Tackling taxes might seem like a daunting task, especially when it comes to forms like BIR 1701Q. But it’s the right time to giddy up and pick up your feet, because this year, we’ll save you from tears. With our guide, we’ll break down BIR Form 1701Q in simple terms: what it is, who needs it, and how to fill it out.

Okay, So What Is BIR Form 1701Q?

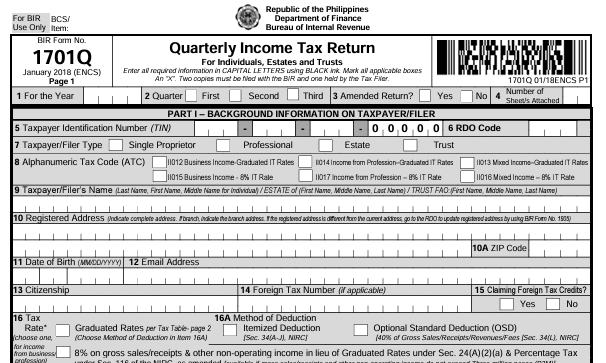

BIR Form 1701Q, or the Quarterly Income Tax Return, is like a report card for your earnings and taxes. It’s something self-employed professionals and business owners in the Philippines fill out every three months to keep things right with the tax folks. (Three months is one quarter, get it?)

This might seem like a hassle, right? To be honest, if you’re manually filing everything, it IS a hassle.

Who Needs to Deal with BIR Form 1701Q?

What’s Inside BIR Form 1701Q?

- Personal Info: Write down your name, address, TIN (Tax ID Number), and the place where you handle tax stuff (RDO). If you have a Taxumo account, you don’t need to manually fill this out every single time you need to file as your information is securely stored within your account.

- Money In and Out: Tell them how much you made and what you spent on your work during the three months. This helps figure out how much tax you owe. Taxumo allows you to store your income and expenses logs easily so you can compile and view them anytime.

- Calculating Tax: Do some math to figure out your tax. Don’t worry; it’s not rocket science—just follow the rules and rates. Your goal is to pay what’s fair. Taxumo allows you to compute your tax dues inside the web-app when you create a FREE account.

- Pay Up Details: If you owe some tax money, jot down how much and how you’re going to pay. Remember the deadlines! Gone are the days that would need to line up at a bank to make payments. With Taxumo, you can make tax payments online!

Extra Papers: Depending on your job, you might need to clip on some extra papers like receipts or statements to prove what you’re saying. If you require attachments and you’re not too confident about your organization skills. Having a Taxumo account provides you with the peace of mind that all your attachments are readily available.

Tips for Compiling BIR Form 1701Q:

- Keep It Neat: Organize your paperwork so you can easily find what you need when filling out the form. Never lose a document ever again when you have a Taxumo account.

- Stay in the Loop: Taxes change sometimes, so keep an eye out for updates from BIR. This helps you stay on the right track. Never miss a filing ever again as Taxumo diligently updates you with the deadlines way in advance.

- Do it on Taxumo: If this tax stuff gives you a headache, don’t be shy to ask a pro for help. We’re like tax superheroes, here to save the day. You can directly reach out to our ever-responsive Customer Service team or if you require professional tax advice, you can book a session with any of our vetted CPAs at https://txmo.co/booktaxumoconsult

Still unsure?

Here are some videos that might help!

BIR Form 1701Q might seem like a big deal, but with our simple guide, you’ll be the boss of it. Understand what it is, know if you need it, and glide through your tax troubles like Santa dropping those gifts on Christmas. Remember, you don’t need to be an accountant to conquer taxes—just a bit of know-how and maybe a friendly tax expert by your side. Happy filing!