Freelance Tax Made Easy

Whether you’re a freelancer, entrepreneur, or side-hustler, Taxumo’s built-in self-employed tax calculator helps you compute, file, and pay your freelance tax online in just a few clicks; the smarter way to stay compliant and save time.

Certified by:

As seen on:

Learn how to file and pay taxes in Taxumo!

Trusted by our customers

Here are some of the customers that use Taxumo to file and pay their taxes.

“I found the vibe of Taxumo was aligned with my personal philosophy. I like teaching myself things. I taught myself how to code and do double-entry bookkeeping… The Philosophy of Taxumo: Let’s help you become compliant. It wasn’t shady. It was transparent.”

Nephi Malit

Freelance Musician, Content Writer, & Web Developer

“Maganda yung website, hindi magulo. easy to navigate. Basta you enter things correctly, one click lang, nakapagfile ka na nang tama.”

Daphne See

Freelance Designer

“I’ve been with Taxumo for two years now… Taxumo has really helped my anxiety dealing with forms and processes I have no experience dealing with. It’s impossible to keep up [with tax guidelines] when you’re just a stressed-out-of-your-wits freelancer like me (in my case, I’m a graphic designer working with top design firms in the US.)”

Dry_Caligrapher_167 (on Reddit)

Freelance Graphic Designer, & Virtual Assistant

Be free from tax worries!

Here’s why thousands of freelancers all over the Philippines use Taxumo!

Cost Effective Freelance Tax Tool

The app does most of the work seamlessly and is far more affordable than hiring an accountant or a bookkeeper!

Reliable Customer Support

Our responsive and friendly customer support associates are ready to help you especially during tax due crunch time.

Your Bestfriend in Taxes!

The app helps keep track of your income and expenses, while automatically filling and computing taxes.

Real-time Tax Calculation

Ever experienced “tax bill shock”? With Taxumo, you don’t have to. Taxumo shows you updated tax dues in real time.

Submission of Attachments

The process to create attachments is especially tedious. Taxumo will automatically create the relevant QAP, SAWT, and SLSP/VAT Relief attachments for each filing.

Mobile Friendly

Taxumo also works on mobile! As long as you have a smartphone, you can file and pay for your taxes anytime, anywhere

BIR Registration Online

Besides tax filing, you can comply with government policies, gain credibility, seek consultation, and meet client requirements through other services in Taxumo.

Frequently Asked Questions

Here’s the simplified process:

Register with the BIR using Form 1901.

Get a Certificate of Registration (BIR Form 2303).

