It continues to be business unusual for the Philippines.

Despite the rollout of more vaccines, the easing of travel restrictions, and the reopening of more businesses – the Philippine workforce will never, ever be the same again.

Many have traded their 9 to 5 to pursue a passion, open a business, or explore the joys of permanent remote work. And who could blame them? With worsening traffic, increasing prices of goods, and a pandemic that still rages on, change seemed to be the best survival strategy.

This report is a continuing story of the never-ending struggle of small business owners, self-employed professionals, and freelancers with taxes (and more)

But change does not mean escaping from challenges. Running things on one’s own is tough. One struggle for first-time business owners and employees is how, when, and where to get started on filing taxes.

When addressed proactively, transitioning to self-filing can be a painless process, especially now that multiple solutions make filing and paying taxes easier.

This year’s State of Online Taxation Report gives us a perspective on how businesses and professionals have been slowly adapting to our COVID reality. We crunched our data to give you a snapshot of the fast-evolving online taxpayer landscape in the Philippines.

The State

of Online Taxation,

and what

it means

for you

Our 2020 and 2021 report revealed insights on how taxation has changed since the onset of COVID-19.

Fast forward to today, we’re once again diving into our user data to zoom in on income growth, workforce trends, and the different taxation patterns shaping our economy.

Explore all this, along with insights like:

-

Who the top online taxpayers are

-

Income trends over the past two years

-

Top BIR Forms filed over the year

- Socioeconomic classes

Individuals

- Professionals classified as self-employed

- Single proprietorship

- Compensation wage earners

- OFW/ non-resident citizens

Non-individual (or Corporate)

- Domestic corporations or businesses created and organized under Philippine law

- Foreign corporations created and organized under foreign laws

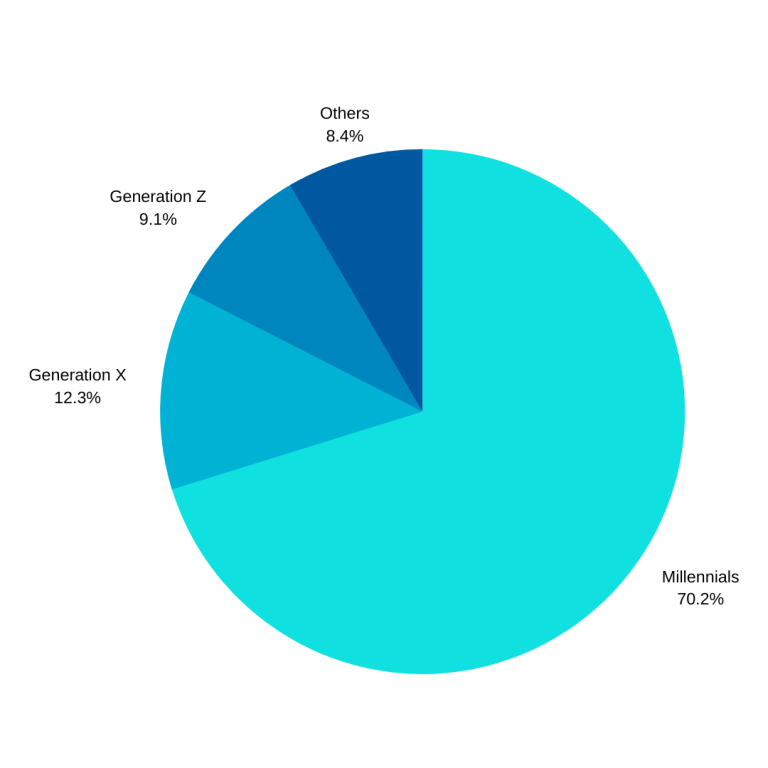

How Old Are the Online Taxpayers?

Here, we show you the different generations who pay their taxes online.

Boomer

Adults born from 1946 through 1964

Generation X

Adults born from 1965 through 1980

Millennials

Adults born from 1981 to 1996

Generation Z

Individuals born from 1997 to 2009

Age groups or generations stated in this report are based on Pew Research Centre definitions

Like our report in 2021, Millennials continue to be the top taxpayers online.

