If you are like many individuals who pursue freelancing or setting up their own business, you may find yourself clueless on how to do proper tax filing. For instance, one of the more daunting tasks you may be facing would be how to calculate your tax dues. Not all of us have been taught the basics of taxation or accounting back in school or in university. In fact, a few wish that they had taken classes that would be extremely useful such as a lesson on Philippine tax calculator.

For the smarter ones, they opt for an online tax calculator in the Philippines—so they wouldn’t have to worry about miscalculations which add to the unbelievably long amount of time spent on tax-compliance. Did you know that according to the Bank and PricewaterhouseCoopers (PwC)’s “Paying Taxes 2018” report, filipinos take an average of 182 hours a year to comply with tax regulations?

Of course, this does not mean that they completely rely on this innovation to compute their taxes. They also make sure that they have a proper understanding of how much they need to pay to the government.

Whether you are an employee, a freelancer, or a small business owner, it would be better for you to start reading up on the tax laws in the country, so you would better understand how tax dues are computed. More importantly, so you would better appreciate why you need tax calculators to help do that job for you. Our goal is to prepare you for that, which is why this article has been divided in four sections:

- An Overview of the TRAIN Law

- Personal Tax Income and Excise Tax Under TRAIN

- Tax Calculator Checklist

- Convenient & Quick Tax Filing with Taxumo’s Online Tax Calculator

Ready? Let’s continue reading!

An Overview of the TRAIN Law

The Tax Reform for Acceleration and Inclusion (TRAIN) law is the revised version of the National Internal Revenue Code (NIRC) of 1997 wherein major changes have been implemented. One change is the introduction of the lower income tax bracket for low-income earners. On top of this, there is an additional excise tax on certain products like cars, gasoline, and beverages.

More importantly, income tax computation has experienced a major shift. With new income tax rates comes a reform to the Tax Calculator in the Philippines. The TRAIN law also implemented Value Added Tax (VAT) exemptions on certain commodities and products.

The most popular part of the TRAIN law is the reduction of the personal income tax of a majority of individual taxpayers. Before the enactment of this new law, an individual employee or self-employed taxpayer would normally have to file an income tax at the rates of 5% to 32% depending on one’s bracket.

So, if you are earning the minimum wage of Php 15,000, you can have an additional take-home pay of Php 1,541.83 per month under the 2018 tax reform. Since its implementation on January 1, 2018, the personal income tax rates now come in two sets:

- Income Tax Tables to be implemented for the years 2018-2022

- Income Tax Tables to be applied from the year 2023-onwards

Under TRAIN, a taxable income of Php 250,000 will be subject to the rate of 20% to 35% for the year 2018, and 15% to 35% starting on 2023. In addition to this, the deductible 13th-month pay and other benefits are now higher at Php 90,000 compared to Php 82,000 under the old NIRC law.

Your take-home pay will generally increase. However, the amount you pay for the good and services you usually avail would also be raised.

Apart from that, you also have to be aware of the bracket where you belong. Keep in mind that if you are earning Php 250,000 or below annually, you will no longer pay any income tax. On the other hand, those that pay Php 250,000 and Php 400,000 per year will be charged an income tax rate of 20% on the excess. This increases as the rate of your annual wage increases. Remember that this is effective for the year 2018 up until 2022 only because from the year 2023 onwards, the income tax rates will be further adjusted accordingly so that withholding taxes have lower rates than before.

Personal Tax Income and Excise Tax Under TRAIN

As previously mentioned, TRAIN law decreases the tax on personal income, estate, and donation. However, it increases the tax on certain incomes, documents (documentary stamp tax), and also excise tax on minerals, petroleum products, automobiles, and cigarettes.

The TRAIN law also imposes excise tax on sweetened beverages and non-essential services, such as invasive cosmetic procedures. Aside from this, it removes the tax exemption of Lotto and other PCSO winnings amounting to more than Php 10,000. By knowing these changes, you will not become overwhelmed by the reforms. After all, it is important to be smart about this vital information.

The TRAIN law also aims to simplify tax compliance by having certain provisions geared towards that purpose.

On reforms and shift on excise taxes, the increase in their rate should factor in how you see the tax calculation in the country. The significant shift in rates would be valuable information if ever you are going to avail a certain product or service so you know how their rates are proposed.

There are also amendments to the Value Added Tax (VAT) which lessen the weight of taxes to taxpayers:

- Increase of VAT threshold from Php 1,919,500 to Php 3,000,000

- Starting 2019, the sale of drugs and medicines for diabetes, high cholesterol, and hypertension will have a VAT exemption.

- Increase of VAT exemption for the lease of a residential unit from Php 12,800 to Php 15,000.

- Association dues, membership fees, and charges collected by homeowners’ associations and condominium corporations are now exempt from VAT.

If you are planning on starting your newfound independence as a professional by investing in a new home, you’ll be glad to hear about these VAT exemptions. The exemption on drugs and medicines is also good news for you, if you are the one providing help to sickly grandparents or parents.

Here are the other items that are exempted from VAT:

- Raw Food

- Agricultural Products

- Health and Education

- Senior Citizens

- PWDs

- Cooperatives

- Renewable Energy

- Tourism Enterprises

- BPOs in special economic zones

- Socialized Housing

- Leases below 15,000 per month

- Condominium association dues

In addition to this, the excise tax on cigarettes, manufactured oils and other products, mineral products, and automobiles have also shifted dramatically—taxes on these goods have been increased.

