A Beginner’s Guide to Filing Your Income Tax Return in the Philippines

It’s the season for filing your annual income tax return in the Philippines once again. You might have noticed all your accountant friends and family are in a state of disarray recently, and rightfully so. Most of us probably do not like filing their taxes, specifically their income tax return, especially when finding out that additional taxes need to be paid.

So, in this article, let’s discuss who needs to file income tax returns and how do you file them?

Where to begin filing your Income Tax Return?

First things first: what are income tax returns? Before you start filling up forms and queueing in line at Philippine tax filing centers, you must first know what it is you are heading into.

An income tax, according to the Bureau of Internal Revenue, is a tax on a person’s income, emoluments, profits arising from property, the practice of a profession, the conduct of trade or business, or the pertinent items of gross income.

However, a tax return is a return of excess taxes paid during a given tax year. The income tax return must be filed annually by a company or an individual that has received income during the year.

What incomes are subject to tax?

The incomes of individuals can be divided into the following categories:

-

- Compensation income is the income that comes from an employer-employee relationship. Salaries, wages, emoluments, and honoraria, commissions, taxable bonuses, and fringe benefits all fall into this category.

- Business income and income from profession consist of business and/or trade income, fees from the exercise of profession, gains from the sale or exchange of assets, commissions, rental income, and other incomes not covered by compensation income.

- Passive income and other sources of income such as interest from foreign or Philippine currency bank deposits, royalties, prizes and other winnings, and dividends. Capital gains from the sales of shares of stock, sales of rental property, and informer’s rewards are also included here.

Citizens of the Philippines whose incomes are derived from sources both within and without the Philippines are subject to tax. Aliens are taxed similarly as resident citizens, but only from sources within the Philippines.

Who is Required to File an ITR?

Simply put, if you have a job and are receiving compensation for the said job, then you are required to file an income tax return. Anyone and everyone who is a citizen of the Philippines, living in the Philippines, and receiving income from within or outside the Philippines are subject to filing taxes in the Philippines.

The company you are employed with will usually file your income tax returns for you. But in instances where this is not applicable, say, for business owners or freelancers, you are going to have to file them yourself.

According to the BIR, you should file your income tax return if you are:

- A Filipino citizen living in the Philippines, receiving income from sources within or outside the Philippines, and if you are:

- Employed by two or more employers, any time during the taxable year.

- Self-employed, either through the conduct of a trade or professional practice.

- Deriving mixed income. This means you have been an employee and a self-employed individual during the taxable year.

- Someone who derives other non-business, non-professional related income in addition to compensation income not otherwise subject to a final tax.

- Married, employed by a single employer, and your income has been correctly withheld—the tax due is equal to the tax withheld—but your spouse is not entitled to a substituted filing.

- Marginal income earner.

- Someone whose income tax during the past calendar year was not withheld correctly—if the tax due is not equal to the tax withheld.

- A non-resident citizen (i.e., a Filipino who works or resides abroad, receiving income from sources within the Philippines. You are taxable only for the income you earn from the Philippines.)

- A Non-Filipino citizen who receives income from sources within the Philippines, regardless of residency. (You are taxable only for the income you earn from the Philippines.)

- Domestic corporations and partnerships receiving income from sources within and outside the Philippines. This also includes foreign corporations and partnerships receiving income from sources within the Philippines.

- Estates and trusts engaged in trade or business are also required to file their ITR.

Who is exempt from filing your income tax return?

- A minimum wage earner

- Someone whose gross income (total earned for the past year) does not exceed your total personal and additional exemptions

- Someone whose income derived from a single employer does not exceed P60,000 and the income tax on which has been correctly withheld

- Someone whose income has been subjected to final withholding tax

- Qualified for substituted filing

- A non-resident citizen who is:

- A Filipino citizen not residing in the Philippines, but who has established with the BIR that you wish to remain living outside the country.

- A Filipino citizen who leaves the Philippines during the taxable year to reside abroad, either as an immigrant or for permanent employment.

- A Filipino citizen who works and earns income abroad.

- A Filipino citizen previously considered a non-resident citizen.

- An overseas Filipino worker whose income is derived solely from sources outside the Philippines.

How Do You File Your Income Tax Return?