Generation X is a distant second, at 12.3%. But as more Generation Z professionals grow disgruntled with their work setups, this technologically-savvy age group might overtake them soon.

Source: Taxumo data gathered in June 2022

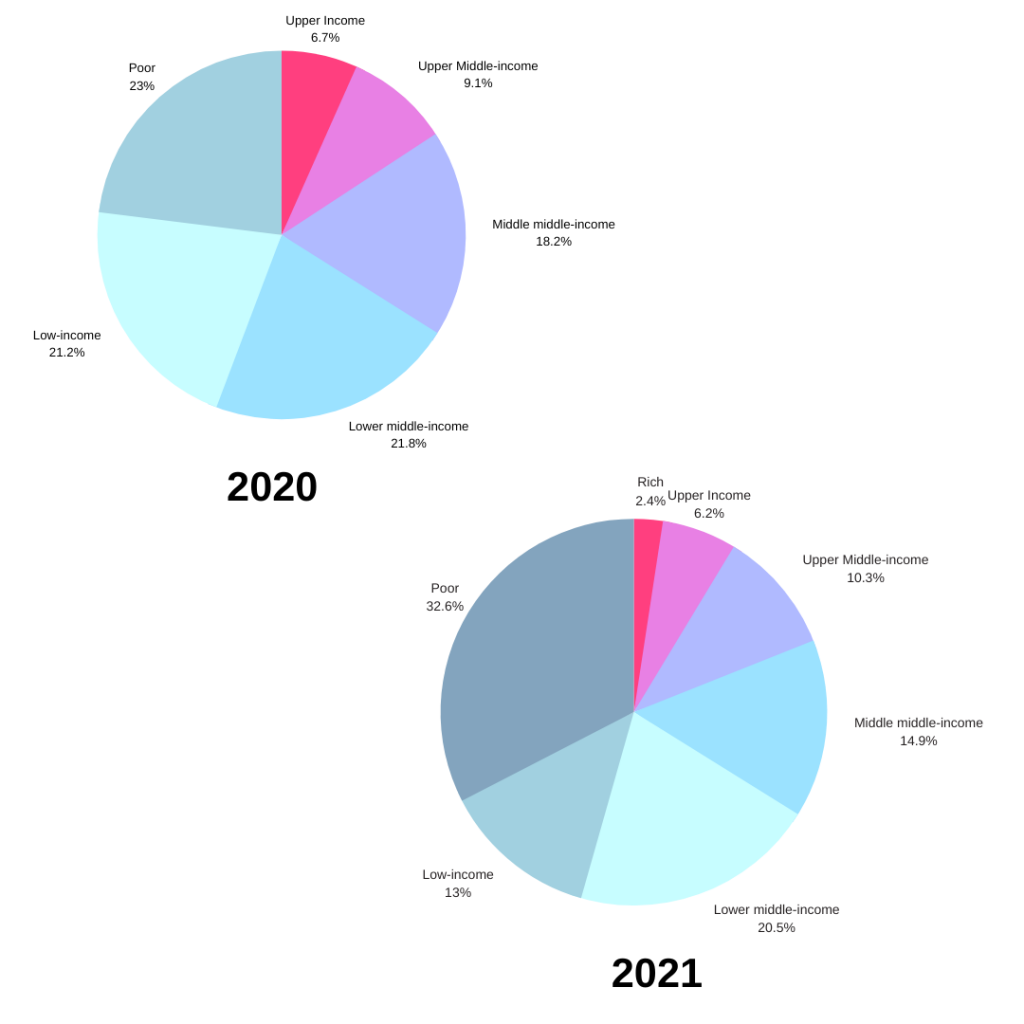

A Growing Divide Between the Rich & the Poor?

Taxumo compared our users’ declared monthly incomes against the classifications set by the Philippine Institute for Development Studies.

