In the digital era, the Philippine Bureau of Internal Revenue (BIR) has taken significant strides towards simplifying tax compliance and administration for taxpayers across the country. The introduction of the Online Registration and Update System (ORUS), accessible through orus.bir.gov.ph, marks a pivotal advancement in the BIR’s digital transformation efforts.

This system designs to make the process of tax registration, information update, and compliance more accessible and less time-consuming for everyone. Here’s everything you need to know about ORUS and how it’s revolutionizing tax management in the Philippines.

What is ORUS?

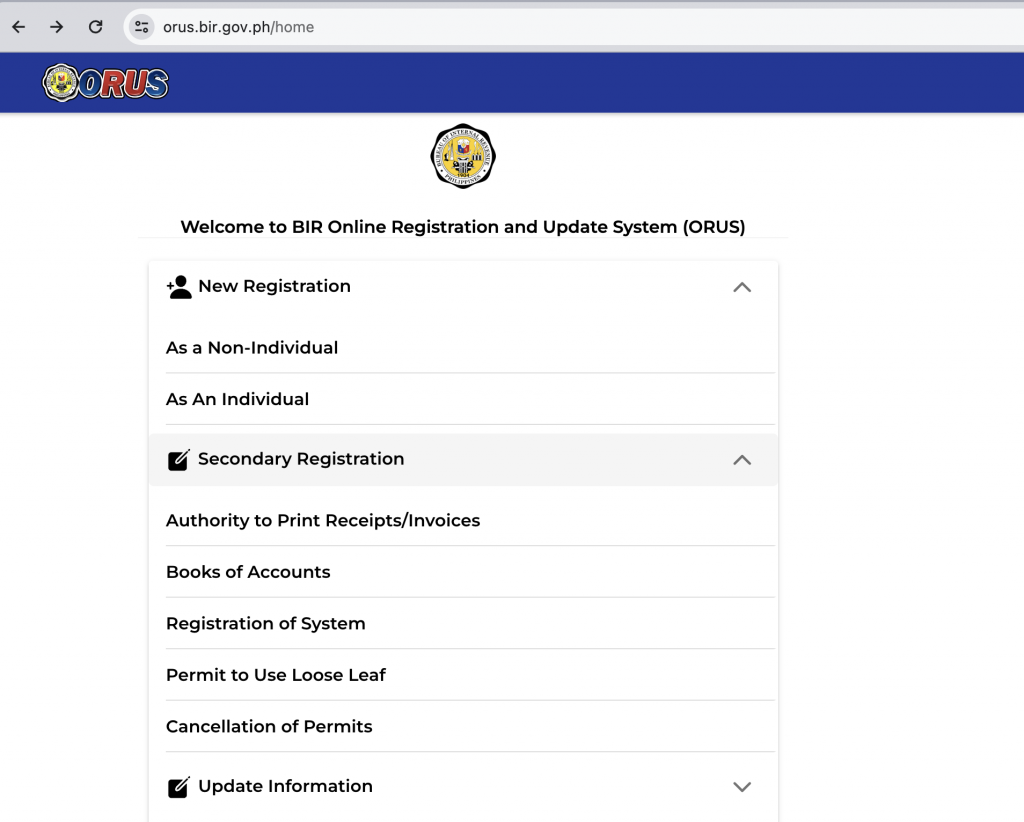

The ORUS platform is a digital initiative by the BIR that allows taxpayers to manage their registration details online conveniently. It’s part of the bureau’s broader strategy to enhance its services and make tax compliance straightforward and hassle-free for individuals and businesses alike. Whether you’re a freelancer, a small business owner, or part of a large corporation, ORUS provides a centralized portal to update your registration information, submit relevant documents, and ensure that your tax records are current and accurate.

Key Features of ORUS BIR

Online Registration and Updates

One of the core functionalities of ORUS is to enable taxpayers to register new businesses online. It also allows them to update their existing registration details. This feature eliminates the need for physical visits to BIR offices, saving time and resources.

Secure and Accessible

Security and accessibility lead the way as orus.bir.gov.ph ensures that taxpayers can manage their information safely and conveniently. The platform employs robust security measures to protect user data and provide a reliable online experience.

Streamlining Compliance

ORUS simplifies various compliance requirements by offering features such as the submission of registration documents and application for tax clearance. It also allows for the updating of taxpayer profiles. This streamlines the compliance process, making it easier for taxpayers to fulfill their obligations.

Benefits of Using ORUS

The ORUS system brings several benefits to taxpayers, significantly reducing the complexities associated with tax compliance:

- Convenience: Access your tax registration details and make necessary updates without leaving your home or office.

- Efficiency: Save time with quick and easy online transactions, avoiding long queues and paperwork.

- Accuracy: Ensure that your tax records are accurate and up-to-date, minimizing the risk of penalties and issues with compliance.

- Security: Rest assured that your personal and financial information is protected through the BIR’s secure online system.

Getting Started with ORUS

To begin using ORUS, taxpayers need to visit orus.bir.gov.ph and create an account. The process is straightforward, requiring basic information and verification steps to ensure the security of your tax records. Once registered, users can navigate through the system’s features, update their registration details, and stay compliant with the Philippines’ tax regulations.

The Future of Tax Compliance in the Philippines

The launch of ORUS by the BIR marks a new era in Philippine tax administration, showing a deep commitment to digital transformation. As ORUS improves, taxpayers will see new features that make tax compliance easier. ORUS acts as a bridge to a more efficient, transparent, and friendly tax system.

In conclusion, the Online Registration and Update System (ORUS) marks a significant advancement in tax compliance for Filipinos. It makes managing taxes much easier. The capabilities of orus.bir.gov.ph help individuals and businesses. They can meet their tax obligations more easily and efficiently. This embodies the BIR’s vision for a modern and accessible tax system.

Once you are done updating your records in ORUS bir gov ph, preparation, filing and payment of tax forms is made easy with Taxumo. Sign up for FREE to Taxumo! It’s made for business owners who want to understand how tax filing is here in the Philippines, make sure that all forms are submitted and don’t want to worry about missing documents and filings!

Want to learn how to file taxes anywhere you go? Sign up to Taxumo for Free!

Looking for for tin number

Hello Orsete,

To obtain a Tax Identification Number (TIN), you must visit a Revenue District Office (RDO) in person. The BIR requires personal appearance to maintain the confidentiality of tax information. Officials at the RDO will assist you with the necessary details and ensure compliance with BIR regulations. 🙂

I just want a Tin ID

Hi Alema,

You can consult one of our accountants regarding TIN here: https://marketplace.taxumo.com/collections/compliance-assistance?page=1