Manual Filing

Don’t let the name fool you. While this definitely counts as manual filing as you still need to go to the BIR’s offices, most of the forms you need are available online and are easy to download and print.

-

- For individuals earning income only as employees and for marginal income earners, you will need to fill up three (3) copies of BIR Form 1701. You will also need the following documents:

-

- Certificate of Income Tax Withheld on Compensation or BIR Form 2316,

-

- A waiver of the spouse’s right to claim an additional exemption

-

- Duly approved Tax Debit memo and proof of foreign tax credits.

-

- For individuals earning income only as employees and for marginal income earners, you will need to fill up three (3) copies of BIR Form 1701. You will also need the following documents:

-

- For individuals who are self-employed or deriving mixed-income, you will need to fill up three (3) copies of BIR Form 1701. The following documents are also needed:

-

- Certificate of Income Tax Withheld on Compensation BIR Form 2316, tax debit memo,

-

- Proof of prior year’s excess tax credits, and

-

- Certificate of Income Payments not Subjected to Withholding Tax or BIR Form 2304.

-

- For individuals who are self-employed or deriving mixed-income, you will need to fill up three (3) copies of BIR Form 1701. The following documents are also needed:

Electronic Filing and Payment System

The eFPS is the electronic processing and transmission of tax return information. This includes attachments and taxes due to the government made over the internet through the BIR website.

Taxpayers that intend to use the BIR eFPS services are required to enroll through the BIR e-Lounge or may directly access the BIR website for requirements and are required to maintain an online banking facility integrated with the eFPS. Those that are required to make use of the Electronic Filing and Payment System include:

-

- Large taxpayers who are duly notified by the BIR

-

- The top 20,000 private corporations duly notified by the BIR

-

- The top 5,000 individual taxpayers duly notified by the BIR

-

- Taxpayers who wish to enter into contracts with government offices

-

- Corporations with paid-up capital stock of P10 million

-

- Entities registered with the Philippine Economic Zone Authority (PEZA) and those located within Special Economic Zones

-

- Government offices, insofar as remittance of withheld value-added tax (VAT) to business tax is concerned

Based on Revenue Regulations (RR) 10-2014, those under the Taxpayer Account Management Program (TAMP). Taxpayers, whether individual or juridical entities, identified by the Revenue District Office (RDO) based on selection criteria pursuant to existing revenue issuances.

Electronic BIR Forms

The Electronic BIR Forms or eBIRForms was created mainly to give non-eFPS taxpayers and their accredited tax agents an accessible and more convenient way to file taxes in the Philippines. It is mandated under Revenue Regulations No. 6-2014.

eBIRForms consists of an offline and online package. The most commonly used package are the offline packages which you can download and install on your computer.

eBIRforms is basically a tax-preparation software that allows taxpayers to fill out their tax forms and submit them to the BIR within the system as well. However, this software is still very basic as it does not compute your taxes for you.

Electronic Tax Service Providers

Electronic Tax Service Providers (eTSP) are tax software providers accredited by the BIR. And, one of those accredited eTSPs is Taxumo.

Taxumo is a tax app that automates your tax filing for you. Unlike eBIRforms where it’s like filling out out a PDF, Taxumo takes care of all the difficult parts of tax filing for you.

Our platform will take care of filling out your tax forms (especially for your Annual ITR), calculating your tax dues and submitting your attachments for you!

You can learn more about the difference between eBIRForms and Taxumo here.

Frequently Asked Questions When Filing Income Tax

When is the deadline for filing and/or payment of the income tax return?

The deadline for filing your income tax return falls on the 15th of April every year following the close of a taxable year.

When is the deadline for the submission of the required attachment to the income tax return?

When filing your yearly income tax return, certain documents are required to be attached with the BIR form. Submitting these required attachments depends on the manner you filed and/or paid your income tax return. For manual filing, you are supposed to submit upon filing. Meanwhile, for the Electronic Filing Payment System or EFPS and eBIRforms, you are supposed to file 15 days from the deadline of filing or date of electronic filing of the BIR annual income tax return.

Filing Your Income Tax Returns

Now that we have an idea of what filing taxes in the Philippines entails, it’s time to finally know how to actually do them.