Poor taxpayers earn less than PHP9,250

Low income taxpayers earn between PHP9,250 and PHP19,040

Lower-middle income taxpayers earn between PHP19,040 and PHP38,080

Mid-middle income taxpayers earn between PHP38,080 and PHP66,640

Upper-middle income taxpayers earn between PHP66,640 and PHP114,240

Upper income class earn between PHP114,240 and PHP190,400

Rich taxpayers earn starting at PHP190,400 and higher

Since our last State of the Online Taxation report, we noticed interesting changes in our taxpayers' earnings, based on their 2021 tax payments.

Rich taxpayers are back, at 2.4%

Income for the upper-middle class is up by 1.2%

Mid-middle class shrank by 3.3% this year

Low-income taxpayers decreased by 8.2%

Poor taxpayers increased

by 9.6%

Source: Taxumo data gathered in June 2022

The Philippines’ original goal was to graduate to upper middle-income status* in 2022 but this goal was pushed back by the effects of COVID-19.

*Source: Jon Viktor D. Cabuenas, “ NEDA’s Chua: Philippines still on track to reach upper-middle income status by 2022”, GMANetwork.com, November 2021

While the country does show promising signs of growth – as evidenced by the income growth of the upper-middle class – it does highlight the divide between the lower- and upper-class.

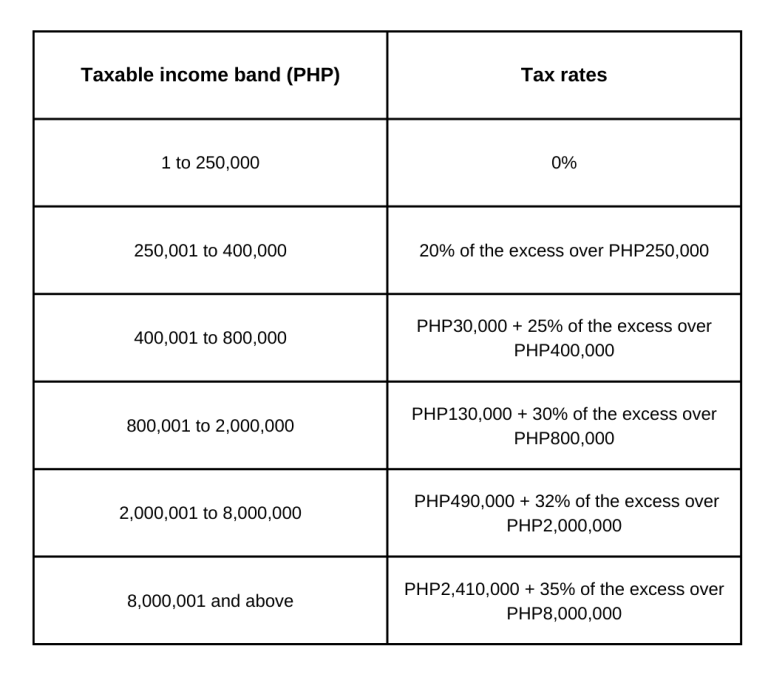

Another way to look at income trends is by analyzing the tax bracket.

There are six tax brackets recognized by the BIR in 2021 and 2022 : 0%, 20%, 30%, 32%, and 35%.

Brackets depend on an individual’s taxable income and filing status.

