Taxumo makes this filing automatic and easy. Here’s how:

Log in to your Taxumo account (or create one if you don’t have yet).

Encode your income and expenses (or just income if you’re on 8% flat tax).

Taxumo will automatically:

Compute your tax due based on your chosen tax type (8% or graduated).

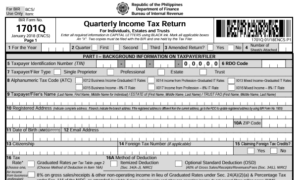

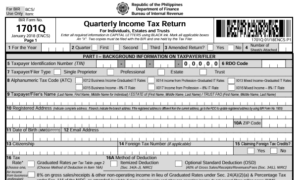

Fill out the BIR Form 1701Q correctly.

Generate the tax returns for you.

Review & file: Just click “File Now” and Taxumo will file and pay online directly to the BIR and accredited banks/e-wallets.

You’ll receive your BIR confirmation and payment receipt in your Taxumo dashboard—no need to go to the RDO or bank.