlighten us OFW🙏. Thanks.

Hi Rocky, we are certified by the BSP as an Online Payment System. You can see our OPS credentials here and here. Hope that allays any fears you may have. If you also have any issues with your payment, you can coordinate with our Customer Service Team and they’ll help you.

hi sir can we pay our Employee loan via Union Bank?

if paying SSS as employer, there is no link to generate PRN.

Any issues? is the use of browser matters?

Good day.

I want to confirm if I can pay my SSS contribution using taxumo.

Are there any issues now?

Going to SSS branch takes a lot of time and I can only process my SSS contribution in Friday because of the last digit in my SSS number.

Thank you!

Pingback: Paano makakuha ng P70k na maternity benefit sa SSS (P80k kung solo mom) - SSS Maternity Benefits Q&A (Tagalog)

Good morning may i ask if talaga po bang hindi nagpopost online ang mga contributions namin dahil manual payment daw po ang ginawa ng employer ko.possible po ba na hindi talaga mapost yun even last year pa yung payment namin.dahil manual daw po ang ginawang process?thank you po

Yes po Ma’am, hindi po iyan ma. popost kasi manual. Kailangan pa po Yan I. process thru creating R3 file. I. Search niyo nalang po ang R3 file kung paano gawin. Advice ko lang po na kailangan talaga ang PRN sa pagbabayad ng contributions para po madali at diristo po ma Post ang payment. Naranasan ko na po ito.

pwede naman po ipost online manually sa sss website ng hr nyo or using the r3 generator.

Before the Pandemic, I paid my SSS Contribution as Voluntary Paying Member directly to the SSS Branch Office at Ipil, Zamboanga Sibugay. When the Pandemic arose, Seniors like me (I’m 68 years old) are prohibited from entering their Office, so I went to Western Union to pay. But today they declined to allow me to avail of their service because, according to them, the SSS Main Office is not providing them with the PRN. With this new development at hand, are there other outlets that I can go to pay my SSS Contribution? Please provide some help and assistance. Thank you and good PM.

You should start applying for your pension at age 60 if you are not working anymore. No more contributions. Age 65 above even you’re still working pension should start.

Good day. Step 6 is already gone from the website

is PRN one time use only for so many transaction?

I want to pay my sss loan in full. I can view in my profile my sss contributions only but my sss loan was not posted there. I sent an email to sss member relations last 2 weeks ago but there’s no reply until now. How do i know my outstanding balance so I can pay my loan. Can I use the create PRN for paying my loan too? Can this be used to all sss transactions? Pls help. Thanks!

I have generated r2 PRn since PRn given NY sss in invalid but still D 2 New Ines are invalid?what happened..my only convenient is paying in rustans bayad Center and ive been doing it awhile..worried coz due date is very NeAr

Hello Mae,

Kindly send us a message via customercare@taxumo.com so we can assist you regarding your concern. Thank you!

How can employers pay their SSS contribution for their employees in Taxumo?

Hi Micah,

Once you have created a Taxumo account, just go to the “Pay Bills” tab and select Govt Contributions.

Once there you may choose SSS or Pagibig.

Let us know if you need further assistance. 😊

Step 2 says that service is temporarily unavailable for updates and maintenance. Not sure if it is because I accessed it on a weekend

Hello Diana,

Thank you for letting us know. We’ll surely check on this.

Can I pay as employer for my domestic help via Taxumo? I have already generated PRN.

Hello Jaded,

Yes, you can pay for your help’s SSS and Pagiibig Fund Contributions via the platform. Thank you!

Pingback: I Now Have SSS, Where Does My Contribution Go To? | Taxumo - File & Pay Your Taxes in Minutes!