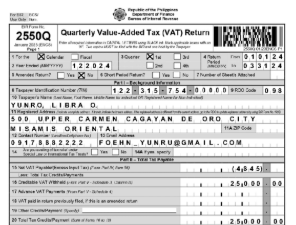

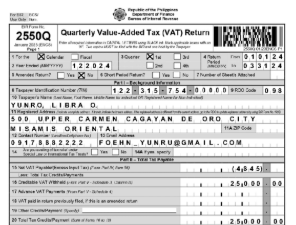

BIR Form 2551Q is the Quarterly Percentage Tax Return for non-VAT registered individuals and businesses earning ₱3 million or less annually. It’s used to report and pay percentage tax based on gross income.

Easily file your BIR Form 2550Q with Taxumo’s automatic tax features! Prepare, fill out, compute and file your VAT returns with 100% accuracy with no accounting background needed.

Here are some of the customers that use Taxumo to file and pay their taxes.

“Taxumo helps me free up my time. I don’t have to schedule my week around tax deadlines anymore.”

RV Marketing and Consultancy

“Paying taxes should not be a pain every month. You can just go online and submit through Taxumo-it’s easy as that.”

Studio Owner Treehouse Yoga

“Because of Taxumo, I don’t have to worry about taxes. All my passion, all my energy, and all my time can go to my business-and most impor-tantly my family.”

Writer & Editor – Topaz Horizon

Here’s why 80,000+ users all over the Philippines use Taxumo

Skip the lines at the bank by paying through our different payment channels. Pay using credit/debit card, Paypal, and even through your favorite pawnshop.

Taxumo is open 24×7 so you can take care of your taxes anytime, anywhere. Finally, you can file your taxes even if you’re on vacation!

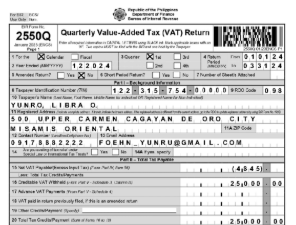

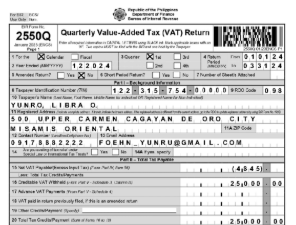

Forget about filling out those complicated tax forms yourself. Your forms are automatically filled out by Taxumo in one click!

Ever experienced “tax bill shock”? With Taxumo, you don’t have to. Taxumo shows you updated tax dues in real time.

The process to create attachments is especially tedious. Taxumo will automatically create the relevant QAP, SAWT, and SLSP/VAT Relief attachments for each filing.

Taxumo also works on mobile! As long as you have a smartphone, you can file and pay for your taxes anytime, anywhere

BIR Form 2551Q is the Quarterly Percentage Tax Return for non-VAT registered individuals and businesses earning ₱3 million or less annually. It’s used to report and pay percentage tax based on gross income.

Freelancers, professionals, and sole proprietors who are:

Not VAT-registered

Not using the 8% flat income tax rate

Earning from sales or services

Log in to your Taxumo account

Go to Tax Dues

Input your income

Review the auto-calculated tax

Click “File Now” and pay online

Done!

You can try Taxumo for free with 0% commitment, or attend a FREE group session where you can watch a live demo and ask your 2550Q questions directly.