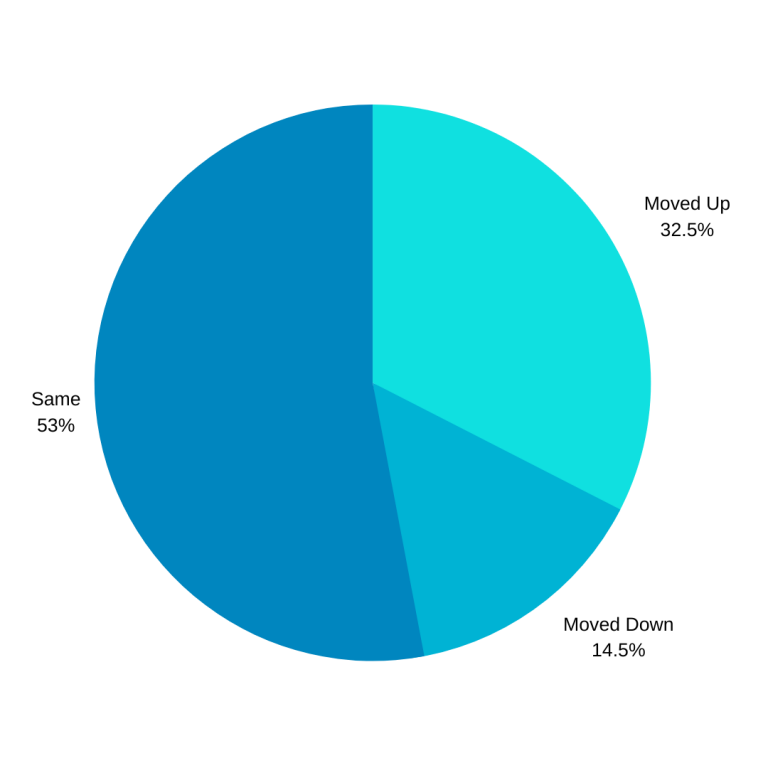

32.5% of taxpayers moved up the tax bracket from 2020.

Meanwhile, 14.5% moved down.

53% remained the same.

Source: Taxumo data gathered in June 2022

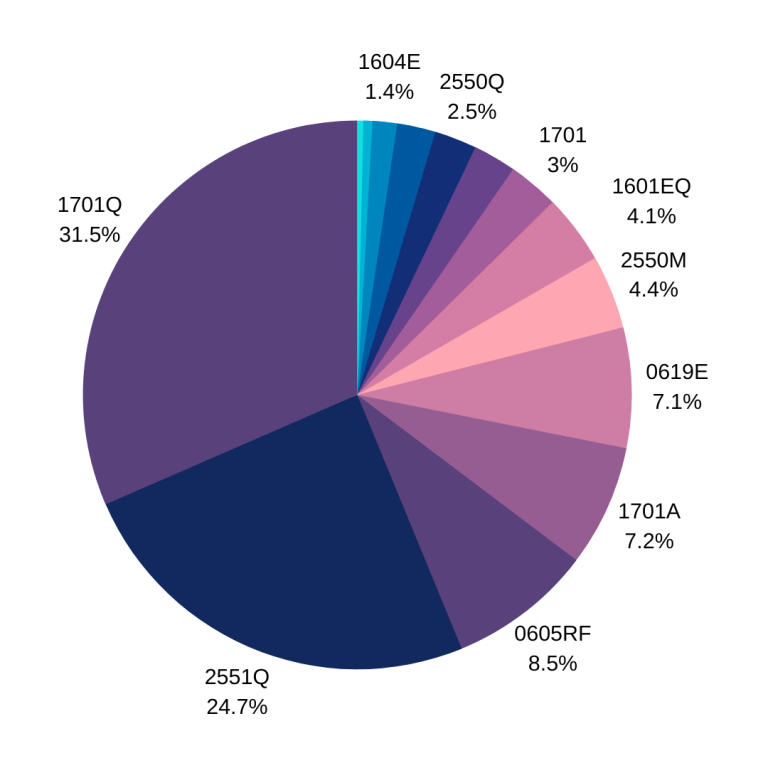

Meanwhile, we also looked into what types of forms they were filing online.

The top 5 forms filed on Taxumo are a mix of business and income taxes:

- 1701Q or the Quarterly Income Tax for Self-Employed Individuals (31.5%)

- 2551Q or the Quarterly Percentage Tax Return (24.7%)

- 0605 or the BIR Annual Registration Fee (8.5%)

- 1701A or the Annual Income Tax Return (7.2%)

- 0619E or the Monthly Remittance Form for Creditable Income Taxes Withheld (Expanded) (7.1%)

Source: Taxumo data gathered in June 2022

Does Your Gender Affect How Much You Make?

