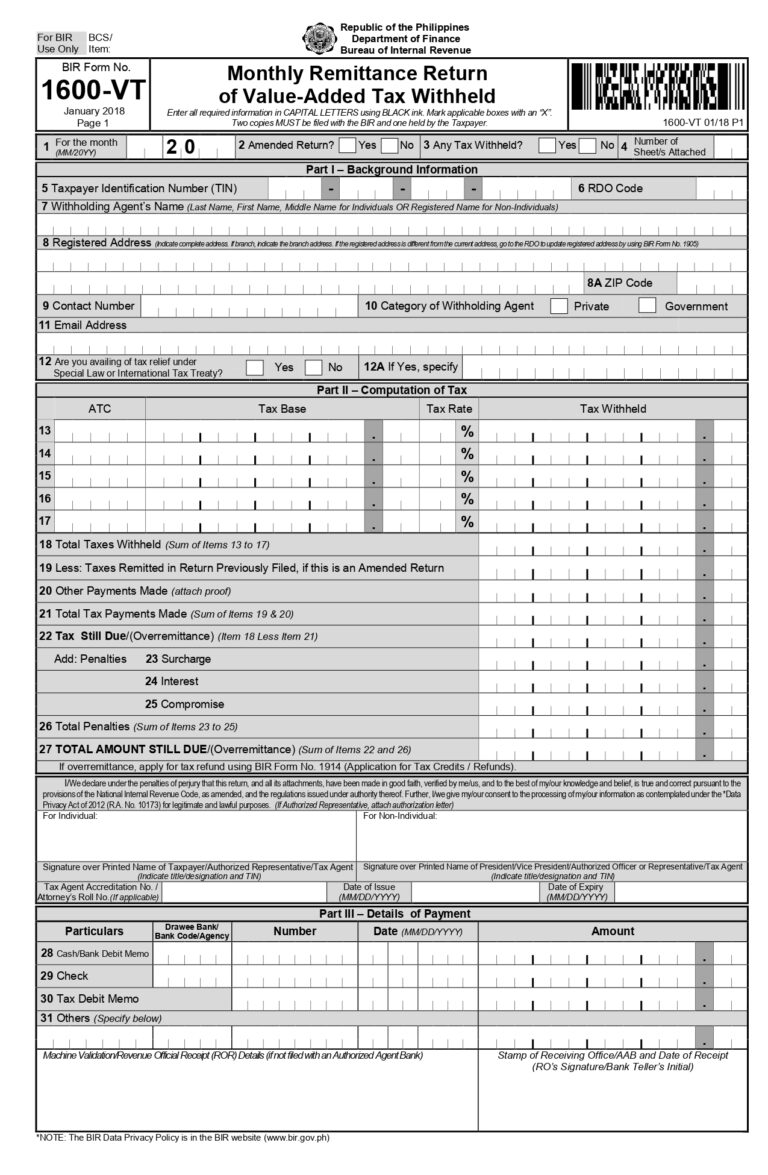

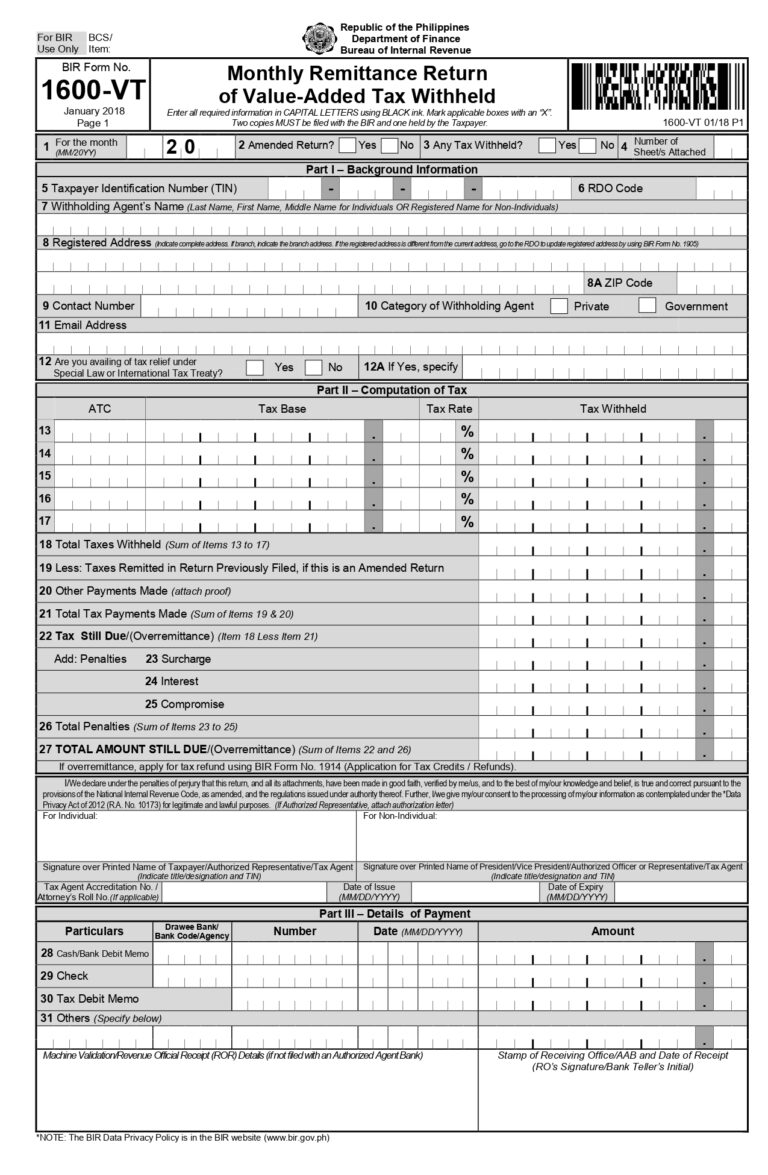

BIR Form 1600VT

Certified by:

About Form 1600VT

|

Full Name |

Monthly Remittance Return of Value-Added Tax Withheld |

|

Issued by |

Bureau of Internal Revenue (BIR) |

|

Current Version |

January 2018 (ENCS) |

|

Who must File |

All Withholding Agents (Government and Private) who pay for services rendered in the Philippines by non-residents, or those purchasing goods/services from VAT-registered sellers where the buyer is required to withhold VAT (e.g., government agencies). |

|

VAT Threshold |

There is no threshold for withholding; the 12% VAT is generally withheld on the full gross payment for taxable transactions. |

|

Filing Channel |

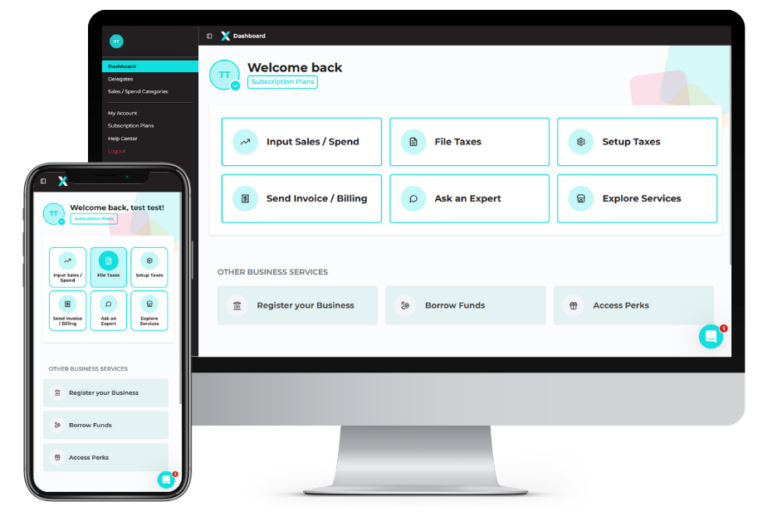

eFPS, eBIRForms, or online tax software providers (TSPs) like Taxumo. |

Deadlines

|

Previous Deadline |

March 10 |

|

Next Deadline |

April 10 |

*Dates above are the Bureau of Internal Revenue’s (BIR) official deadlines. Taxumo sets its deadlines 2-3 days prior to ensure your filings are processed and submitted on time.

Frequently Asked Questions

BIR Form 1600-VT, or the Monthly Remittance Return of Value-Added Tax Withheld, is a tax form filed by businesses that withhold 12% VAT on payments to non-resident digital service providers (NRDSPs). This applies if you’re paying foreign suppliers that are not registered with the BIR or PEZA.

Common examples of taxable payments include:

- Ads on Meta or Google

- Subscriptions to Google Workspace or Microsoft Office 365

- Monthly fees for services like ChatGPT Plus, Canva, or Zoom

If you’re making these payments for your business, you’re required to file Form 1600-VT every month.

Users must file this if:

They pay a non-resident supplier for services rendered in the Philippines

They are required to withhold and remit VAT to the BIR

🚫 This form is not available to 8% Income Tax Rate or Timeout Plan users

- Use “WV080 – FINAL WITHHOLDING VAT ON PURCHASE OF DIGITAL SERVICE CONSUMED IN THE PHILS FROM NON-RESIDENT DSPS (PRIVATE WA)”

-

Tax rate: 12%

-

TIN: Use 000-000-000-00000 for NRDSPs

Enable 1600-VT via Settings → Forms You Are Filing

Go to the VAT Withheld tab

Input your supplier’s name, TIN, and don’t forget the ATC code – WV070 ; then provide the tax base and let Taxumo handle the VAT withholding calculation.

Before filing, you’ll be asked to confirm:

File this as an amendment? (Tick checkbox if amending)

Previous Remittance (only if amending)

Other Payments Made (auto-filled from past returns)

- Input all your VAT Withheld entries

- Go to the Tax Dues tab

- Click “File Now”

- Review pre-submission details

- Pay and you’re done!

After successful filing, go to your Filed Forms (Past Filings) section. Look for the tax card and then you can download:

BIR Form (PDF)

Filing Confirmation

Proof of Payment

- Go to Settings → Forms You Are Filing and tick 1600VT

- Still don’t see it? You may be on an ineligible plan — upgrade via the Subscription page.

Use Taxumo today!

Automate your tax filing with Taxumo. Easily calculate your taxes, generate BIR forms and e-invoices, and track your cash flow in real-time. Pay your dues via e-wallet, card, or installments—anytime, anywhere, on any device.