Simpler tax compliance is also part of the agenda of the TRAIN law. The notable amendments include the quarterly filing of VAT Return and payment of tax instead of the previous monthly scheme. As an individual venturing into the self-employment route, taking note of these changes are a plus as it makes you an efficient and consistent taxpayer.

Tax Calculator Checklist

Before you go about learning how to calculate your tax dues, you should formulate a checklist that can be your guide to the accurate computation of your tax in the Philippines.

To do this, list down your basic salary, status, overtime pay, late deduction, SSS Contribution, PhilHealth Contribution, and Pag-IBIG Contribution.

Then, follow these steps so to guide you on how tax calculators compute your taxes in the Philippines.

- Determine Your Taxable Income

To compute your taxable income, you may follow this formula:

Taxable Income = (Monthly Basic Pay + Overtime Pay + Holiday Pay + Night Differential) – (SSS/PhilHealth/Pag-IBIG deductions – Tardiness – Absences)

Let’s say an employee is earning Php 15,000 from their job and their civil status is single, with no dependents based on the rates of government contributions. This individual will pay:

- Php 545.00 – SSS Contribution (From the SSS Contribution Table)

- Php 206.25 – PhilHealth Contribution (From the PhilHealth Contribution Table)

- Php 100 – Pag-IBIG Contribution

Your taxable income will total to an amount of Php 14,148.75. Here is how it is computed:

Taxable Income = Php 15,000 – (Php 545.00 + Php 206.25 + Php 100)

= Php 15,000 –851.25

= Php 14,148.75

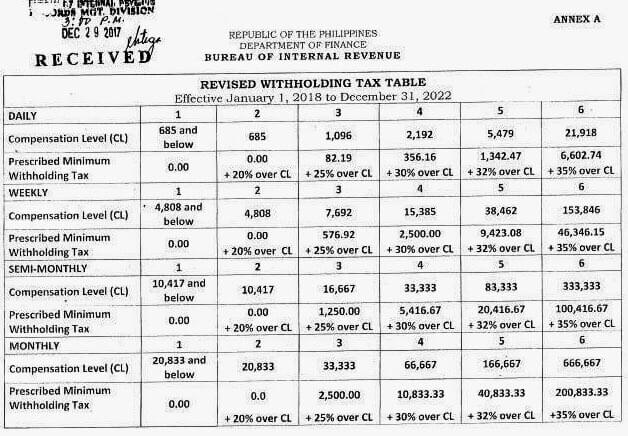

- Refer to the Bureau of Internal Revenue (BIR) Tax Table when Computing Your Income Tax

The Annual Withholding Tax Table can be derived by multiplying all values in the Monthly Table by Twelve (12)—except for the percentages.

BIR TAX TABLE:

Computing your taxes manually may be too much of a hassle for you, good thing that there are tax calculators in the Philippines that can do this job. Through them, you don’t even need to leave the comfort of your home.

Benefits of Determining Your Taxable Income using a Tax Calculator in the Philippines

These chunks of information will be a lot to take in and you are probably scratching your head on how to do it yourself. Don’t fret because there are tax calculators in the Philippines that are reliable sources on the computation of your personal income tax.

An online tax calculator in the Philippines like Taxumo is a reliable resource. But what are the benefits of determining your taxable income using a tax calculator?

- Saves yourself the hassle of manually computing for your taxable income

- You will know the dissemination of government contributions

- You can budget your salary according to tax rates and excise tax on commodities

- If you are using an online tax calculator, you can also have the option to avail their service of filing taxes for you.

- If you have an employee-employer tax filing scheme, you can check if your income is properly computed.

Convenient and Quick Tax Filing with Taxumo’s Online Tax Calculator

Becoming a self-employed individual is commendable because there is a sense of independence and empowerment that comes with it. Speaking of independence, this is also applicable to filing your tax and paying government contributions.

The TRAIN law requires that you pay and file your taxes quarterly, meaning you will have to take some time off your work schedule and join the long queue in your respective bank. Fortunately, online tax payment facilities are now a reality.

Taxumo is an online tax preparation app that lets you can file and pay your taxes in just a matter of minutes. With its free online tax calculator, it has been the choice of many filipino freelancers, small business owners and self-employed professionals. Specifically, it provides real-time tax calculation which can help you avoid tax bill shock. Plus, you can be alert in tax payments by knowing exactly how much you have to pay. The best part? You can use this feature for free when you sign up on its platform. All you need to do is enter your income and expense, and the web-based app calculates your taxes automatically in real-time.

The website also has an easy interface that has auto-generated tax forms where everything is automatically filled up and generated.

It also accessible anytime and anywhere, thanks to its tax calculator and tax filing capabilities that you can access on your laptop or on your mobile phone. It also has multiple payment channels so you just have to choose the one that’s more convenient for you.

Getting excited about Taxumo’s online tax calculator? Click here!

Suggested Readings:

What You Need to Know About The New BIR Forms in 2019

4 Great Reasons Why Filing Taxes Will Benefit Your Life

How to File Your Taxes Fast & Easy Online 404