Manual Filing

- Fill-up three copies of BIR Form 1700, Form 1701, and 1701 as mentioned above.

- If there is payment needed, proceed to the nearest Authorized Agent Bank (AAB) of the Revenue District Office where you are registered.

- Present the duly accomplished BIR Form together with the required attachments and your payment and receive your copy of the duly stamped and validated form from the tax filing center representative.

- If there is no payment, including refundable or creditable returns, returns with excess tax credit carry over, and returns qualified for the second installment, proceed to the Revenue District Office where you are registered or to any established Tax Filing Centers established by the BIR.

- Present the duly accomplished BIR Form, together with the required attachments, and receive your copy of the duly stamped and validated form from the RDO/Tax Filing Center representative.

eFPS

After successfully enrolling with both eFPS and online banking with any of the Authorized Agent Banks, you may simply access the BIR eFPS website, fill out the tax returns filed with the required details, then validate and submit it.

A Filing Reference Number page is generated and shown after successfully filling and submitting the tax return online.

The system will then store the e-filed tax returns for future reference. If you are due for a tax payment, you will be provided with the form with the payment information displayed. Simply choose the mode of payment and the authorized bank and received the proof of successful tax payment.

eBIRForms

You must first download the latest offline eBIRForms package and fill up the information required. After providing your complete information, validate and submit it through the use of the Online eBIRForms System. You will then be asked to provide a username and password, after which, you will receive a Filing Reference Number as an acknowledgment of its receipt. After successful submission, you will receive an email notification.

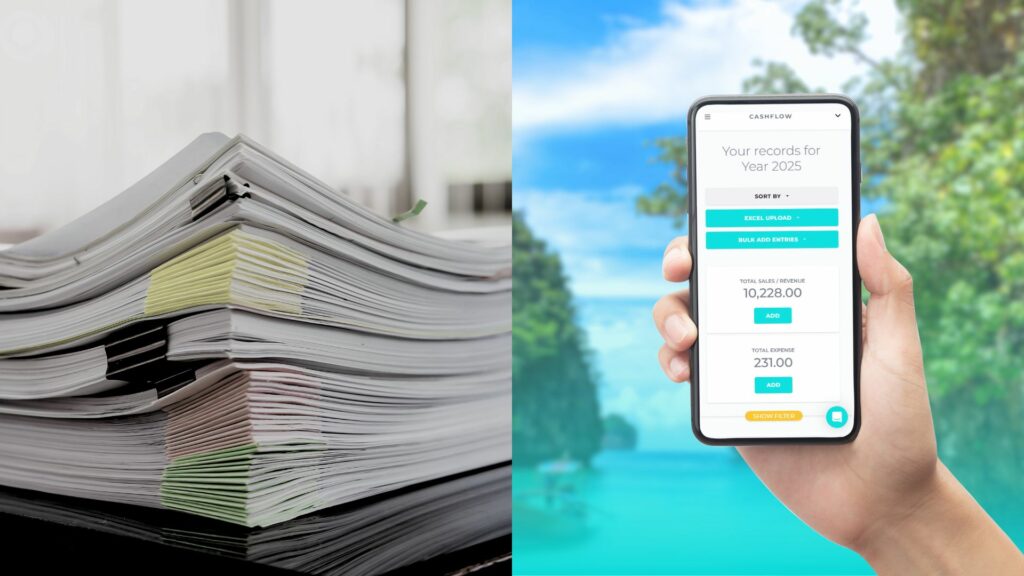

Time To Let Software Do the Work For You

Hopefully, by the time you have reached this part, you now have an idea on how truly exhaustive and time-consuming filing taxes in the Philippines is. While you are encouraged to at least try it out and experience it yourself, some of us just don’t have the time or the effort to spare to tackle this task.

For freelancers, small business owners, and self-employed professionals in the Philippines, Taxumo is a great service to help you out with your taxes. Taxumo will calculate your taxes in real-time so you can avoid any unwarranted payments. It can also fill out your tax forms for you! Other conveniences available to you are multiple payment channels and easy access across different devices.

You don’t have to be an accountant or even have any accounting background to use Taxumo. Simply enter your information and with a click of a button, you’re good to go.

If you want to find out about an easier way to deal with taxes, click here and read more about Taxumo!