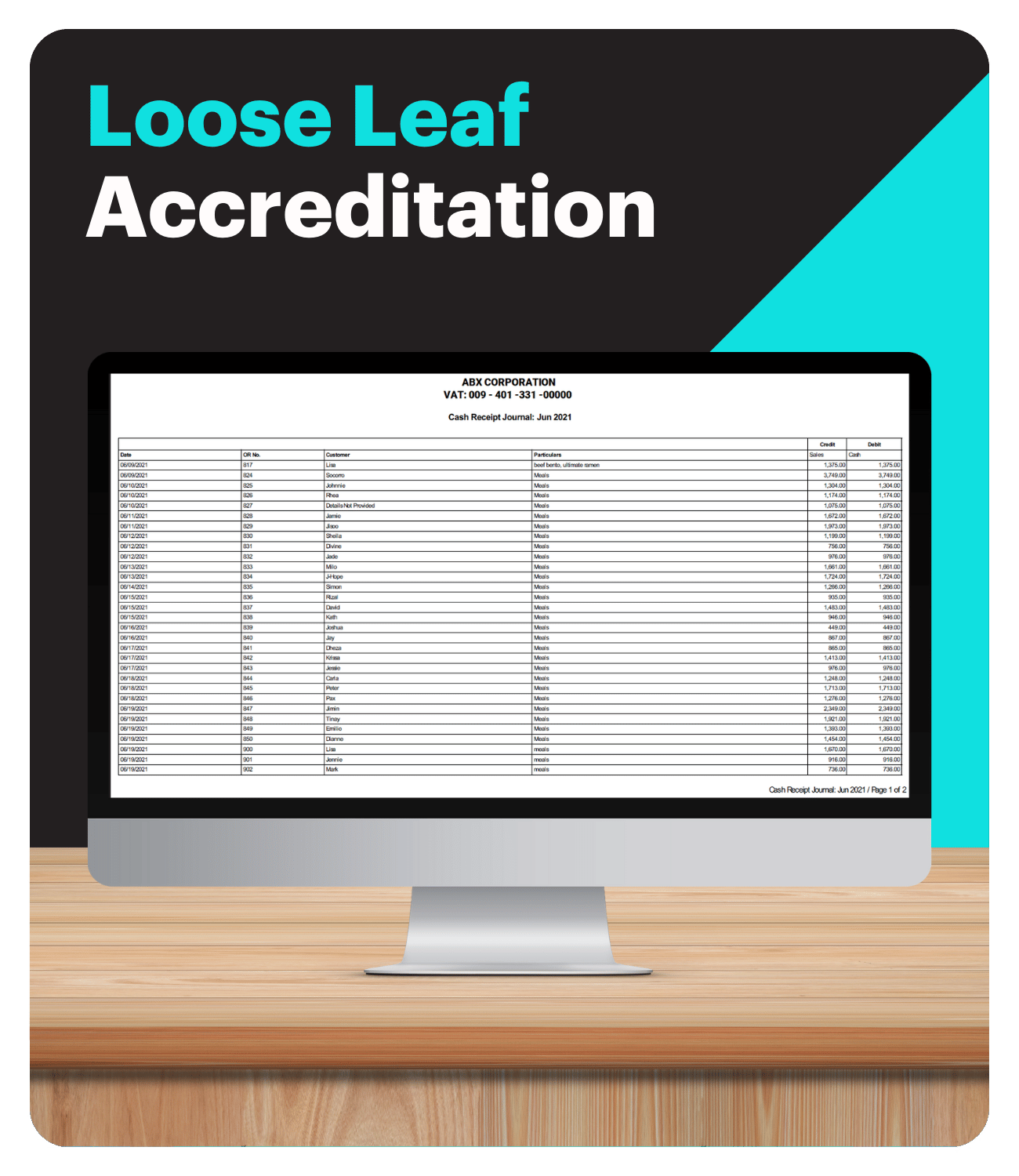

Apply for Books of Accounts.

Print your official receipts.

Choose your tax rate (8% or graduated rates).

Indicate your choice upon registration or in your first quarterly return.

File and pay taxes every quarter and annually via Taxumo

Yes. Freelancers are considered self-employed individuals or professionals under the law. They must register with the BIR, file income tax returns, and pay taxes on their earnings.

According to Section 24(B)(b) of the NIRC:

The first ₱250,000 of your annual gross income is tax-free.

Any income above ₱250,000 is taxable.

You can choose between two tax options if your total annual income is below ₱3 million (VAT threshold):

8% income tax on gross sales/receipts exceeding ₱250,000; Simpler and best for freelancers with minimal business expenses.

Graduated tax rates (0–35%) on net income (income minus allowable expenses) Suitable if you have many deductible expenses.

If your income exceeds ₱3 million, you must register as a VAT taxpayer and can no longer avail of the 8% option.

Freelancers typically file the following BIR forms:

| Purpose | Form | Frequency |

|---|---|---|

| Quarterly Income Tax | BIR Form 1701Q | Every quarter |

| Annual Income Tax | BIR Form 1701A (for 8% option) or 1701 (for graduated rates) | Every April 15 |

| Percentage Tax (if not using 8%) | BIR Form 2551Q | Quarterly |

| Registration | BIR Form 1901 | One-time, before starting your freelance work |

Taxumo offers accurate and updated income tax calculator systems based on the TRAIN Law, CREATE Law, and Creative Industries Act. You can file and pay taxes completely online — no need to visit multiple LGUs or RDOs.

It’s also more cost-efficient compared to traditional accountants or bookkeepers, who usually charge corporate rates. You get the same accuracy and compliance at a fraction of the cost.

You can enjoy affordable and seamless ITR filing for freelancers for only ₱2,699 per quarter!

This package includes:

Income Tax Return (2nd & Annual ITR payment)

Registration Renewal

Percentage Tax Return – Zero Dues

Summary of Alphalist of Withheld Taxes

Books of Accounts

Additional account delegation for two (2) users

This plan ensures your taxes are filed correctly and on time — no stress, no penalties.

Time to tax it easy as a Freelancer!

You can try Taxumo for free with 0% commitment, or attend a FREE group session where you can watch a live demo and ask your freelancer tax questions directly.