When you sign up for a Taxumo account, you will be asked to state the gender you identify as. The choices are:

- Male

- Female

- Non-Binary

- N/A (for non-individual entities)

Your gender identity is not your gender assigned at birth (or biological sex). Gender identity is an individual’s sense of maleness, femaleness, in between, both, or neither. Only you can fully determine your gender identity.

We have a diverse community, and each individual has a different set of needs and challenges. Seeing detailed information such as your gender identity allows us and other people to design solutions tailor-fit to one’s problems and situations.

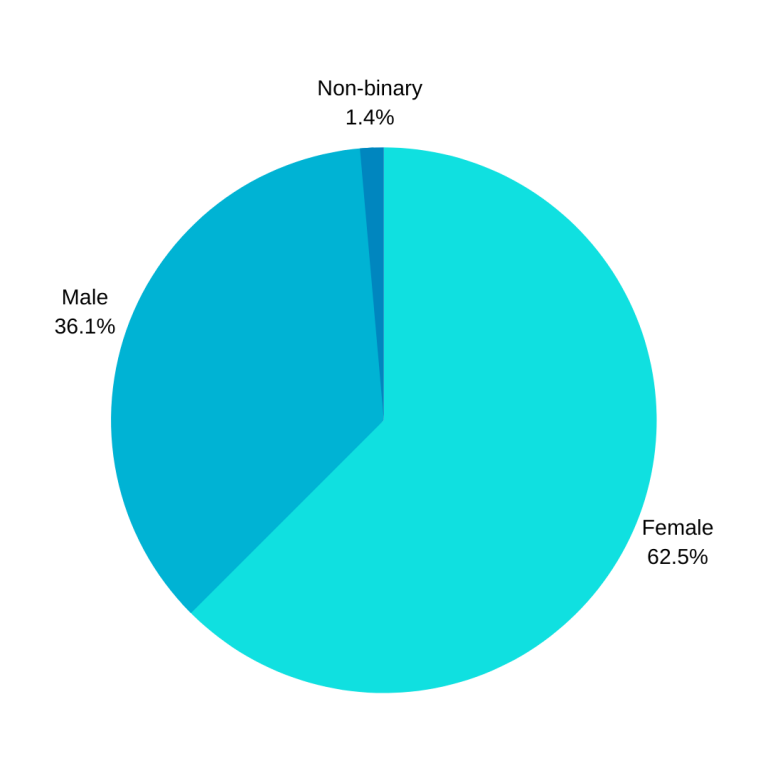

Most of the online taxpayers on Taxumo are women. But that doesn't mean they earn more.

62.5% of online taxpayers on Taxumo are women, with men at a distant second, at 36.1%. As of 2021, women paid 37% more tax forms compared to men.

But while more women pay taxes online, they don’t necessarily pay the highest taxes. This year, men’s earnings have overtaken women, with men’s tax payments 11.5% higher than women’s.

This earnings gap should be observed closely, as we foresee that it could worsen over time. Coincidentally, we also saw that the Philippines dropped by a point last year in the global gender equality rankings, as reported in the 2021 Gender Gap Report*.

Source: Global Gender Gap Report 2021, World Economic Forum, March 2021

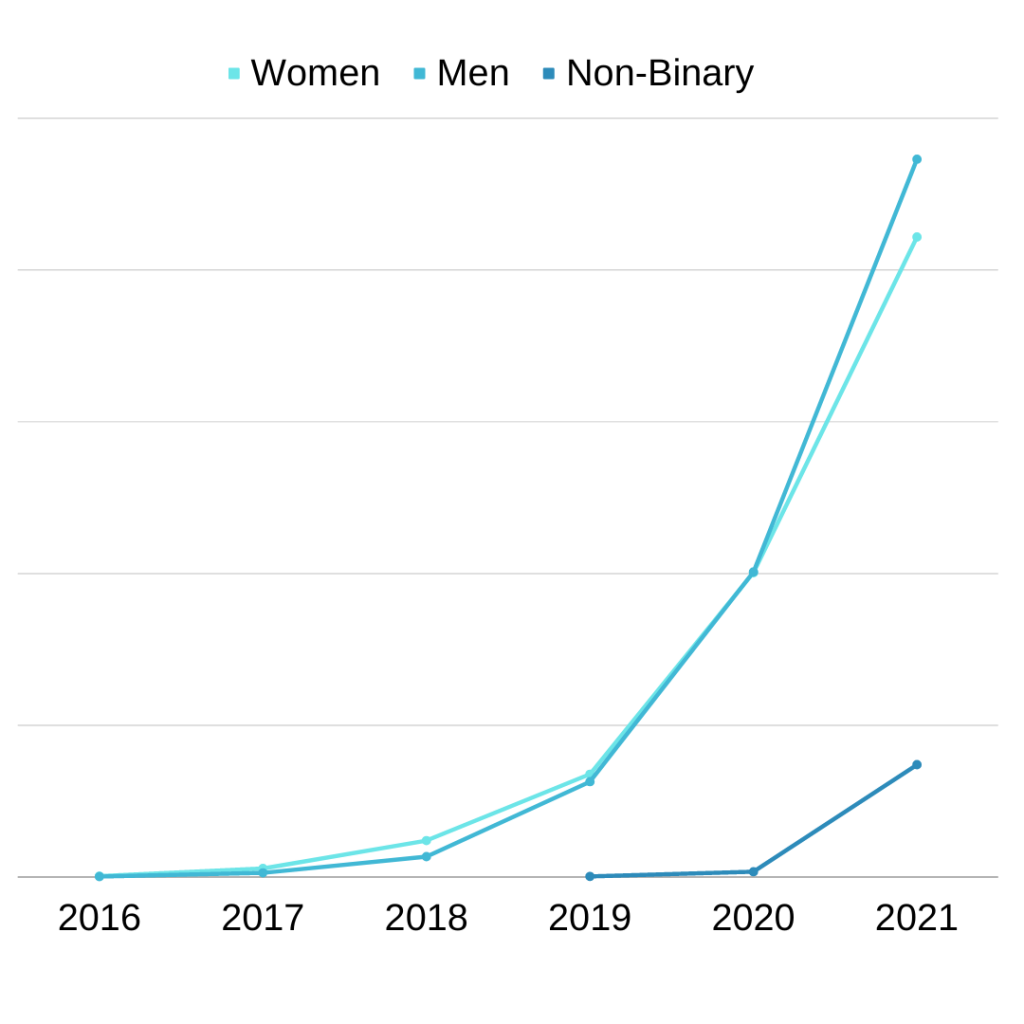

This year, we saw the income of non-binary taxpayers go up.

Non-binary taxpayers saw a whopping 2,200% increase in Non-Binary Tax Payments from 2020 to 2021.

Much has been said about the power of the pink peso, and this could be a glimpse of the spending power of the LGBT+ community. But it’s too early to tell. We’ll see if this trend continues.

Source: Taxumo data gathered in June 2022

Final thoughts

A number of factors are set to shape the Philippine tax landscape in the next few months. For one, as we start to see the light at the end of this pandemic, we can foresee more people self-filing their taxes as they transition to independent work.

Next, the incoming administration has begun to lay out its plans to impose new and higher tax measures, defer personal income tax reductions, and repeal some tax exemptions to raise the country’s revenues and settle debts.

It’s safe to conclude that both these factors will largely impact the data we’ll gather by the end of the fiscal year.

About Taxumo

Taxumo is the country’s pioneer tax compliance platform accredited by the Bureau of Internal Revenue (BIR).

Since 2016, users signed on our platform have remitted over PHP 52 million pesos to the BIR.

We continue to serve the Philippine tax paying community through our seamless platform, customer-first support, and resources to make tax compliance a breeze.